Investors love to worry. It’s probably what we do best. Fortunately for us, analysts always come up with new things to worry about. Their latest suggestion is that we should worry about FANG, which is also spelled FAANG. Or more specifically, what happens to the stock market if the FANG stocks break down.

Facebook, Apple and Amazon, Netflix, and Google (FANG) are the undisputed heavyweights of the Internet economy. In mid-June, they sold off as a group. Investors worried that a bear market had begun after the tech-heavy Nasdaq 100 Index dropped 4.5% in just two days. Compounding the worries, the two days were a Friday and Monday, giving us the weekend to wonder what would happen next.

That weekend, concerns grew that the bull market would end. Analysts explained that the bull market depended on these five stocks. If they went down, some analysts worried that the market would crash.

That sell-off showed us all that this concern is overblown. Looking beyond the FANG stocks, the rest of the stock market did OK. The S&P 500 Index sold off just 1% over those two days. The truth is, these five stocks don’t control the destiny of the broad market.

Just the Tip of the Iceberg

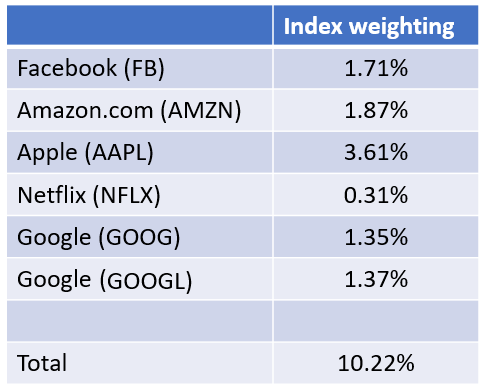

As a group, FANG stocks account for more than 10% of the S&P 500 Index.

(Sources: Morningstar and SlickCharts)

That’s significant. But the remaining stocks account for 89.78% of the index. That means, obviously, the S&P 500 can move higher even without this group of stocks.

As an extreme example, let’s assume the FANG stocks drop 20%. This would drag the S&P 500 down by only about 2%. This is because, as a group, these stocks account for just 10% of the index’s performance.

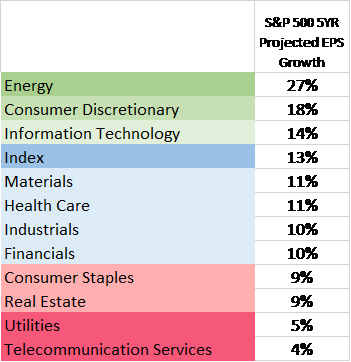

While the FANG stocks are important, the overlooked energy group could be the most important sector to watch. Analysts are expecting this sector to grow earnings faster than all other sectors. That could mean energy stocks control the fate of the bull market.

(Source: S&P Global)

Growth in the leading sectors in the table above is all related. Analysts are expecting consumers to shop for things they want rather than need, driving the consumer discretionary sector. FANG stocks provide the technological means to do that shopping online, driving information technology. Trucks and fuel are needed to deliver all those products, driving demand for the energy sector.

Looking at earnings, it’s obvious that the FANG stocks are just the tip of the iceberg. In the long run, it’s earnings that drive the market. To be more specific, it’s earnings growth that drives a bull market. Energy stocks are expected to grow earnings twice as fast as the overall market, and that should push stock prices higher.

This doesn’t mean energy stocks are a buy. The bull market really depends on the price of oil. If energy companies can’t meet expectations, earnings for the index won’t meet expectations. Most energy stocks aren’t worth buying because there is too much uncertainty in the sector.

Unfortunately, there isn’t a catchy acronym like FANG to describe the energy stocks. But investors should watch earnings knowing that the fate of the bull market depends on that sector. And based on the current price of oil, they should be very worried.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader