The one thing I was certain would happen over the past 12 months turned out to be the exact opposite.

Last November, the newly elected president was committed to stirring up the typical D.C. drama.

President-elect Donald Trump had a mission to “drain the swamp.”

He promised to be a president who went against the grain of how things were done.

I, along with many others, expected the one thing the markets would experience in his presidency would be wild market swings, also measured as volatility in the stock market.

After one year, we saw the exact opposite.

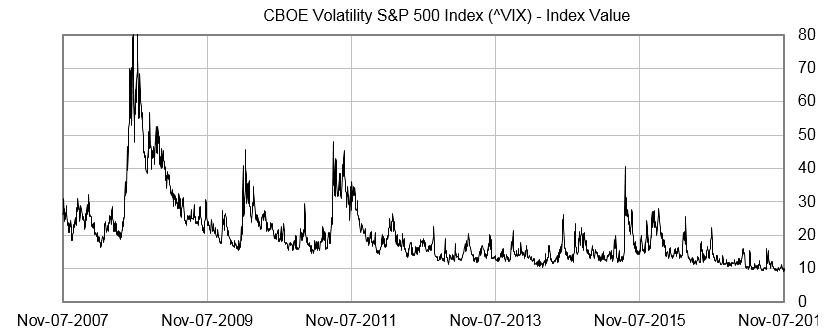

Volatility, as measured by the CBOE S&P 500 Volatility Index (VIX), is at all-time lows.

The stock market has experienced one of the longest runs in history without a 5% correction.

In short, there is a remarkably low amount of volatility in the markets.

And I hope you are taking advantage of that by riding the market rally with options. Let me explain…

Use Volatility to Your Advantage

Options aren’t something most people associate volatility with, but it is the first thing that comes to mind for me.

See, options are a leveraged bet on a stock moving in a certain direction. And many people use options to do just that — place bets.

But you can also strategize with options to use volatility to your advantage.

Let’s start by looking at a chart of the VIX.

If you are looking at this chart and wondering how it relates to the options market, think of it this way: When the VIX spikes higher, you are paying more for the options than you did the day, week or month before.

Volatility is factored into the options price because the price of an option is made up of three factors: intrinsic value, time value and implied volatility.

You don’t have to know what each means for now. I just wanted to note that volatility is an input that can determine the price of the option.

And since it helps determine a price of an option, it means we can take advantage of it.

Volatility Needs to Be on Your Radar

What you want to see in the options market is low volatility when you are buying options, and high volatility when you are selling options.

Buying options when volatility is low allows volatility to rise and work in your favor. If volatility increases after you buy the option, and the stock hasn’t moved much, you could be sitting on a nice gain even though the underlying stock was basically flat.

On the other hand, if you are buying options when volatility is high, and then volatility declines, you could lose money even if the stock went the direction you expected.

Again, these gains and losses in the options market can come simply from volatility movement, and not from price movement of the stock.

That’s why volatility needs to be on your radar if you are trading options.

With the current low-volatility market, buying options is something we all should be taking advantage of.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert