Stock prices reflect future expectations. Trends in the price action of major stock market averages like the S&P 500 Index show what investors think about the future.

An uptrend in prices indicates investors expected growth in the economy and in the earnings of publicly traded companies. Generally, the economy and earnings move in the same direction. Downtrends show pessimism about growth.

Data tells us investors will grow pessimistic next year as both the economy and earnings grow slower than they did this year.

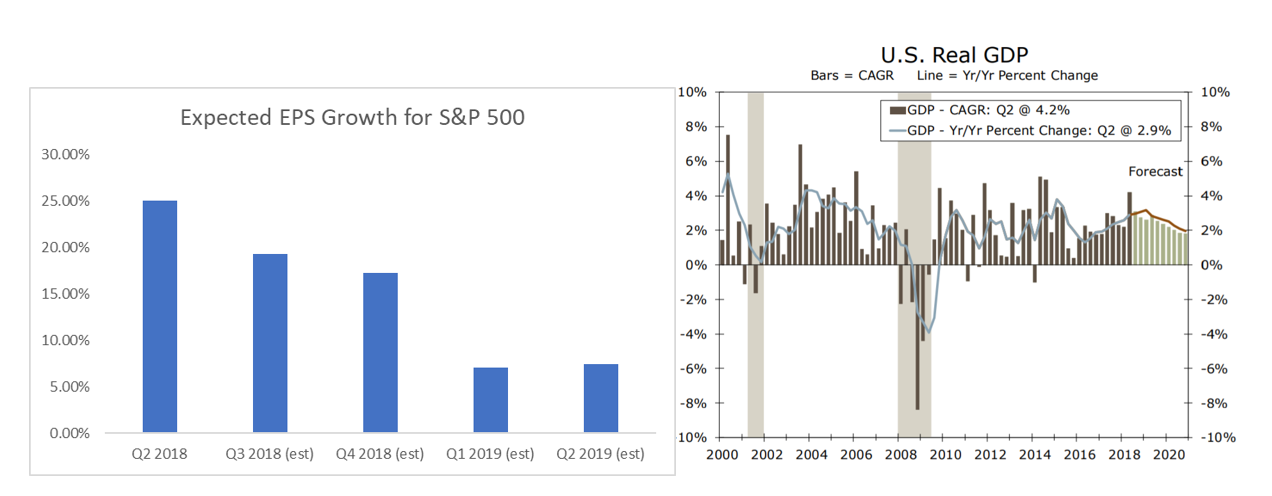

(Sources: FactSet and Wells Fargo)

(Sources: FactSet and Wells Fargo)

The chart on the left shows expected growth in earnings per share for the companies in the S&P 500. Analysts expect the growth rate to drop by 70%, from 25% to just 7.4%, in the next 12 months.

On the right, the chart shows expectations for growth in gross domestic product (GDP). Economists expect GDP growth to fall by more than half, from 4.2% to about 2%.

There’s a direct relationship between growth and stock prices. Rapid growth justifies high stock market valuations.

Earnings growth of 25% a year and GDP growth of more than 4%, the current conditions, support an above-average price-to-earnings (P/E) ratio. That’s where we are now in the stock market.

In a slow-growth environment, stocks trade with a below-average P/E ratio. That’s where we’re heading to next year.

To get to a lower P/E ratio, prices will have to fall. The S&P 500 should fall more than 20% before reaching its fair value.

This doesn’t mean it is time to sell all stocks. It means it is time to be careful. Stocks are volatile as trends change. That volatility brings potential profits.

For now, November’s election news will drive stocks. After the election, traders will refocus on earnings and economic prospects. That’s when the danger of a slowdown will grow.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader