Superman was ahead of his time six years ago, when he renounced his U.S. citizenship following a dispute with the federal government.

As an observer of the expatriate exodus from America, I never imagined that Superman (aka Clark Kent) would decide to end his years as a respected U.S. citizen of the city of Metropolis. But in 2011, the youthful (then 73-year-old) Man of Steel joined thousands of other Americans by ending his U.S. citizenship, as reported in The New York Times.

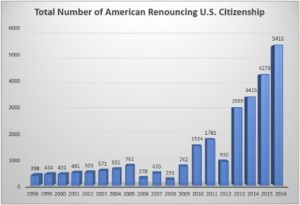

Since then, 18,817 ex-Americans have followed Superman’s example. The number renouncing their U.S. citizenship during 2016 soared to a new record of 5,411 — up 26% from 2015, as revealed by the latest government data.

As millions of foreign persons and refugees clamor to get into the United States, why are thousands — mostly wealthy, talented young Americans — leaving?

Among the factors that contribute to this sad exodus are the loss of freedom and U.S. government oppression.

In Superman’s case, it was official criticism of his active support for the 2011 “Days of Rage” in Iran, which protested government oppression there. Superman flew to Tehran during a huge protest, while President Obama said little. “Truth, justice and the American way — it’s not enough anymore,” Superman told President Obama’s national security adviser.

Count the Ways

I could spend days cataloguing the many and varied ways liberty in America has been diminished — the collapse of the rule of law, the “guilty until proven innocent” bureaucratic regulation of every aspect of our lives, official threats to freedom of religion and speech, dictated health care, billions in property confiscation by police forfeiture, ignored civil rights and excessive taxation.

Renunciation of citizenship is linked intimately to the absence of a fair, residence-based, territorial tax system.

The U.S. is one of the few countries requiring citizens to pay income taxes on their worldwide income, without regard to where they live or where it’s earned. The only way an American can end that tax obligation is to terminate U.S. citizenship, a constitutional right the U.S. Supreme Court has upheld.

The 2010 adoption of the Foreign Account Tax Compliance Act (FATCA) imposed on this worldwide U.S. tax obligation a tyrannical web of onerous and complex reporting, replete with civil fines and criminal penalties. And as you can see in the chart below, with the implementation of FATCA, we have witnessed a doubling and tripling of the number of Americans racing to give up their citizenship.

Based on the radical U.S. IRS claim that tax jurisdiction extends to every bank and financial institution in the entire world, FATCA has been a main impetus for renouncing U.S. citizenship.

Many of those leaving the U.S. have had enough, thank you.

Repeal FATCA

Congress needs to repeal FATCA, as we long have advocated. A FATCA repeal could be included in the major tax overhaul legislation now said to be a priority in both Congress and the White House.

In 2014, led by the Center for Freedom and Prosperity, we joined 21 major U.S. groups urging repeal. Sen. Rand Paul (R-Ky.) has introduced bills to repeal the law. The 2016 Republican platform calls for FATCA’s repeal, denouncing the law’s “warrantless seizure of personal financial information without reasonable suspicion or probable cause.” A new campaign to repeal FATCA has been launched.

Use your First Amendment right to petition; contact your elected U.S. senators and representatives and tell them to repeal FATCA.

This is one issue on which “truth, justice and the American way” can and should triumph.

Yours in liberty,

![]()

Bob Bauman JD

Chairman, Freedom Alliance