Congressional oversight isn’t a good thing.

When Congress watches, that means new rules are likely. That’s why Washington, D.C.’s recent interest in social media companies is a problem for the sector.

Social media is an “anything goes” media platform. That’s OK for some things. But policy makers are concerned that political speech needs regulation.

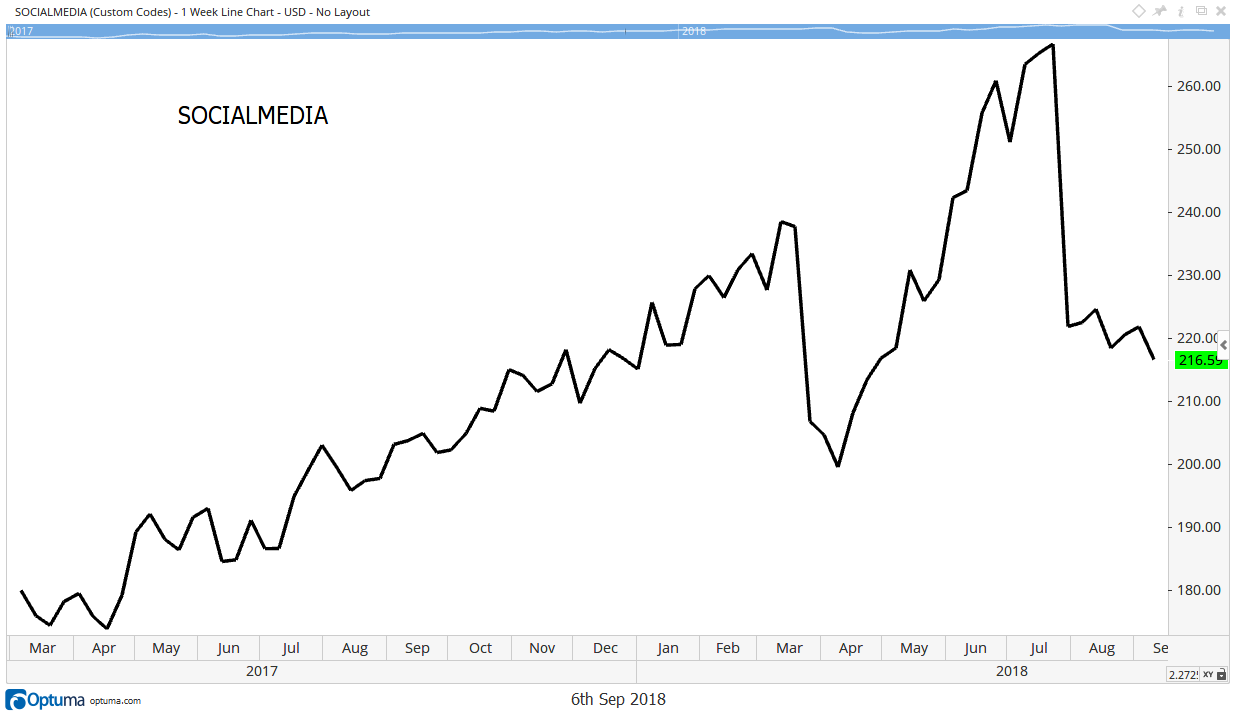

Traders seem concerned about regulation. The chart below shows that concern. It’s an index of social media companies. The recent crash is a sell signal.

The stock market is pricing in the cost of increased regulation of social media sites. That makes sense.

Politicians are arguing about everything. But there’s one exception: Both parties agree social media needs regulation.

Politicians are concerned about privacy. They worry about potential Russian interference in elections. This, and other problems, united politicians.

Regulation is likely. That’s costly. Companies will pay for technology to meet new regulations and legal advice to comply. Those expenses will reduce profits.

New rules highlight privacy concerns. That means social media regulation could also reduce the popularity of the networks.

Losing users is a surprising impact of the news. But it’s happening.

Adweek reported 74% of Facebook users adjusted their privacy settings, took breaks lasting a few weeks or deleted their app after reports of privacy breaches.

New rules will add to the problems of Facebook, Twitter, Snapchat and other apps. Many users will further limit their social media presence. That will reduce the revenue of companies providing the services.

That means their stocks are likely to fall further.

So, even though Facebook Inc. (Nasdaq: FB) is more than 25% below its all-time high, it’s not a bargain.

Neither is Snap Inc. (NYSE: SNAP) at more than 50% below its all-time high.

Twitter Inc. (NYSE: TWTR) at 25% below its high is also not cheap.

Bargain hunters should wait. The time to buy will be when the threats to the business model subside and prices stop falling.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader