Stocks are in a bull market. At least that’s what the price action is telling us.

Skeptics argue that the bull market is built on a pile of sand. And, they warn, sandpiles have a habit of collapsing suddenly.

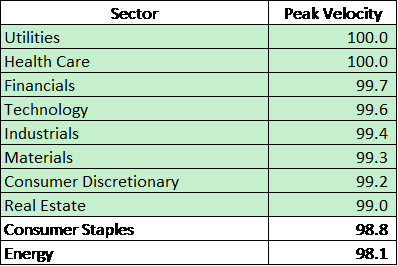

But the chart below shows the stock market isn’t ready to collapse. My Peak Velocity indicator shows this is a broad-based bull market that should keep climbing.

The skeptics have a point. Sandpiles are prone to collapse. This is especially true when the pile grows unevenly. Without a broad base of support, the pile is increasingly vulnerable as it grows.

But in the current stock market, we see there is a broad base in the chart above. The chart shows eight of the 10 sectors tracked by S&P are on Peak Velocity buy signals. The other two are within 1% of a buy signal.

This shows the market’s rally is not dependent on just a few stocks or just one sector. That was true in 1999 when technology led the market into a crash. We also saw a narrow market advance in 2007 as financials led the market into a crash.

Right now, investors are buying everything. Utilities are a favorite of conservative investors. Technology is the most aggressive sector. Both are giving Peak Velocity buy signals with readings above 99.

This indicator identifies the most likely direction of the short-term trend. When it’s above 99, we tend to see prices move up in the next three months.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader