Patterns in markets exist because human nature never changes.

In the early 1600s, individuals in Holland somehow convinced themselves that tulip bulb prices could only go up. It was history’s first recorded bubble.

In the late 1990s, individuals around the world decided that the prices of stocks of internet companies could only go up.

They knew startup companies weren’t profitable, so they justified high prices with new measures and invented the price-to-eyeballs ratio. Somehow, eyeballs on a website would eventually lead to revenue and profits.

You know how that story ended.

Less than 10 years later, houses became like tulip bulbs and internet stocks. The bubble in housing led to a global financial crisis.

Yet, even after the crisis, it’s safe to say there will be another bubble. It might even be underway right now.

Human Nature Influences Japanese (and all) Stock Prices

We know there will be another bubble because human nature never changes. The emotions of greed and fear drive bubbles and crashes in markets.

Less dramatic examples of human nature include how individuals respond to taxes. We tend to wait as long as possible to pay what we owe the government. This is true in the United States and around the world.

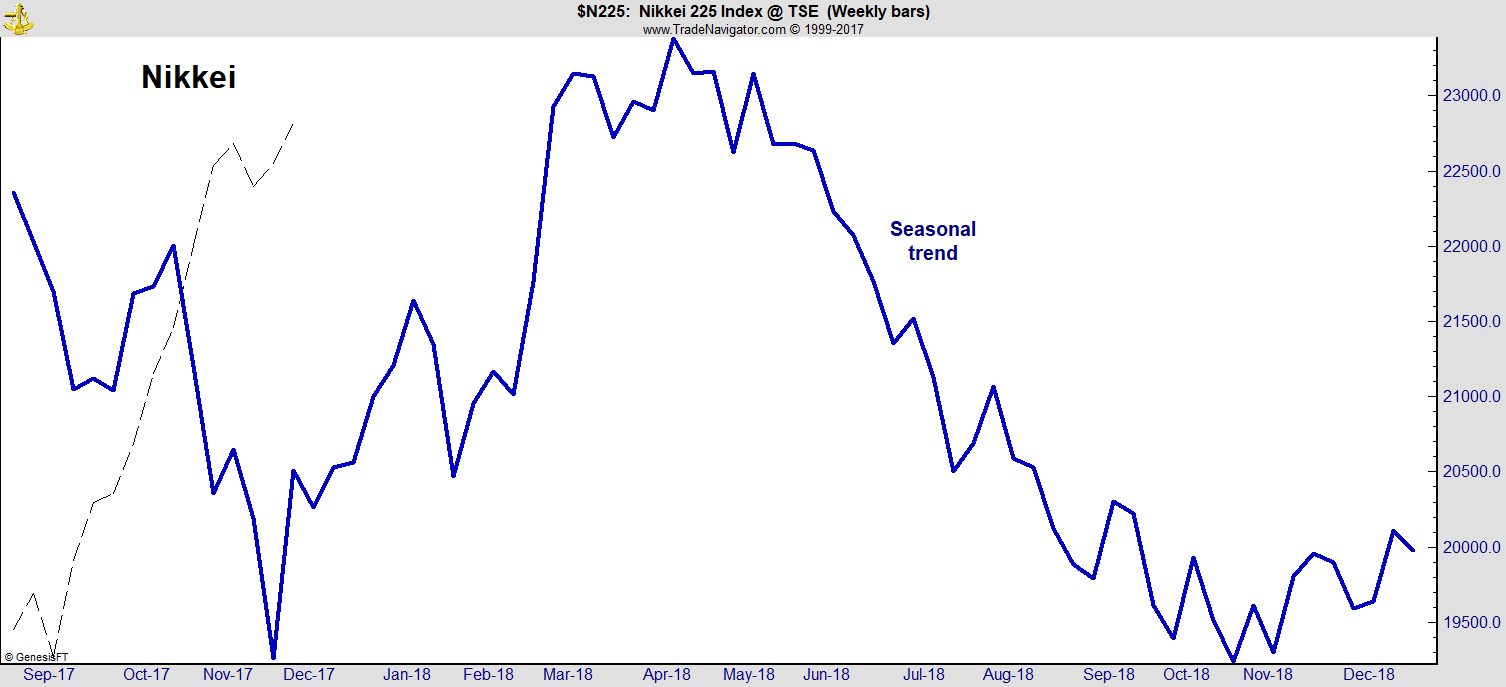

Waiting until the last minute means we often see certain trends in cash flow. These trends show up as patterns in the stock market. That’s why now is the time to buy stocks in Japan. The chart below shows the trends in cash flow.

In Japan, income taxes are due on March 15, or April 15 if paid with a bank draft. These dates coincide with peaks seen in the chart above.

The final market peak in April comes as many Japanese companies and foundations start their fiscal year. In Japan, the fiscal year starts on April 1 and runs through March 31.

Human nature almost completely explains this chart.

Individuals tend to review their finances at the end of the year. Extra cash finds its way to the stock market from December to March, which is when the tax deadline hits.

Foundations reviewing their financials invest at the end of March and beginning of April.

Then, for the rest of the year, individuals ignore their financials. This isn’t ideal, but it is the way many individuals handle financial planning.

Everywhere in the world, cash flows cause all stock market swings. Increases in cash flow push prices up. Decreases in cash flow lead to bear markets. Crashes are, inevitably, the result of liquidity crises.

These cash flows often create seasonal trends. These trends can show us how to trade if we combine them with other indicators. For example, to benefit from the trend in the chart, we could buy exchange-traded funds like the iShares MSCI Japan ETF (NYSE: EWJ).

Options Can Make You Big Gains in Japanese Stocks

We can use call options to trade EWJ. We could buy now and sell in March. Call options can benefit from an increase in price with limited risk. And there’s an option expiring on March 16 that closely matches the time frame for this strategy.

EWJ is trading near $59. Buying 100 shares would cost $5,900. If the ETF gains 10%, you would earn $590.

The call with an exercise price of $59 costs about $2 to trade. If EWJ gains 10% by March 16, this call would be worth at least $5.90. Each contract covers 100 shares, so you would earn $390 per contract.

Buying two EWJ call options would cost about $400. If EWJ gains 10%, these options would be worth at least $1,180. That’s a 195% gain.

In dollar terms, you could gain twice as much as the shareholder who buys 100 shares — and that’s with an investment that’s less than 7% of the amount required to buy 100 shares.

When buying option contracts, you can never lose more than you pay to enter the trade. In this trade, that’s $400.

Options might not be the best strategy for all investors. But they could provide large gains. Because the gains can be so large, almost all investors should consider options strategies.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader