I’ve talked about being greedy while others are fearful in recent essays.

Why stop now?

In a recent weekly update for Jeff Yastine’s and my Insider Profit Trader service, I highlighted the recent carnage we had seen in several sectors of the market.

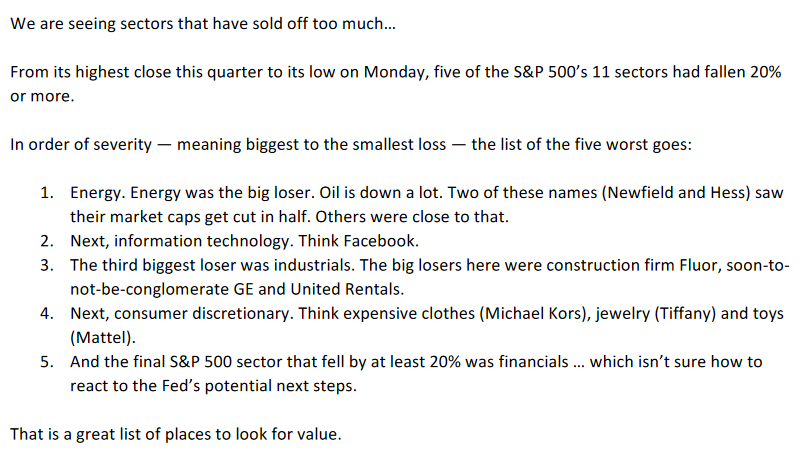

Here is a snippet from a transcript of that podcast. I said:

As you might imagine, most of these sectors moved higher in recent days. So, which sector is the most attractive today?

Let’s Take a Look at the Numbers

One way to assess this is to look at the numbers.

I expanded this analysis to include the recent market uptick.

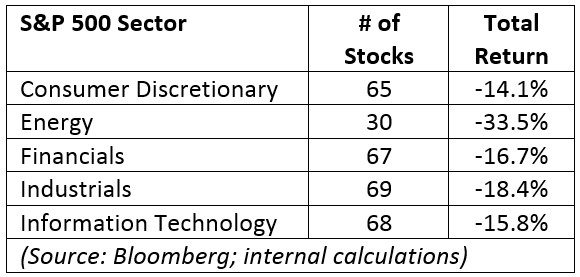

When I did the podcast, I looked at the numbers from October 3 to December 24. Today, we have more numbers. Here are the details for five S&P 500 Index sectors through December 28.

Except for the number of stocks in each sector, the numbers are medians. This is the middle number in a range of values.

Through December 24, all these groups had total returns of negative 20% or worse.

Today, four of these sectors have improved, while energy continues to struggle.

What Does This Mean?

Let’s ignore energy for now.

As a value investor, I like the fact that it’s down. And its price/earnings-to-growth (PEG) ratio is the lowest.

But its price-to-free-cash-flow (P/FCF) ratio is by far the highest. (Free cash flow equals cash from operations less capital expenditures.)

We don’t know when the oil price will improve. When it does, we can reconsider.

And of the four remaining sectors, I like financials.

They’ve had trouble lately. Look at their 2018 performance:

Except for that final blip up, they’ve been weak.

Nothing they do seems to be right.

The financials sector of the S&P 500 includes a few types of financial firms. The two most notable are banks and insurance companies.

My favorite trade here is the banks.

They seem caught in the tug of war between the Federal Reserve and the president.

And while uncertainty is bad for stocks, it’s good for the valuations of these names.

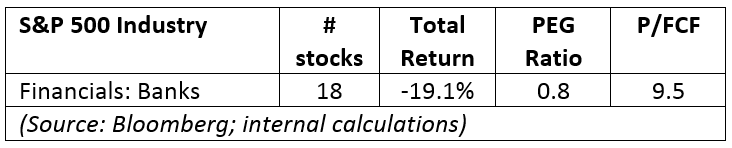

If we drill down a bit further on banks in the context of the table, here’s what we find:

This Sector Is Poised to Move Higher

Eighteen of the 68 financials stocks in the S&P 500 are banks.

These are the banks that were around before the financial crisis … and remain so today.

The S&P 500 banks industry excludes companies like investment bank Goldman Sachs, which created a traditional banking division to survive. Or credit card company Capital One, which is currently growing its banking business.

These 18 banks include names like JPMorgan Chase, Bank of America and Citigroup.

You can see banks were the most-sold group that I profiled except for energy.

Sell-offs create opportunity.

You can also see that banks are relatively cheap compared to the other struggling sectors.

Value investors often think a low price-to-earnings ratio means a stock is cheap. But if a stock isn’t growing, it can remain at that ratio for a long time.

So, when we see PEG ratios that are less than 1, that is a good thing. It means the expected growth is greater than the current valuation.

We see that today with banks.

And with respect to P/FCF, smaller is better.

The smaller it is, the more free cash flow a bank generates compared to its current price. Banks’ 9.5 ratio is the lowest we’ve seen since 2016.

So, What Do We Do?

We don’t want to buy anything while it is still falling.

The banks in the S&P 500 are moving like the rest of the financials in the chart above. They recently bottomed.

If the current bottom holds and the uptrend continues, you should consider buying some banks.

Many have fallen recently and present a decent value.

Or if you prefer to buy a basket of them, consider the SPDR S&P Bank ETF(NYSE: KBE).

Based on its most recent quarterly dividend, the fund pays a 2.8% yield. That’s some decent income to receive while you wait for banks to move higher.

Good investing,

Brian Christopher

Editor, Insider Profit Trader