The headlines are clear: Oil will never be able to pull out of this bear market. The problem is that there’s too much oil. OPEC is producing too much, and American shale production has revolutionized the market. With too much supply, the price will continue to fall, according to conventional wisdom.

That may be true, but there are some bullish investors in the market. Showing that they don’t read the headlines, the bulls in oil are the smart money. These are the producers and industrial users such as refiners. According to the chart below, the smart money is more bullish now than they have been at any time in the past two years.

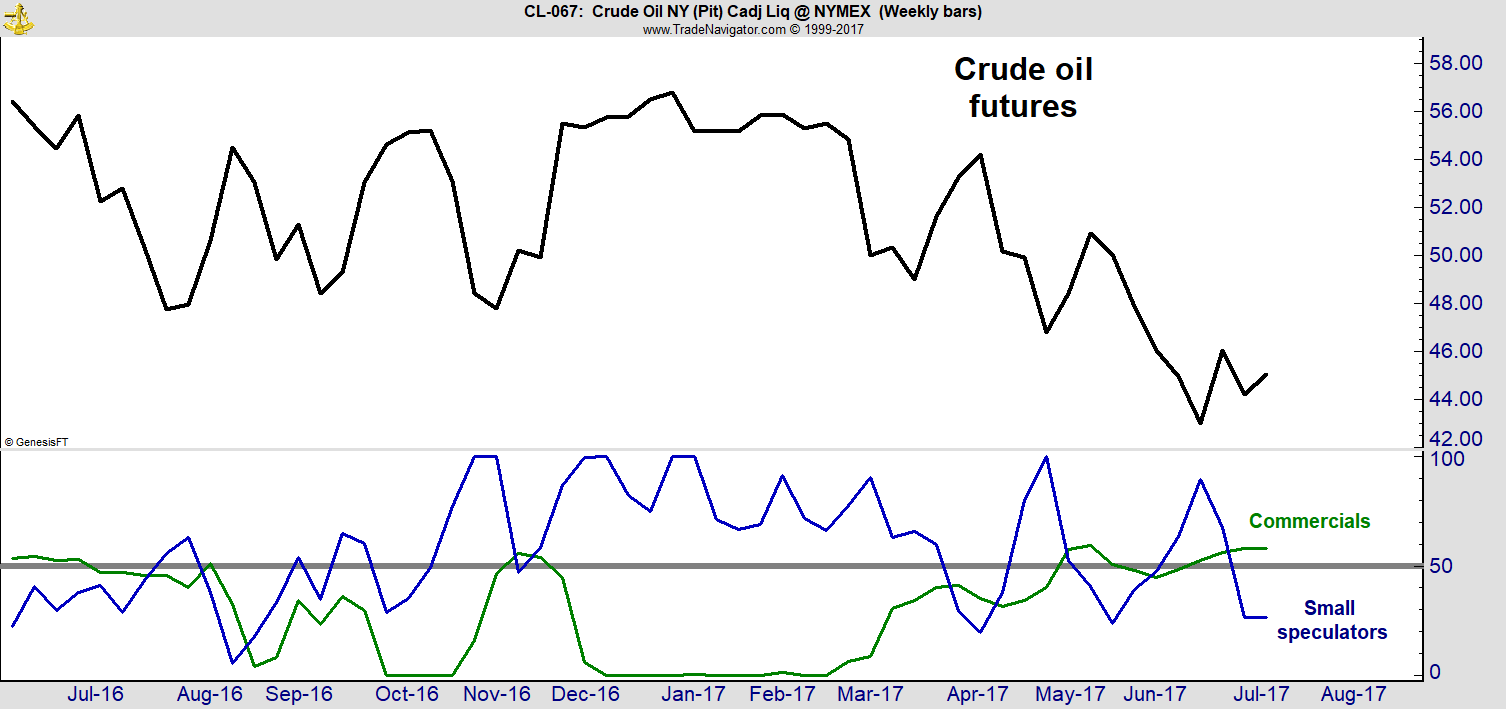

This chart shows data from the Commitment of Traders report. Every week, futures positions are reported to government regulators. The raw data is difficult to read. Instead of using the government numbers, this chart converts the data to an index.

The green line in the chart is the position of commercial traders in the oil market. This is the smart money. The blue line represents small traders, the ones who tend to be on the wrong side of the market most often.

The lines show how bullish each group is. To do this, their current holdings are compared to holdings over the past two years. When the index is above 50, traders are more bullish than average. Commercials have just moved above 50. At the same time, small speculators dropped below 50.

This tells us the smart money is buying and the dumb money is selling. That’s often the setup for a rally.

This signal isn’t perfect, but it indicated a large rally at the end of 2016. Now, oil is down quite a bit, and commercials seem to believe it’s a bargain. This could be a signal that a new rally is about to start.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader