Fridays are the most volatile day of the week. Most of that volatility occurs in the first week of the month. That’s because day traders react to the employment report.

Because it’s such an important report, traders search for an edge that helps forecast the report. Some use surveys of economists. These are widely available, but they are always wrong.

In fact, stock market volatility depends on how far off the economists are.

This Friday, economists are likely to be off by quite a bit. That’s good news, this time, and stocks should soar on the news.

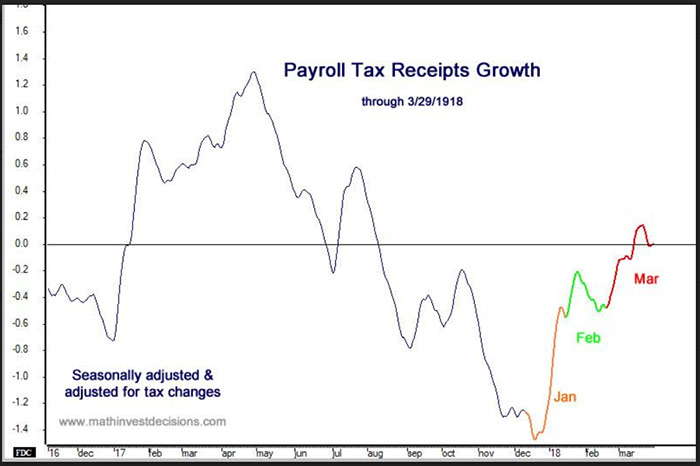

That’s based on my interpretation of the data shown below.

(Source: MathInvestDecisions.com)

As you know, employers withhold money from your paycheck. They deposit these payroll taxes a few days after they pay employees.

The Daily Treasury Statement offers real-time data on the amounts of deposits. Analysts at Mathematical Investment Decisions track those tax deposits. They found it’s a leading indicator of the employment report.

In March, the chart shows the trend in payroll taxes was up. That strength in taxes is at odds with analysts’ expectations.

Bloomberg surveys economists each month to see what they expect. The average of the survey is for a gain of 175,000 new jobs in March. But there’s a lot of uncertainty. Estimates range from a low of 112,000 to a high of 225,000.

In February, analysts expected 205,000 jobs, and 313,000 jobs were created. The S&P 500 gained 1.7% that Friday.

Analysts underestimated the strength of wage growth in the January data, and the S&P 500 fell more than 2% on the report day.

Almost every month, there’s a big move in stocks the day the employment report comes out. This month, the expectations are for small growth in jobs and solid gains in wages.

Payroll taxes tell us to expect a strong report. That means traders will be buying, and the S&P 500 should deliver a substantial gain.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader