Artificial intelligence is capturing imaginations, self-driving cars are in development, more and more devices are connected to the Internet and dreams of flying cars are already taking hold. The New York Post recently described the dream: “Imagine skipping the subway and instead heading to your local ‘vertiport,’ where you can hop into an aircraft the size of an SUV that runs on electricity and works pretty much like an elevator.”

This dream is almost affordable. The ride-hailing service company Uber believes that a 50-mile air taxi trip “might initially cost around $129 and eventually be as cheap as $20.” It doesn’t tell us when to expect the first ride. But one thing is clear: Unimaginable ideas are now within reach thanks to increases in computing power.

Wall Street firms are also chasing their dreams with computing power. And what they’re dreaming of is obvious: making lots of money.

Welcome to the Machine

To make their dreams come true, large Wall Street firms are letting computers manage money. They are hiring quantitative analysts and using what are known as quant strategies.

At its core, Wall Street is a collection of numbers. Wall Street consists of price histories extending back hundreds of years. It also includes the financial statements of thousands of companies reporting on performance. Each statement contains hundreds of data points.

Quantitative analysts use data mining to make sense of the numbers. Computer programs dictate what and when to buy. Sell signals are fully automated. This discipline prevents panic and ensures managers won’t make mistakes based on emotions.

The potential profits of quant funds are almost unimaginable. We know this based on their results.

Renaissance Technologies is home to the greatest quant investors in the world. This hedge fund firm started doing business in 1982. Hedge funds aren’t required to report their results, so a complete track record is difficult to find, but partial reports are available. According to Bloomberg, one Renaissance fund owned mostly by the firm’s employees delivered an average annual return of 71.8% from 1994 to mid-2014.

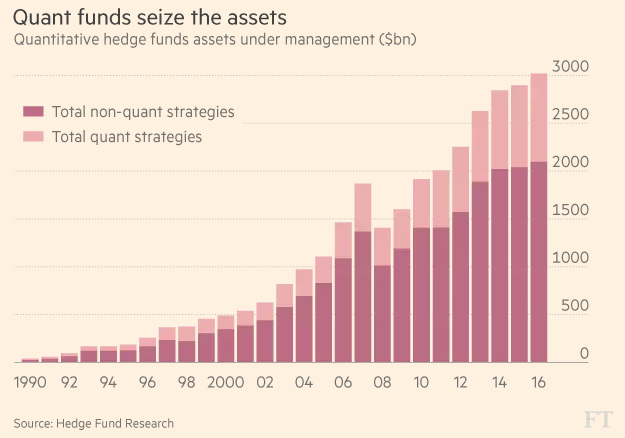

This type of performance attracts attention on Wall Street. Quant funds are now among the fastest-growing investments. Since 2009, computer-driven hedge funds doubled their assets. They now control about $918 billion.

(Source: Financial Times)

Quant strategies are based on history and rules. They should be able to deliver large returns even as money pours in, although this is not always true.

Many mutual funds, such as Fidelity’s Magellan Fund, watch performance drop as they grow. This is because their strategies, often based on value, can’t scale up. Investment managers know it’s more difficult to manage $5 billion than $5 million. However, they also know that they generate higher fees with $5 billion.

Smaller funds have more flexibility and can often generate better returns. But higher fees mean that investment managers would rather increase assets even if performance suffers.

Quant funds shouldn’t have this problem. Renaissance has been able to grow to about $72 billion with no sign of slowing down.

Ones and Zeroes

The reason quant funds can perform well as they grow is because of their computer-driven decision models. Quant managers can test strategies and know what works before they risk money in the markets.

Quant managers also allow the market to provide feedback so they know when a strategy stops working.

Traditional managers using growth or value strategies don’t have performance feedback built into their systems. They believe in something they call “the long run,” where they accept that they’ll underperform at times. Quant managers build in safeguards to avoid underperforming.

Discipline and feedback loops show that quant funds have advantages over growth and value strategies. Wall Street firms know this, which is why they are adding hundreds of millions of dollars to the funds.

As this becomes increasingly clear, individual investors may finally work their way into the winner’s circle of strategies.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader