Big pipeline stocks are poised to breakout in 2019.

The United States has over 200,000 miles of pipelines that transport crude oil, natural gas liquids and refined products around the country. That’s long enough to wrap around the earth over nine times!

If we add in the natural gas pipelines, it could wrap the earth 100 times.

These are the toll roads of the energy industry. Companies own them and charge other companies to transport liquids and gas from point A to point B.

While they are expensive to build, they should generate healthy profit margins. Particularly when the volume of the stuff that they move is getting larger.

When you mix in some Fed-created turmoil, you’ve got the makings for a great investment opportunity…

A New Oil Production Boom

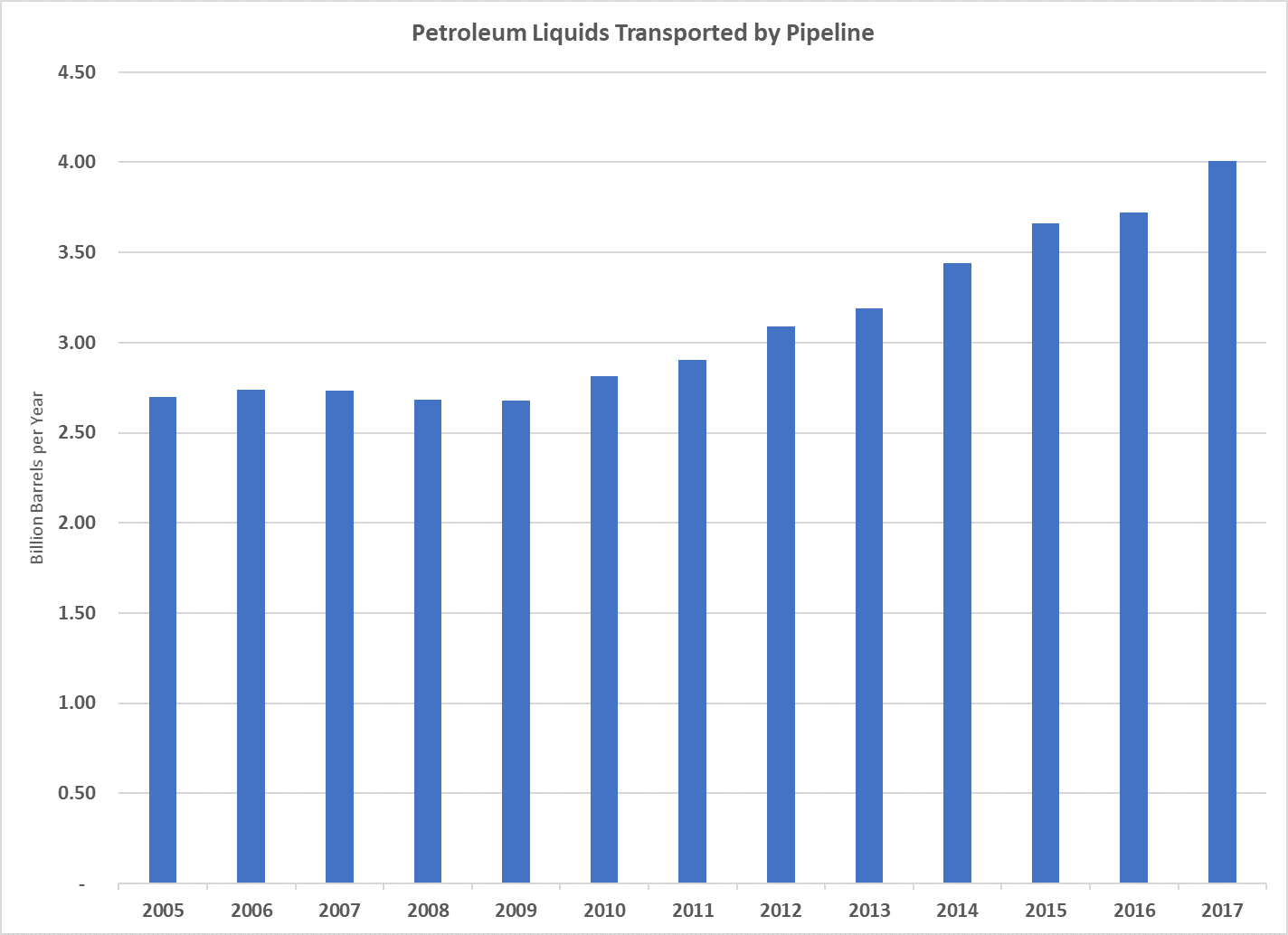

As you can see in the chart below, there was a dramatic increase in petroleum products transported by pipeline. From 2009 to 2017, the volume increased by 50%.

From 2016 to 2017 alone, the volume jumped 8%. That trend will continue through 2019.

Liquid production in the U.S. is at an all-time high. The U.S. oil production broke 11 million barrels per day. That will be a huge boost in pipeline transport volumes.

Many of those pipelines are owned by unusual companies called “master limited partnerships,” or MLPs.

That’s an official designation, which means the company gets a tax break for operating vital infrastructure.

In exchange, the company must pass on most of its revenue to its shareholders. That means these companies pay extra-large dividends. That’s great in times of uncertainty in the market. We get paid to wait things out.

However, rising interest rates can be hard on MLPs.

The Fed Is Creating a Bump in the Road

As the federal reserve raises interest rates, it costs these companies more to borrow money. They use those loans to buy or build new pipelines and acquire assets. The higher borrowing cost cuts into our dividends.

Today, shares of these giant energy toll roads are down.

Look at the chart below:

Shares of the Alerian MLP Index are down 15% since August 2018 and are approaching their two-year lows.

As these share prices fall, the dividend yield goes up. The Alerian MLP index pays 8.5% today.

However, the trend is down. With another hike coming later this month, shares continue to fall.

That probably won’t be the case in 2019. Slowing global economic growth, low oil prices and sluggish economic indicators will reduce the Federal Reserve’s need to lift interest rates. That should be good for MLPs.

Add to that investors looking for yield, and this sector could boom.

Considering that this index sat at $22 per share in 2014, there is a lot of upside. We could easily see it double from today’s price. Not to mention locking in an 8.5% yield for a few years.

MLPs are a sector to own in 2019.

Good Investing,

Matt Badiali

Editor, Real Wealth Strategist