“Thank the Lord, volatility is back,” said no investor ever.

Traders, however, salivate over volatility.

I, too, welcome volatility because it fits my trading style. In fact, right now, I see a handful of decent opportunities to bet against the trend in several commodities and markets: crude oil, copper and iron ore, to name a few.

Welcome Volatility

But there’s something bigger I want to share with you today, something I’m much more excited about…

Even though I see a chance to bet against the prices of some commodities right now, I can’t ignore the fact that we could be witnessing the start of a new bull market in commodities, natural resources and basic materials.

For crude oil, I could point to shifting fundamentals.

For gold, I could point to changes in inflation and policy.

For copper, industrial metals, specialty metals and basic materials, I could point to coordinated global economic growth and new industry needs, including alternative energy and associated infrastructure.

And in the coming weeks, I’m sure I will point to all those things.

And here’s something to suggest the timing is now (or almost now!)…

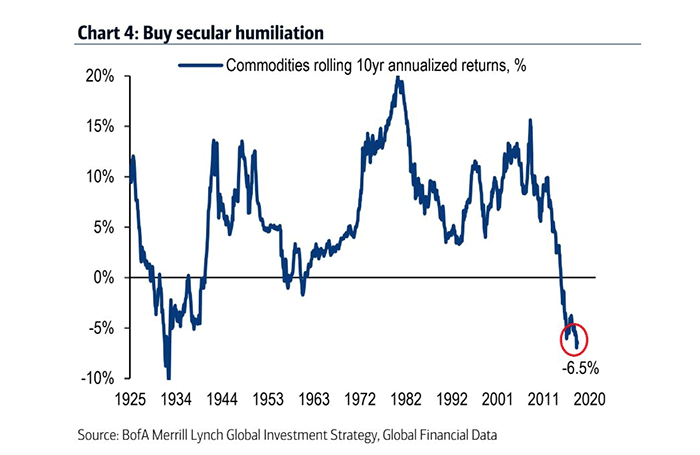

Not since 1934 has the 10-year average of commodity market returns been as dismal as it is today.

This chart scratches my contrarian itch.

And it meets a basic criterion of many successful investors whose eyes get big when they see an asset class that’s as hated as commodities are right now.

Commodities could struggle in the short term, but this is the type of opportunity that can radically alter an investor’s financial fortunes.

Longer-term players should consider scaling in now.

There are many ways to tap into the beaten-down world of commodities. Buying into shares of gold miners, oil drillers, oil service companies, or copper or lithium producers are among the ways that my colleagues and I snag profits.

There are also exchange-traded funds (ETFs) to consider. They make it easy for passive investors to tap into markets, industries and sectors without some of the risk that comes from investing in individual companies.

There are ETFs for those categories of stocks I just mentioned above. There are also ETFs that hold the physical commodity and trade in line with the underlying price of gold, oil, palladium or whatever.

For broad exposure to the commodity market, you might want to consider the PowerShares DB Commodity Tracking ETF (NYSE: DBC). It tracks the prices of a basket of 14 different commodities.

Good investing,

John Ross

Senior Analyst, Banyan Hill Publishing