Ethanol was sold as the key to America’s energy independence.

Now a decade after a Congress’ mandate on ethanol, the new-age biofuel is falling short of expectations.

In 2007, the government passed the Energy Independence and Security Act (EISA). Its mandate was to set guidelines for the growth of biofuels, including ethanol.

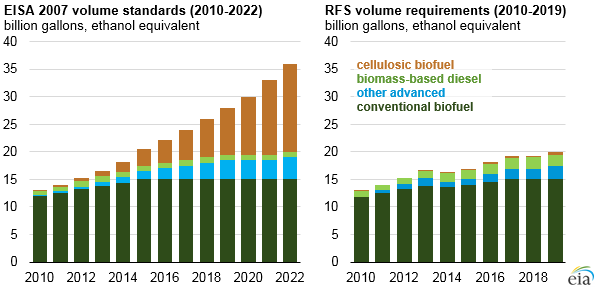

But production of these fuels is well below initial guidelines. Biofuel production is 30% short of targeted production.

The biggest laggard in biofuels is the subclass known as cellulosic biofuels.

Unlike traditional biofuels that are made from the grain or fruit of plants, cellulosic biofuels are made from the entire plant. That means a greater conversion ratio because most of the plant is used.

At least in theory.

In reality, cellulose-based ethanol is harder to produce than anticipated. Technology has been slow to develop techniques. The result is an over 85% shortfall in output compared to 2007 expectations.

The chart below shows expected biofuel production on the left. On the right is realized production volumes.

The trend in weak cellulose biofuels production will continue. The Energy Protection Agency (EPA) is proposing only a 3% boost in cellulose biofuels for 2019 through its Renewable Fuel Standard (RFS) program.

This program gives the EPA the “teeth” to support the EISA program. It also lets the EPA pull back when it sees the market can’t support parts of the EISA.

Refiners use biofuel credits to stay within compliance. Refiners that produce excess biofuels can sell credits to others that don’t produce enough.

Little Upside Expected for Biofuel Companies

With only light pressure from the EPA to boost biofuel production, levels are likely to remain low.

Most biofuel-specific companies such as Green Plains (Nasdaq: GPRE) are down on the year.

Without a strong sign of growth in this sector, 2019 will likely continue to be a tough year for biofuel producers.

Regards,

Anthony Planas

Internal Analyst, Banyan Hill