When I opened my first brokerage account outside of my 401(k), I did so from my cellphone with $250.

I signed up for a Robinhood account. The mobile app doesn’t charge fees to invest in stocks and exchange-traded funds. (It recently expanded to include options and cryptocurrency.)

Ten years ago, starting small was far more difficult for investors.

Standard investment accounts required minimum balances. Even minimums of $1,000 or $2,500 can seem daunting for market newbies.

And financial advisers typically won’t bother with clients who have under $100,000 in investable assets.

But robo-advisers changed the game and made investing accessible for everyone.

2 Common Issues With Investing

The first robo-adviser, Betterment, launched in 2008.

The idea was to counter two common issues with investing:

- People buy stocks at their highs and sell at their lows.

- Fees and trading costs eat up far too much of users’ accounts.

This low-cost alternative allowed users to go to a website and answer a few questions. The robo-adviser then chose their investments for a fraction of what they’d pay a human adviser.

Robo-advisers are now more sophisticated. Some can handle retirement planning and tax-loss harvesting.

Investors are buying into the technology. Robo-advisers managed $60 billion by the end of 2016. Fintech advisers expect that amount to skyrocket to at least $2 trillion by 2020!

It’s no surprise that Forbes recently called robo-advisers “revolutionary.”

They allow low-net-worth individuals to access the market. They keep more hard-earned cash in users’ accounts. And they invest in plans that data show will survive market cycles.

My colleague Anthony Planas summed it up in a discussion about the advantages and disadvantages of robo-advisers: “I like it. Services like Betterment are helping members of the ‘gig economy’ to save for retirement. It’s filling the gap of a 401(k) for independent contractors and service workers.”

And John Ross reminded us of a billionaire investor’s recent take on the markets: “Ray Dalio says not to put your money in cash or deposit accounts. Invest it; otherwise, you’re losing.”

Acorns: The Robo-Adviser That Invests Your Spare Change

My college-age cousin recently told me he downloaded the Acorns app on his cellphone.

Acorns rounds up his debit card spending to the nearest dollar. It invests those pennies in the stock market.

There’s no minimum balance. It’s free for college students for up to four years.

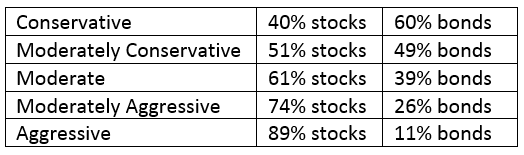

Based on your investing goals, the app places you in a portfolio of stocks and bonds. The same funds make up every portfolio, but the percentages differ.

It chose a moderate portfolio for my cousin. If you don’t like the portfolio the app places you in, you can choose any of the five available options:

Robo-Advisers Won’t Replace Your Brokerage Account

If you sign up for Acorns, you’ll notice right away that you can’t choose individual stocks to invest in.

If I wanted to buy the oil market dip as John Ross suggested last week, I couldn’t do that with an Acorns account.

See, robo-advisers do all the work for you. They won’t replace an account that lets you choose your stocks.

They are, however, a fantastic option for first-time investors who don’t know how to begin choosing stocks.

And they are a great complement to a brokerage account.

We have to decide when to buy and sell the stocks in our brokerage accounts — and try to avoid the typical investor behavior of buying stocks at their highs and selling at their lows.

With an Acorns account, we can let our spare change roll in and not think about it.

Robo-advisers are certainly no substitute for experts like Matt Badiali, Chad Shoop and Ted Bauman — but we should all welcome fintech that makes investing more accessible.

Good investing,

Kristen Barrett

Managing Editor, Banyan Hill Publishing