It seems that with every new development or press release, Tesla Inc. (Nasdaq: TSLA) manages to throw Wall Street into a tizzy. When the company announced it was buying SolarCity, analysts emerged from the woodwork to decry the cost of the deal, or the negative impact to Tesla shareholders, or the questionable ethics and motivations behind CEO Elon Musk’s drive to unite the two companies. (Musk was chairman of SolarCity when the deal went through.)

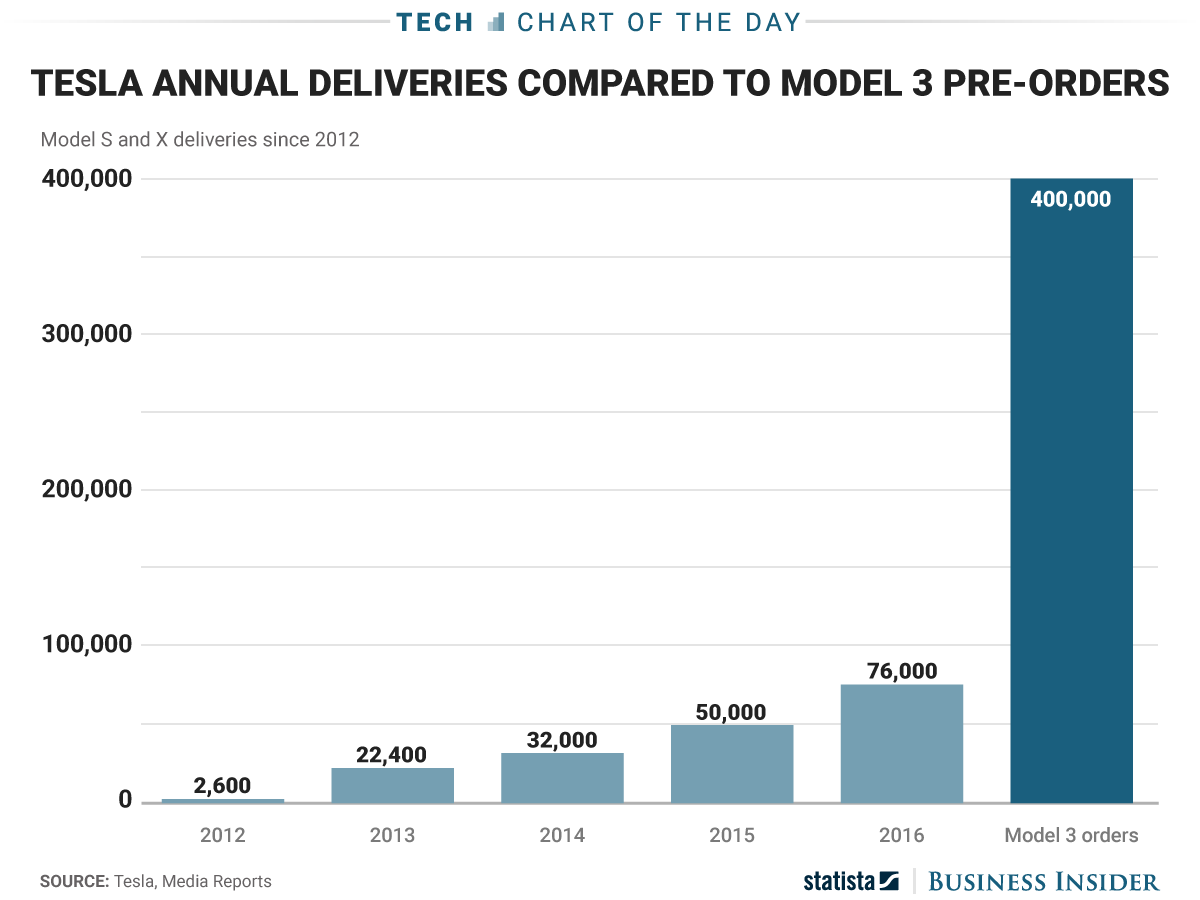

The advent of Tesla’s Model 3 car has created a similar tizzy among the talking heads on Wall Street. Musk has promised to ramp up production to roughly 500,000 vehicles per year by 2018, more than quintupling 2016’s output. And the company will need every bit of that production just to fulfill Model 3 preorders.

Regular followers of the automotive sector are used to hearing numbers that large on a regular basis. But regular investors new to the field, or Tesla enthusiasts, may not quite have a handle on the scope of the project. The chart below should help put Musk’s promises, and Model 3 preorders, in perspective:

(Source: Business Insider)

(Source: Business Insider)

Indeed, ramping up production to meet current demand is a near-Herculean task. Many believed that Tesla didn’t have the cash on hand to accomplish such a feat … and they were right. But with Tesla stock trading at a strong valuation, Musk and company had the solution to their funding problems right in hand: issue new stock and take on more debt, to the tune of $1.15 billion.

The issuance of new Tesla stock initially frightened the weak hands, sending the shares sharply lower. But Tesla shares are on the mend and are recovering nicely as smart money moved in to buy the dip. It’s a theme that my colleague Paul regularly talks about with his Profits Unlimited subscribers — how smart money and Wall Street insiders will take advantage of market fear to drive down a stock they wish to buy.

Sure, there is risk any time a company takes on a task as large as rolling out a revolutionary vehicle like the Model 3. And there is risk involved in taking on debt and issuing new shares. But companies do this all the time to raise cash.

The bottom line with Tesla is, do you believe in the company’s vision for electric cars? You don’t have to be as fanatical as Musk, but you do have to be able to see the forest for the trees. And if the company hits its delivery targets for the Model 3, the payoff for establishing a mass-market electric car could be far more than the risk hinted at in production and preorder charts.

Regards,

Joseph Hargett

Assistant Managing Editor, Banyan Hill

P.S. Before my colleague Michael Carr became a Chartered Market Technician, he was a nuclear missile architect in the U.S. Air Force. He was one of the few people responsible for writing the computer code that made sure each nuclear missile would hit its target with 100% accuracy. The smallest mistake could have resulted in thousands of innocent lives being obliterated … leaving no room for error. He designed his trading strategy the same way, working every day for the last 10 years to correct any flaws. And the good news is, he’s finally ready to reveal his strategy today at 1 p.m. Eastern time in an exclusive webinar. There’s still time to sign up, so don’t hesitate to click here and reserve one of the remaining spots now.