When you look at Tesla’s 3,220% surge, people think, “I missed out. The rally’s over. Everyone already knows about what’s happening in the electric vehicle (EVs) market.”

I have to disagree.

I think investors are still severely underestimating the EV market’s growth.

Today, I want to show you why it’s not too late to buy EV stocks.

In fact, there’s never been a better time than now to invest in EV companies.

(If you’d prefer to read a transcript, click here.)

Hey everyone. Steve Fernandez here with this week’s edition of Market Insights.

Today, I want to show you why it’s not too late to invest in EV stocks. I don’t think there’s been a better time than now.

So, before we get started, go ahead and hit the like button and subscribe. You’ll get access to all of our content as soon as it comes out.

Now, like I said, I don’t think there’s been a better time to buy EV stocks. When you look at what Tesla did, obviously people are thinking, “Well, we missed that rally. This rally is over. The market already knows about EVs and what’s coming in that market.”

Now I have to disagree.

I think that the market is still severely underscoring the EV growth that we’re seeing. Maybe not in Tesla, but in other automakers, and more specifically materials companies, which I’ll cover later in the video.

EV Sales Are Crushing It!

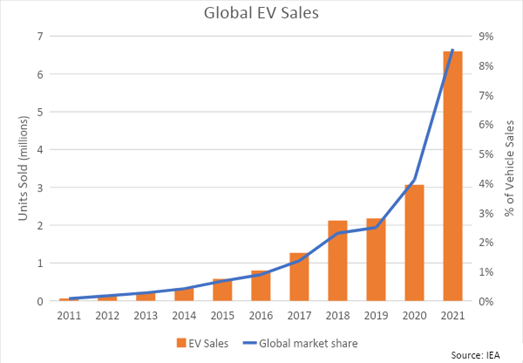

Anyway, EV sales are really crushing estimates right now. They just had numbers come out officially for 2021. It was 6.6 million EVs sold globally in 2021. That’s above the 4.2 million estimate that IHS Markit had provided just a year ago.

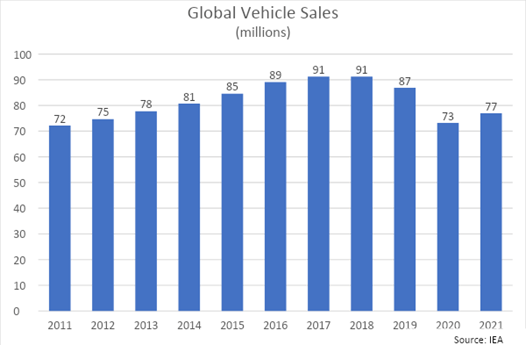

So, 2021 was pretty astonishing. And keep in mind that overall new vehicle sales haven’t been good. You can see in this chart that it really hasn’t rebounded from that 2020 COVID low that we saw.

And I don’t really expect them to make new highs within the next couple of years. But I do expect EV sales to continue climbing.

In 2021, 9% of global auto sales were EVs. Looking ahead, Bloomberg expects in 2022 there will be about 10.5 million EV sales. And keep in mind, just seven months ago, the same analysts at Bloomberg predicted that wouldn’t happen until 2024.

So, we’re seeing huge sales momentum in EVs. Consumers want to park their money in EVs, no pun intended. And, you know, I expect that we’ll continue seeing these upside surprises, and I’ll go over that here in a bit.

Now, a lot of you have heard us talk about the semiconductor shortage. And that’s another thing that’s kind of surprising, which is that EVs have really been strong amidst a semiconductor shortage.

So, we’re seeing producers constrained by supply in terms of semiconductors. But semiconductors are really ramping up spending.

They never spent more than $110 billion until last year, where they spent $150 billion. That’s a pretty big move in semiconductor spending. And I expect that to really enable more EV sales this year and into the coming years.

What’s probably most underrated with what’s happening in EVs right now is the release of these light truck models — light trucks being pickups, minivans and SUVs.

In the U.S., there’s a really big market for those. Over 70% of total sales are light trucks. So, the fact that we’re now seeing these light trucks come to market — obviously we’re seeing the Ford F-150 Lightning that we’ve talked about, the Chevy Silverado and other vehicles that are coming to market — that total percentage of global sales going to EVs has to increase.

A lot of people are holding out on EVs because they didn’t have those models before. So, I think estimates are low. Like I said, these vehicles are now coming to market, and we’re going to see these sales reflected in future financials.

So, you know, I think the market is really underscoring this growth. The auto industry’s actions are speaking volumes. They’re committing $330 billion in spending through 2025 just to get new EV models on the road.

If they think that this is the future, and they think that there’s going to be easily over 50% of vehicle sales coming from electric by the end of the decade, you have to assume that the people in the front lines doing this are right.

How Much An EV Cost?

Now, again, I’m confident that EV demand won’t be an issue. What we’re seeing now in terms of auto sales isn’t demand related or supply related. The recent sale numbers that I showed you just a second ago are proving this.

Anecdotally, I don’t know about you, but I haven’t met anyone that really hasn’t considered buying an EV. They’re pretty cool.

It’s not even really the environmental concern. It’s more, wow, you can get this vehicle for this much, and I can save money over time. And, you know, that’s pretty cool. You can just charge it in your garage.

For most people, the social sentiment about EVs is improving dramatically over time. And you do have to consider the reasons why someone wouldn’t want to buy an EV, or the reasons for buying it.

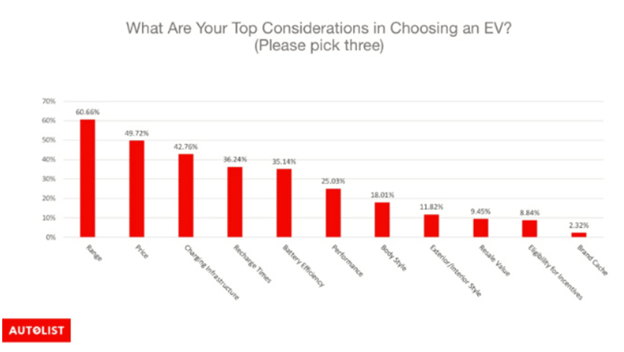

You can see in this chart that basically the top concerns or considerations about EV buying from auto buyers are really heavily weighted toward range, price and the total cost of ownership.

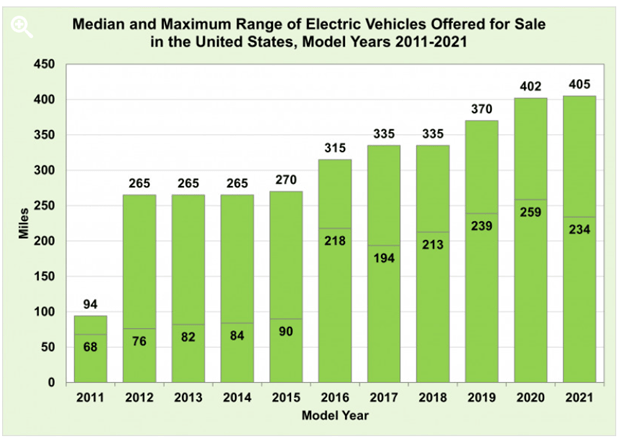

So, the range right now on EV models isn’t great. The median — so, basically, the middle — EV has about a 250-mile range, and I expect this to continue trending higher as battery tech improves.

But we’ve seen EV manufacturers really rush to get some of these models to market, and with prices so high for raw materials, they’re keeping the batteries a little bit lower range at the moment. But that will change.

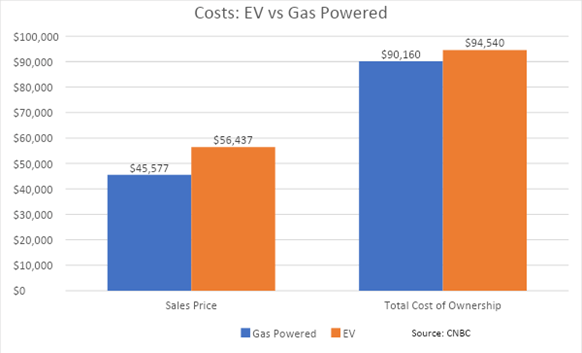

Also, price has been, obviously, a big consideration. EVs are more expensive, at least on the ticket price, than their gas-guzzling counterparts. But it’s probably less of a difference than you’d think.

You can see about a $10,000 difference between EVs and gas-powered vehicles. And really, there’s no difference, almost, when you look at the long-term total cost of ownership.

It’s about the same, and that’s before tax credits. With state tax credits, it could actually be cheaper in some states.

And lastly, charging infrastructure is really the big thing that will either make or break EVs.

We’re seeing a huge commitment by the U.S. government. And that was manifested this week. President Joe Biden came out with a plan that allocated $5 billion over five years to build out a public charging network.

Now, I can tell you from my research that most vehicle owners want to be able to charge their vehicles in a garage at their home, but it’s not always possible for a lot of people when you think about it.

A lot of people live in apartments. or they may have townhouses without garages or, you know, driveways. So, they’re at the liberty of whatever is available at that complex. And right now, that’s relatively underdeveloped. I expect that to change.

And as these chargers get faster, you know, there’s a focus on Level 3 charging by a lot of these charging networks. As those come to market, the time to actually charge at these locations goes down. And it makes EVs more appealing, especially to people that can’t charge in their garage.

How Can You Invest In EV?

Now, you might be thinking, “Well, how do I invest in this, Steve? You haven’t said anything about how to buy any stocks.”

Obviously Ian King and I aren’t as optimistic about the price of Tesla. But we think there are other opportunities out there.

I really lean toward the materials side of the EV trade specifically. You know, battery materials.

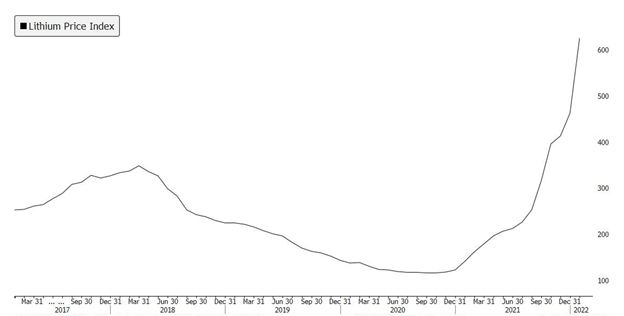

Obviously, lithium is the biggest component of lithium-ion batteries. And it’s really causing a spike in the price of lithium.

Now, it’s not only car batteries that are feeling the price increase. It’s also consumer electronics, for example. But EV growth, in the upside surprise there, is really sending the price of lithium and other battery metals higher.

You can see in this chart that there’s a huge spike in lithium in just the last year or so. It’s over a 400% increase since 2021 started. So, it’s pretty dramatic.

Automakers are constrained by supply. If they can’t get the materials that they need, you know, they can’t produce more vehicles. The only way that they can really make money is if they charge higher prices.

And you probably understand that the auto market is really competitive. There’s so many brands. Consumers are really price sensitive. So, unless it’s a luxury brand that really has that following, you know, where customers are willing to pay anything, auto manufacturers can’t pass on all of this cost.

That’s part of the reason we don’t really see profit margins for automakers go up over time. They’re relatively range bound. And I expect that might change slightly. As the next EVs come out, they might increase prices a little bit.

But generally speaking, automakers are at the liberty of what they’re paying, and they’re constrained on how much they can sell vehicles for.

That’s not necessarily the case for these material companies.

Obviously, they’re limited by how much they can produce in terms of the raw material. How much can they mine, for example. But the prices aren’t. They don’t have to be as constant. Like I just showed you with the lithium prices, they continue going up.

EV makers have to buy these materials to put vehicles in these lots and sell them, and they’re willing to spend up to get those materials. So, I think it’s really bullish for metal stocks, specifically EV metals.

And I know Ian and I are really bullish on one in particular. I can’t give it away in this video. That would do a disservice to our subscribers. But if you’re interested in learning more about our report, go ahead and click here and give this video a watch.

Thanks for tuning in to this week’s edition of Market Insights. I hope you learned something. And again, it’s not too late to invest in EV stocks. If I didn’t convince you, I don’t know what will. I’ll talk to you again soon.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Y-mAbs Therapeutics Inc. (Nasdaq: YMAB) develops and commercializes novel antibody based therapeutic products for the treatment of cancer. The stock is up 26% after the company had a meeting with the FDA and announced its plans to resubmit an application for its drug Omburtamab.

Mr. Cooper Group Inc. (Nasdaq: COOP) provides loan servicing, origination and transaction-based services related to single-family residences. The stock is up 18% after the company beat expectations for the fourth quarter and announced plans to create the first cloud-based platform for mortgage servicing.

Zillow Group Inc. (Nasdaq: Z), the digital real estate company, rose 18% this morning. The stock is up after it beat analyst expectations for the fourth quarter and announced plans to scale up its core business to create an all-in-one housing app.

Xpel Inc. (Nasdaq: XPEL) manufactures, sells and installs after-market automotive products internationally. It is up 17% on the news that it is set to join the S&P SmallCap 600 Index next week.

Carpenter Technology Corp. (NYSE: CRS) manufactures, fabricates and distributes specialty metals worldwide. It rose 17% after analysts at JPMorgan Chase upgraded the stock from a neutral to an overweight rating and raised the price target following its recent earnings report.

Bloom Energy Corp. (NYSE: BE) designs, manufactures and sells hydrogen fuel cell systems for on-site power generation. It is up 15% after the company reported a revenue beat for the fourth quarter and said that it expects to generate positive cash flow from operations in 2022.

Vimeo Inc. (Nasdaq: VMEO) operates as a cloud-based software platform for professionals, teams and organizations to create, collaborate and communicate with video worldwide. It is up 15% on a rebound after a sell-off on Thursday when it reported earnings and issued weak guidance.

Newell Brands Inc. (Nasdaq: NWL) designs, manufactures and distributes a wide range of consumer and commercial products worldwide. The stock is up 13% after the company managed to beat fourth-quarter estimates with strong results across every business unit and geographic region.

Diebold Nixdorf Inc. (NYSE: DBD) provides connected commerce solutions to financial institutions and retailers. The stock is up 13% as it recovers from a drop on Thursday when the company reported an earnings and revenue miss for the fourth quarter.

Precision Drilling Corporation (NYSE: PDS) provides oil and natural gas drilling and related products and services. It is up 13% after reporting better than expected revenues for the fourth quarter thanks to rising global demand for oil.