There’s an old internet meme that explains economic systems with bovine means:

SOCIALISM

You have two cows.

You give one to your neighbor.

COMMUNISM

You have two cows.

The state takes both and gives you some milk.

FASCISM

You have two cows.

The state takes both and sells you some milk.

CAPITALISM

You have two cows.

You sell one and buy a bull.

Your herd multiplies, and the economy grows.

You sell them and retire on the income.

But there’s a new wave of economic thinking that goes like this:

MODERN MONETARY THEORY

You have two cows.

The government has a monopoly on cow production and can make as many cows as it wants.

Everyone thrives on endless cows.

If that sounds like an economic system that would never work, let me explain how we arrived at this dystopian utopian future.

2 Economic Levers

To stimulate an economy, governments have two economic levers available to pull.

There’s the monetary lever, controlled by the central bank.

It has been yanked on around the world for a decade now. Interest rates at zero and bond purchases keep rates low and stimulate growth.

Insofar as the Federal Reserve attempted to reflate assets such as houses and stocks, its grand monetary experiment was successful. (The jury is still out on the longer-term consequences of “free money.”)

Then there’s the fiscal lever.

This one involves increasing government spending on things such as wars, health care, entitlements, infrastructure, etc.

Cutting taxes is also considered fiscal stimulus.

Some of these fiscal levers lead to higher levels of productivity and economic output. Some don’t.

When you pull the fiscal lever and spend too much without raising the tax level, you run a budget deficit.

The government must issue debt to make up the difference between what it spends and what it collects. Governments make up the revenue shortfall by selling debt in form of government bonds.

In 2018, the U.S. ran an $830 billion budget deficit.

In 2019, the projected budget deficit is nearly $1 trillion.

Furthermore, the Congressional Budget Office predicts that the deficit will continue to rise over the next 10 years under current laws.

