Everyone always wants to go back to the “good old days.” Even the Federal Reserve is nostalgically eyeing the past.

Fed officials are planning to normalize policy. They want things to get back to normal, just like they were in the good old days. Turning back the clock is always a popular idea in the country, as President Donald Trump’s election demonstrated.

Trump promised to bring back jobs and “make America great again.” He never really said anything new. He repeated the campaign promises of Warren G. Harding, who won in 1920 by promising a “return to normalcy.”

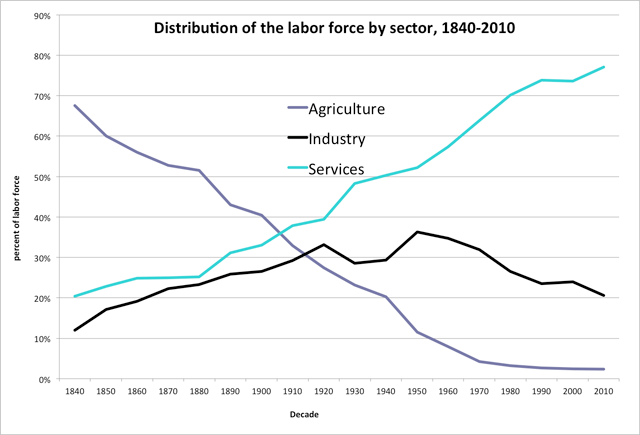

Economically, when we think of normal, we think of high-paying jobs, especially union jobs in the manufacturing sector. But as the chart below shows, low-paying service jobs were always more normal.

(Source: MinnPost.com)

America began as an agricultural society. It seems safe to say no one wants to go back to the days when 70% of Americans worked on farms. That’s partly why equipment replaced people so easily. No one fought to keep backbreaking jobs associated with farming.

Manufacturing jobs, shown as the black line on the chart, always lagged employment in the services sector. Most jobs have been in services since the 1940s.

Service jobs is, of course, a broad category. It includes retail and restaurant jobs. It also includes high-paid software programmers and CEOs. There are opportunities in services. But competition is fierce, and the percentage of winners is likely to be small.

Now we know data shows that even in the good old days, whenever they were, there were few manufacturing jobs. That tells us manufacturing is unlikely to make a comeback. New jobs will need to be in new sectors, maybe even sectors that are still undiscovered.

For investors, the chart above highlights an important principle: Data always need to be reviewed. By doing so, we see that a manufacturing resurgence is unlikely.

Throughout history, manufacturing grew twice: once after the Civil War as the country industrialized, and again after World War II as the rest of the world rebuilt. Those were unique times and don’t really qualify as the good old days.

The truth is, there probably never were any good old days. Each generation faces struggles and looks back at what seemed like a simpler time.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader