As 2018 ends, the natural resource sectors finish the year with a whimper. Oil, copper, gold, silver, platinum and nickel all fell in price since January 1.

The Commodity Research Bureau Index, the S&P 500 Index of commodity prices, fell 10% in 2018. That’s the index’s worst performance since 2015.

That means 2019 will begin with most investors hating or ignoring natural resources because they will look back at 2018’s losses.

That’s a mistake.

There is something important going on right now. Something that we shouldn’t ignore.

Something that points to 2019 being a great year for natural resources. Particularly for precious metals.

The Natural Resources to Watch in 2019

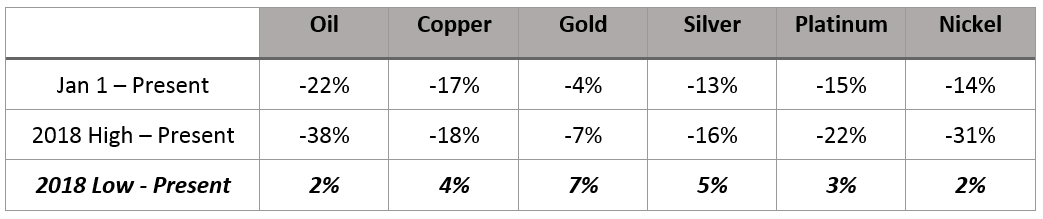

Take a look at the table below:

The table shows the performance of each commodity.

The first row shows it from the start of the year to today.

The second row shows it from the high price in 2018 to today.

The third row shows the difference between the low of the year and today.

Some commodities, like oil and nickel, are close to their lows for the year. But others, like gold, are moving up.

That’s important because, in 2019, those are the sectors to watch … particularly gold.

Look at the chart of gold in 2018:

You can clearly see the bottom in late summer and the uptrend through fall. That’s a great signal for what we can expect in 2019.

How High Can Gold Go?

The key to timing gold prices comes from the U.S. dollar.

As the dollar strengthened in 2018, it began to erode the gold price. Fears of trouble in Europe and China made the U.S. dollar a haven for investors. That pushed the dollar higher in terms of other currencies … and commodities too.

In other words, as people competed for dollars, it drove the value up. So, it took fewer dollars to buy an ounce of gold or silver.

Now, as the Federal Reserve noted on Wednesday, the outlook for 2019 isn’t great.

The global growth looks poor. The value of the dollar looks like it will weaken. As that happens, it will take more dollars to buy commodities, like an ounce of gold or silver.

That’s great news for investors looking forward to 2019. It means we will see higher gold and silver prices. The question is: How high could they go?

Gold has not broken $1,400 per ounce since 2013. That year, its high was nearly $1,700 per ounce.

However, the seeds of a rally are planted.

2019 could be the year that we see gold prices begin to climb back to those levels.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist