Stop, Drop, Roll, Close, Add … Exercise?

Great Ones, I have to commend you: Y’all are just plain amazing.

Most of you are stock and ETF traders. But, when I wrote about trading options on Advanced Micro Devices (Nasdaq: AMD), y’all dove in headfirst like those crazy polar-plunge videos you see on YouTube.

And some of you made a crap-ton of money doing so. That’s an imperial crap-ton … not a metric crap-tonne. It’s also bigger than a raft of gains or a boatload of gains, to be sure.

For instance, on Monday, I talked about how Great One Mike B. said he made a 600% return on an AMD August $100 call. He paid $1.61 for the option and sold it for $11.30!

However, as Mike noted, the process of trading options could’ve gone a bit smoother. Mike’s a big boy and ties his own shoelaces, so he figured it out eventually.

But there are a few addenda … some quid pro quos that newly minted options traders might have trouble with.

Which leads us to today’s Great Stuff Reader Feedback question from Samuel F.:

Hey Great Stuff,

My question is: How do I now sell the option I bought? There are these options: Add, Roll, Close, Exercise. Since I am up 421%, I want to cash in, but when I choose to exercise, it says I cannot because there is remaining time value. What do I do to make my money?

Kindest regards, — Samuel F.

Thank you so much for writing in, Samuel. A 421% gain in less than a month is freaking amazing! Congratulations!

As you know, I don’t always go into the nitty-gritty details. However, I do provide links to additional research — especially when it comes to trading options. But, in this case, we have a very fundamental question about trading options.

You successfully entered an options trade, and you sit on massive gains. So, just how do you get those gains?

With options, you have … well … options. Let’s look at your options, Samuel. You say that your brokerage offers the following on your options trade: add, roll, close, exercise.

Only two of these will allow you to get your gains now: close and exercise.

If you choose “add,” you’re adding additional options contracts to your existing position — i.e., you’re buying more options. If you want to capitalize on your 421% gain, adding to your position is no bueno.

If you choose “roll,” it means you’re “rolling” your position out to a later month — i.e., you’re extending the amount of time you want to be in the position. If you expect bigger gains or you need more time for your goals to play out, this is a viable course.

However, Samuel, you’re sitting on a 421% gain. Don’t get greedy. Let’s look at the options that will allow you to get your gains ASAP.

Is Exercising For You?

You say that your brokerage won’t allow you to “exercise” your AMD $95 call option because there is remaining time value. First, this is really odd and must be a brokerage-specific rule. In most cases, you can exercise an option at any time prior to expiration.

When you exercise a purchased call option, you execute the contract to buy 100 shares of the underlying stock at the agreed-upon price. In this case, if you exercise the AMD August $95 call option, you’re saying you want to buy 100 shares of AMD at $95 each.

Doing the math, it would cost you $9,500 to buy those shares. At its post-earnings peak, AMD hit $121. Assuming you turned around and sold those AMD shares for $121, your profit would’ve been $2,600 on the entire position. Not too shabby at all, considering you only paid a fraction of that to buy the option.

But exercising an option requires you to have a margin account or enough cash on hand to buy the shares. In this case, you’d need $9,500 in cash or margin to exercise your AMD call.

What if you don’t have $9,500? Are you screwed?

No, far from it. I know stock traders like to exercise their options because stocks are something they understand. But there’s a much, much easier way to rake in that 421% gain.

No Exercise Needed

Samuel, when you entered the AMD August $95 call option, you did what is known in options lingo as “buy to open.”

You paid money — “buy” — to open a contract agreeing to purchase 100 shares of AMD stock for $95. Since you were buying, that means that someone else was selling.

When you “close” an options trade that you bought to open, you “sell to close.” Samuel, you have a contract to buy AMD stock for $95. Since AMD is above that price, the contract itself rose in value. To bank your gains, you can simply sell that contract to someone else and run.

There’s no need to get physical — you can leave Olivia Newton-John by the wayside. Exercise is optional with options.

By selling to close your option, you get paid immediately for the option itself. There’s absolutely no need to even touch the underlying stock and own shares.

This is what most options traders do. Buy and sell the option itself — not the stock.

So, to recap: To “get your money” out of an options trade you can exercise the option, buy the stock and then sell the stock for a profit. Or, you can simply “sell to close” your option and get the money firsthand.

I highly recommend the “sell to close” method. It’s what I do when I trade options. No need to make this harder than it is — you have a 421% gain ready to bank for crying out loud!

See, most investment strategies fail for one reason — they’re too complicated.

But Mike Carr has unveiled an ingenious new trading strategy. Investors make the same trade on the same ticker symbol in and out once a week, and they can target gains of 10% … 50% … even 100% or more every time.

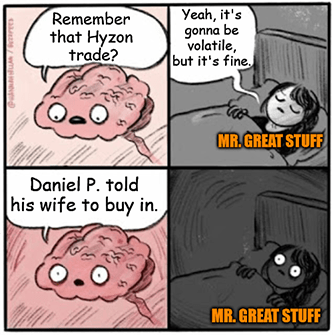

Options trading, Robinhood, Hyzon (Nasdaq: HYZN) … there’s a lot on Great Ones’ minds these days. Oh, and Georgia too (no peace I find, no peace I find).

What’s on your mind this week? Options trades giving you trouble? Got a new earnings play in your sights? Give us a shout in the inbox, and we’ll catch up in next week’s Reader Feedback!

Reach out to us at GreatStuffToday@BanyanHill.com whenever the market muse calls you. Now on to the show.

Dramatic …….. Pauses

Just like the Spanish Inquisition, no one expects share offering sell-offs!

Hyzon’s selling some shares and warrants as part of its weird, overly cumbersome listing process. Remember how Hyzon’s public foray was delayed because of weird SEC rule changes? SEC rules about SPAC warrants change like the stairs at Hogwarts — but when people see a company selling shares, everyone loses their minds.

Or in Daniel P.’s situation — where he told his wife to buy HYZN — maybe his life? Hang in there, Daniel. Do what’s right for you and your wife, my man.

Now, I know that Hyzon was kinda selling off even before this share offering … to say the least. Trust me, I know it hurts. That’s why, a few weeks back, we told you to use your best judgment and get out if you’re uncomfortable. This is your money. Period. End. Stop.

That said, I’m staying in.

Why? Have I lost my mind? Am I crazy?

You may be right. But, here’s the thing … absolutely nothing tied to Hyzon’s business operations, prospects or performance is driving the stock lower. In fact, we’ll get a more in-depth idea of Hyzon’s current state of affairs when the company reports earnings next Wednesday, August 11.

As long as Hyzon says business is on track, Great Stuff Picks is holding through Wall Street’s hydrogen stock hissy fit. If not, then we’ll sell the stock and throw the sucker overboard like it’s the horse latitudes.

The Brokerage That Shall Not Be Named

Dear Mr. Hot Stuff, I mean Great Stuff!

Always enjoy your advice and love your humor! I’m also a subscriber to Paul . He couldn’t be more bullish on the stock. In fact, he told us to open an account with Robinhood, so we could get in on the pre-IPO price.

I happened to have an account (opened a while back to purchase cryptos), so I placed an order for 100 shares at the opening price of $38. It’s only been a couple of days, and the stock is all over the map!

In general, Paul is bullish on whatever Ark invests in. I don’t know how long I should hold on to it, since I also don’t like their business model. I do all of my trades through Schwab. Thanks for keeping us informed!! — Carolyn L.

What else can I say? Welcome to meme stocks, Carolyn. Robinhood gazed so long into the meme stock abyss that now the abyss is staring back.

In all seriousness, there are a couple of factors at play here since many of your fellow Great Ones have also asked: “Hey, what’s with the flop-flipping, stock-dissing?” Jeff B., I know you wrote in with similar concerns.

Don’t let this keep you up at night; you’re not misled … this is just how the whole investing shebang works!

Different investors look at different things before they invest. I know this seems like oversimplifying things, but it’s worth pointing out. I fully believe that Robinhood (Nasdaq: HOOD) can crank out cash flow and make money for investors.

But there are more than a few “ifs” surrounding Robinhood right now. And I’m not a fan of these particular “ifs.”

For instance, Robinhood will live or die by the sword of investor sentiment — the same investor sentiment that Robinhood and the financial media try to manipulate. That makes me uncomfortable … but it doesn’t mean that Robinhood won’t keep printing money.

Now, these “ifs” stop me from recommending the stock. But that doesn’t mean other investors and editors see the situation differently. What this ultimately comes down to is how you feel about the stock — and I encourage every one of you to consider this before buying into any recommendation. Even Great Stuff Picks.

Some investors feel they must love and support the business model of any company they invest in, while other folks just want to see green when they open up their brokerage of choice. Both approaches are fair if it’s what works for you!

And that’s my bottom line: I know many different investing approaches, strategies and specific stocks appeal to y’all in different ways. Some of you are high-risk high rollers, and that’s fine. Other Great Ones are value nuts scrounging around for dividend yield. No judgment here — we bring it all to you.

At the risk of sounding like a complete shill, I like listening to all the perspectives here at Banyan Hill and beyond specifically because they disagree at times. You get more well-rounded insight when you look at all the angles.

If you trust my thoughts on the Robinhood situation … bully for me. If you disagree completely, that’s great. Honestly. That’s your prerogative … because it’s your money. You do with it how you please.

Great Stuff is just here to make sure you think about what you’re doing before you do it.

I’m just this guy, you know?

Potent Mr. Hot Stuff? Hold On Now…

Joseph, I think I have a few years on you (74), but I feel you. I love your humor and the potent great stuff that lets us carry on. I hope your schedule gives you the freedom from pressure that is sooo hard to avoid. But please don’t stop writing.

Humor and expertise go hand in hand if you’re doing it right. Write on, Brother! — Woody W.

Woody you hear, Woody you say? Thanks for writing in, brother!You receive our unofficial “oddly put but incredibly wholesome compliment” award this week. I, too, hope my schedule gives me the freedom from pressure … or, “chill” as them whippersnappers say.

I wanted to include your email to end the day on a positive note — so you don’t stop writing in either, capisce?

I mean it: Anytime any of you get confused or feel overwhelmed by the market, just reach out and write me! Your own personal Great Stuff. Questions, rants, raves and the rare recipe — it all belongs in our inbox.

GreatStuffToday@BanyanHill.com. Drop us a line! In the meantime, here’s where you can find our other junk — erm, I mean where you can check out some more Greatness:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff