Editor’s Note: Welcome to our week-long special series! Our editors for both the Sovereign Investor Daily and Winning Investor Daily are looking ahead to 2018 and providing their insights into what they believe will be the big movers and shakers for the new year. They are also looking at critical steps you can take to preserve and grow your wealth. Happy reading! — Jocelynn Smith, Senior Managing Editor

With just a few days left in the year, it looks like the S&P 500 Index will deliver a gain of 20% or more for 2017. Investors should be happy about that.

But, instead, many will worry. They worry the gains won’t last and 2018 will deliver a loss.

Data says those worries are misplaced. After a good year, history tells us to expect another good year.

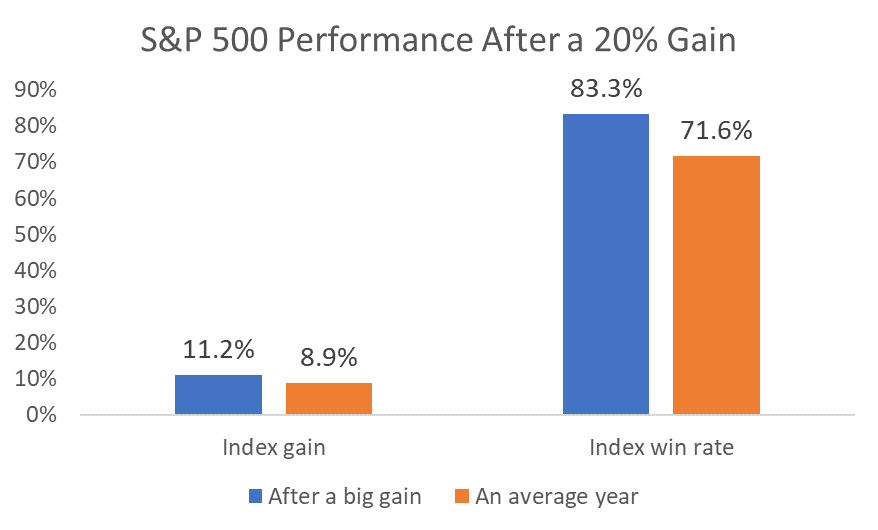

On average, since 1950, the S&P 500 Index gained 8.9% a year. The index ends the year higher 71.6% of the time.

But, after a gain of 20% or more, the index gains an average of 11.2% in the next year. And the win rate jumps to 83.3%.

This means investors should be excited about 2018. They should invest aggressively until there is a clear sell signal. A close below the 200-day moving average could be a sell signal, although there are other, and better, signals.

Selling early means missing out on gains. And the gains after a good year could be substantial.

In one recent case, a winning streak in the stock market produced life-changing gains for investors.

The longest streak of big gains started in 1995. For five years in a row, the S&P 500 gained at least 20%. Gains averaged 28.8% a year. Over that time, a $1,000 investment grew to $3,475.

Could that happen again? Yes, it can.

And that’s important to remember. We could see big gains for a few years in a row.

So stay invested until the market turns down. None of us can afford to miss a bull market.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader