A year ago, the billionaire founder of Bridgewater Associates, Ray Dalio, said that most of what we think we know about the economy is wrong.

That’s setting us up for a big, unwelcome surprise.

Dalio’s point is one I make often. If you only pay attention to averages, you’ll miss the most important things about the economy.

And it’s likely to cost you a lot of money.

Every day we’re bombarded with statistics. Gross domestic product (GDP). Unemployment. Inflation.

But those numbers are averages. The problem with averages, as an economics professor once told me, is that if you put one hand in a bucket of ice water and another in a bucket of boiling water, statistically, the water is warm.

In the second decade of the 21st century, the U.S. economy is also divided into two buckets.

In one is the top 40% of the population. They enjoy a cool and comfortable life. In the other is the bottom 60% of the population whose living standards boiling away from the combined effects of too little income and too much expenditure.

If GDP is growing, unemployment is falling and inflation is under control — but a big chunk of the population is just scraping by — can we really say that all is well?

We could, but we’d be dead wrong.

A Tale of 2 Countries

When it comes to things like income, retirement savings, health care, death rates and education, the United States is two countries, not one. If investors ignore that fact, we set ourselves up for trouble.

As Ray Dalio’s report points out, the income of the bottom 60% of the U.S. population has remained stagnant since about 1970. But the steadily increasing cost of the pillars of middle-class life — health care, education and housing — means hundreds of millions of Americans can no longer afford to save anything.

And if you can’t save, you can’t build wealth.

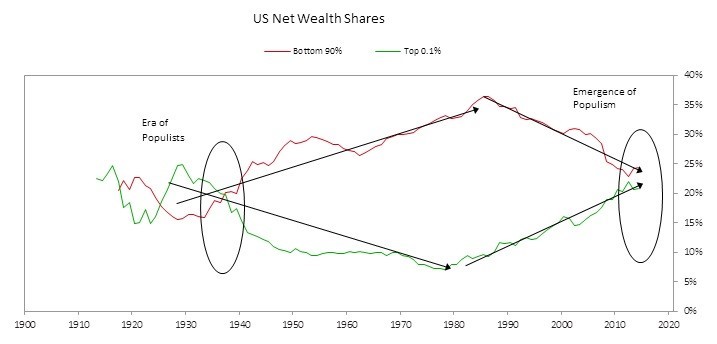

To illustrate this, Dalio’s report included the following chart. It shows the share of national wealth held by the bottom 90% of the population versus the top 0.1% since World War I.

In the run-up to the Great Depression, the wealth share of the top 0.1% rose rapidly. The share of the rest of the population declined just as fast. Then came the Great Crash of October 1929 and the depression. A turbulent era of populist political unrest followed.

After the New Deal and World War II, the wealth share of the majority increased steadily. That of the top 0.1% declined, then stabilized. The gap between the two was at its maximum in the mid-1980s.

After that, however, the trend reversed sharply. The wealth share of the top began to rise again, and that of the majority began to fall. And once again, our politics has become populist and increasingly unstable.

An Engine Running on Fumes

The engine of the United States economy is consumer spending. It accounts for 68.5% of U.S. GDP. Without consumer spending, the economy would collapse.

For the 40% of us who have enough income to meet our needs, this doesn’t appear problematic. A growing economy means we have more to spend. We borrow strategically, not out of necessity.

But for most of the rest of the economy, continued consumption depends on access to credit. After deleveraging somewhat after the financial crisis, U.S. consumers began to take on debt again after 2013. Today, U.S. consumer debt is again at record levels.

This might be OK if the debt was being used to fund household-level investment in the future … if Americans were investing in their capacity to be more productive.

Instead, an increasing proportion of U.S. consumer debt is being used to pay for basic expenditures. Recent data from the New York Federal Reserve shows that that increases in consumer debt over the last 12 months were highest for credit card loans (5.7%), followed by student loans (4.5%), auto loans (4%) and mortgages (3.5%).

Now, we might say that student loans and mortgages are investments in the future. But given the weak earnings prospects of college graduates and the inflated cost of housing, these types of debt are more about trying to maintain living standards that investing in the future.

Overall, from 2012 to 2017, the rise in household expenditures for the bottom 40% of U.S. households outpaced their before-tax income. They had to borrow to make up the difference.

Those borrowers accounted for almost all the growth in U.S. consumer spending — nearly 70% of GDP.

That’s not a healthy economy.

Après l’Apogée, le Déluge

One of my favorite metaphors for the U.S. economic situation is a ballistic missile.

At launch, a missile develops powerful thrust. It rockets upward, gradually decreasing thrust until it’s close to the top of its trajectory. At that point, the engines cut out … but the missile keeps going upward until the point where gravity begins to pull it back down … the apogee.

U.S. GDP is like that missile. It’s still going up, but the engine is sputtering out. People can’t continue to borrow to fund almost 70% of GDP for much longer.

That’s why it’s important to be skeptical about GDP figures. Whether or not rising GDP is a happy story depends entirely on the fuel the engine is using. Right now, that fuel is debt.

As we all learned in 2008, an economy based on debt means crisis is around the corner. If your investment plans don’t take that into account, they should.

Kind regards,

Ted Bauman

Editor, The Bauman Letter