Story Highlights

- The Federal Reserve’s decision to cut interest rates points to a weakening economy.

- The U.S.-China trade war adds to the stock market’s uncertainty.

- One index shows that fear in the market is higher.

- Last October, Chad Shoop recommended using this strategy on 14 trades — and closed out every one for solid profits.

Last Wednesday, the Federal Reserve made its big announcement.

The quarter-point cut wasn’t a surprise. The Fed went along with the market’s wishes.

But as I have written in recent weeks, this is big news for the economy.

The rate cut signals economic weakness. It’s worse than the data suggests.

And the new twist in the U.S.-China trade war creates even more uncertainty.

As a result, volatility in the markets surged over the last week.

I know stock market volatility isn’t a friend of long-term investors. But if you have a shorter-term view, you live for it.

Times like these create enormous opportunities across the market.

Today, I’m sharing my favorite strategy for volatile times in the market.

VIX Index Shows Rising Fear in the Markets

Watch my video below to learn more about how you can profit from the stock market’s volatility.

I track the CBOE S&P 500 Volatility Index (VIX). The different levels tell us the market’s expectations.

When the VIX is under 20, it tells us the market is full of greed. And when it’s above 30, it tells us there is extreme fear in the market.

But when the VIX is between 20 and 30, it indicates elevated fear. That’s the sweet spot for the strategy I’m talking about today.

Once the index jumps above 20, it tells me it’s time to be more aggressive. I know how to capitalize on that fear.

Selling Put Options Is a Win-Win

Selling put options is my favorite strategy during volatile times.

It allows us to collect income from a stock. And at the same time, we get the possibility to buy shares.

And here’s the key: When volatility rises, the prices for put options also rise. This reflects the added volatility.

That’s because investors use put options to hedge their portfolios and make bearish bets.

As options sellers, it means we are collecting more income — all things being equal.

So we get the best of both worlds:

- We collect income at a higher-than-usual rate.

- We can add exposure to beaten-down stocks that we want to own.

It’s a win-win scenario.

Double-Digit Gains With Pure Income

October 2018 was the last time the VIX held above 20 for an extended time.

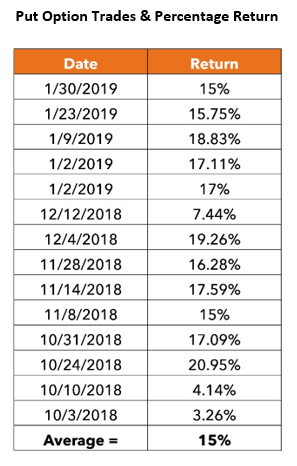

During the three months that followed, fear in the stock market was elevated. I made 14 recommendations to sell new put options.

We closed all of those trades for solid profits. The table below shows you the percentage return for each trade.

That’s why I’m excited about the opportunities this new turn of events is creating. I’ll be taking advantage of the stock market’s volatility in the coming weeks.

When the VIX is low, it’s a challenge to find great companies to sell put options on. The market simply doesn’t pay enough in premiums to do so.

But, with the VIX above 20, there are ample opportunities for investors like us.

I’ll have a new income opportunity tomorrow for readers of my premium Pure Income service.

It’s on a blue-chip retail stock that has been oversold in this volatile market. It gives us a chance to make a 20% annualized yield given the volatile backdrop.

To put that into perspective, the average yield for the S&P 500 Index sits at 1.9%. We’ll collect more than that in just over two months.

If you want to collect income, click here to learn more.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert

P.S. I’ll be talking about two of my best strategies to take advantage of the stock market’s volatility at this year’s Total Wealth Symposium. Join me and learn more about how you can generate more income during volatile times.