Every day, the stock market moves. And every night, articles appear explaining the move. Oil is a popular reason. I’ve seen headlines saying: “Stocks Rally After Oil Gains.” I’ve also seen headlines saying: “Stocks Fall After Oil Gains.”

Neither one is correct. Oil doesn’t move the stock market. Incorrect headlines extend well beyond oil. Elections don’t move stock markets in the long run. Congress has no effect on day-to-day moves in any market. These, and other factors, may contribute to market moves, but they aren’t the cause.

In the long run, only one thing moves the stock market — earnings.

Earnings Mean Success

This might sound overly simplistic. But earnings are the measure of a company’s success. When business is good, earnings are rising. When business turns down, earnings decline.

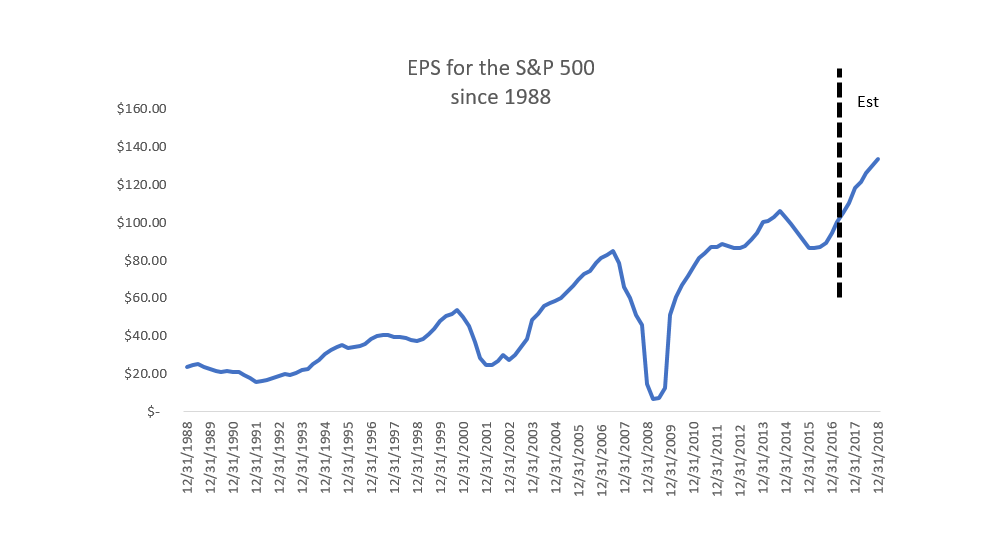

The long-term trend in earnings for the companies in the S&P 500 is shown in the chart below. Total earnings are weighted by the company’s contribution to the index.

(Source: Standard & Poor’s)

The chart looks a lot like a chart of the S&P 500 price action. The bull market in the 1990s coincided with a steady uptrend in earnings. Bear markets in 2000 and 2008 show up in earnings. That makes it important to consider what the current expectations mean for stocks.

As earnings climb, stock prices should remain in a bull market for the next few years.

Even though the chart is clear, many investors will refuse to believe that a bull market is likely. These investors will be watching the headlines, and they will see war and turmoil all around the world. They will weigh the implications of the United Kingdom’s decision to leave the European Union. Worries about debt in Greece, the health of banks in Italy, upcoming elections in Germany and hundreds of other stories will keep them from believing the stock market can rally.

These stories do matter. If consumers in the United Kingdom believe leaving the EU will create economic chaos, they may stop spending on everything except survival goods. If that happens, earnings of companies doing business in the country will plummet.

The same is true of other areas of concern. If concerns grow enough, they will affect consumer spending and, eventually, the earnings of companies. That’s when the stock markets will reverse course — when politics and other stories affect earnings.

Until then, the trend in earnings and stocks is up.

An Important Trend

Of course, this type of analysis applies to individual companies as well as broad stock market indexes. Earnings for companies also trend. Not surprisingly, the trend in the stock price tends to be in the same direction as the trend in earnings.

This makes earnings an important input into an investment decision. Stocks could move up or down for years while earnings move higher or lower.

These trends take time to unfold for a couple of reasons. The first reason is obvious — earnings are only updated once every three months. The second reason is that investors react slowly to news about earnings.

It can take two years or more for investors to realize a trend in earnings is in place. Then they tend to underreact again when the trend reverses. This behavior creates opportunities for profitable investment strategies.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader

P.S. Chad Shoop’s new research service makes it easy to profit from earnings season. And the real beauty of his system is that earnings announcements happen four times a year — meaning that you can continue to tap into these profits over and over again, every year. Chad’s service will be launching soon, so keep reading Winning Investor Daily to find out more about this system’s incredible money-making potential.