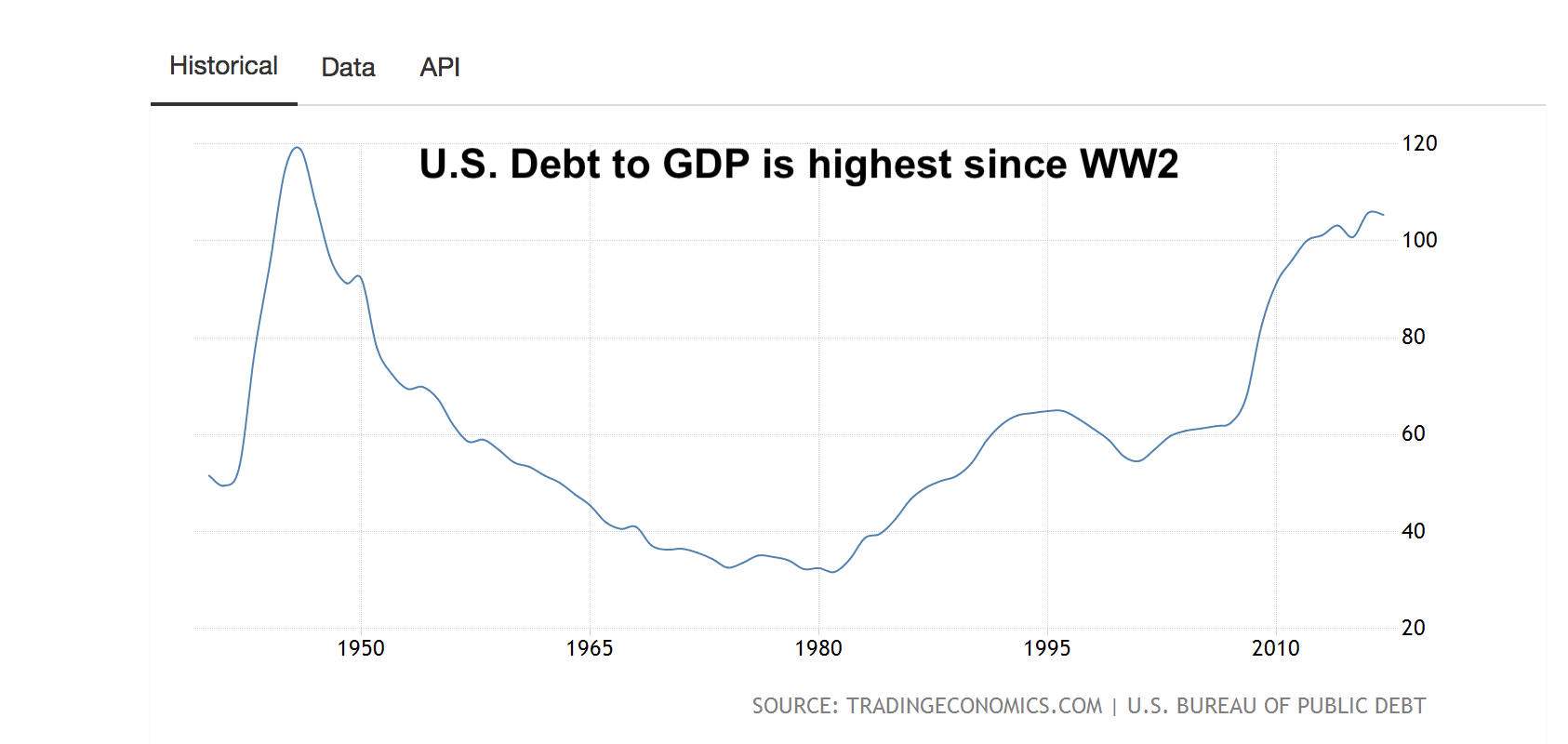

The U.S. has been running fiscal deficits for the better part of the past 20 years. That means current U.S. debt to gross domestic product (GDP) has risen to 105.4%.

This would put the country at its highest debt levels since World War II, when fiscal deficits soared to pay for war spending.

Remember, the Fed’s endless quantitative easing programs seemed to have worked. So why not try it on the fiscal side?

The Only Thing to Fear Is Fear Itself

In government circles, concerns about debt and deficits have gone away.

Longtime budget hawk and acting White House Chief of Staff Mick Mulvaney even went so far as to say “nobody cares” about the ballooning deficit.

This would indicate that both sides of the aisle finally agree on one thing: Debt and deficits no longer matter.

Perhaps that’s because a 10-year interest rate of 2.7% and low inflation suggest the government can borrow endlessly without any recourse.

Perhaps that’s because the Fed was able to print infinite monetary reserves to stimulate assets. That lets the government pay for increased military spending and other ballooning expenditures.

And a new economic theory is providing the justification for the run-up in debt.

It’s called Modern Monetary Theory (MMT), although it’s modern in name only.

MMT’s key proposition is that government has the monopoly on money creation. And because it is the sole issuer of money, it can afford to spend infinitely without fears of running out of cash.

This means that the government doesn’t need to collect our tax dollars before spending them.

It also means that budget surpluses — years when the government collects more than it spends — are a drag on economic growth.

If the government is running a surplus, money is accruing in government coffers instead of in the hands of corporations and ordinary people where it could be readily spent.

It’s a novel way of justifying a government’s ability to spend, just as Roman emperors would debase their own currencies by adding lower-value metals to pay off war debts.

Is There a Debt Limit?

As MMT gains credibility in political circles, it will ensure that U.S. debt continues to rise until either the bond market or the currency market says: “Time’s up.”

So this begs the historical question: Is there a debt level that can trip off a financial crisis?

A decade ago, economists Ken Rogoff and Carmen Reinhart published a noteworthy book titled This Time Is Different. In their book, they looked at an 800-year history of financial crises.

They concluded the opposite of their title: It’s never different. It’s actually always the same.

Policy makers, central bankers and investors delude themselves into believing that the era of financial panics have gone away. Then one arrives on your doorstep like an unexpected tornado.

Rogoff and Reinhart found a pattern that once debt breaks above 90% of debt to GDP, risks of a large impact on economic growth become significant.

This implies that the U.S., at 105.4% of debt to GDP (and growing), is going to face tough economic times ahead.

The More Things Change, the More They Stay the Same

No matter what theories are used to justify the debt, the free market always decides who is right and who is wrong.

This time will be no different.

We’ll end up in the same manner as all previous debt episodes — with slowing economic growth as the government raises taxes and cuts spending to reverse course.

Or, in the words of French writer Jean-Baptiste Alphonse Karr: “Plus ca change, plus c’est la meme chose.” (“The more things change, the more they stay the same.”)

In economics, there’s no such thing as a free lunch. And there is no such thing as a government that can spontaneously fabricate cows.

Regards,

Ian King

Editor, Crypto Profit Trader