The Federal Reserve concluded its meeting last week with a small gift to the savers — it boosted its fed funds interest rate by 25 basis points.

The fed funds rate now stands at between 2% and 2.25%. It doesn’t sound like much, but it’s the highest level since August 2008.

Chairman Jerome Powell took the gloves off. The Fed is done being “accommodative.” It’s even looking at another rate hike of a quarter point to close out 2018. That would make a total of four rate hikes for the year.

Rising interest rates are a vote of confidence in the economy. The Fed is signaling that everything is humming nicely along. That the market can take higher interest rates and keep growing.

And after years of near-zero interest rates, the savers can certainly appreciate interest rates above 2%, even though we are a long way off from the 5% we had in 2007, or even the 6.5% in those last days before the 2000 dot-com meltdown.

But the savers aren’t the ones we have to worry about with higher interest rates. As interest rates climb, we have to look at the flip side of the same coin.

Those holding a mountain of debt are going to find themselves in trouble. And that could spell trouble for the entire economy…

The Ticking Time Bomb We’re Ignoring

In 2017, Americans paid $104 billion in credit card interest and fees. That’s an 11% increase over what was paid in 2016.

The Fed has since boosted interest rates three times, with the promise of a fourth still on the way.

Credit card companies don’t hesitate to pass along those higher interest rates to those with debt.

Right now, Americans are poised to spend an additional $6 billion in interest payments in 2018, and it’s only going to get worse.

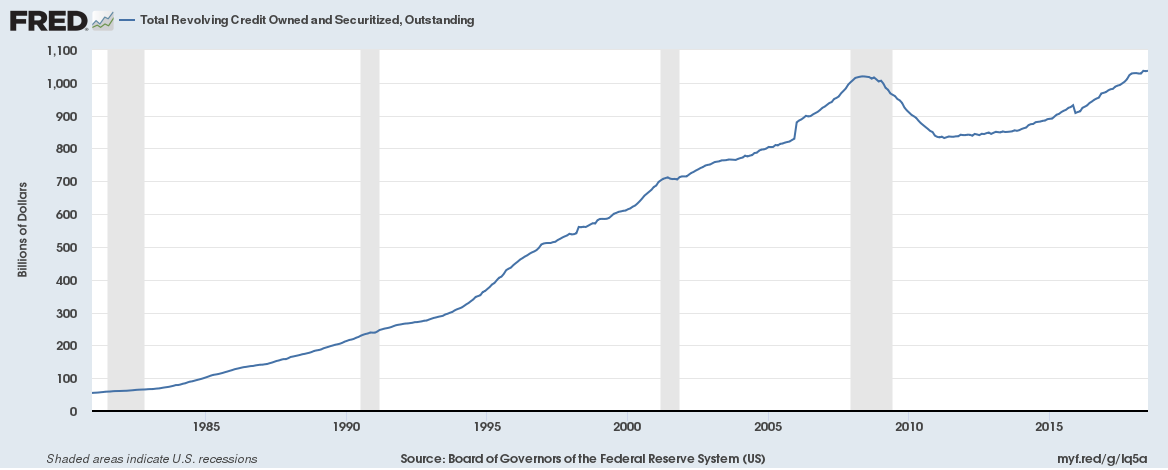

The Federal Reserve reports that Americans had $1.04 trillion in revolving debt in July 2018 — easily surpassing the last peak reached in May 2008.

What’s more, a recent study by MagnifyMoney revealed that 40% of U.S. adults don’t have enough savings to cover a $400 emergency.

It looks like the Fed is playing a game of chicken with the American consumer. The employment picture is rosy, but wages haven’t been rising as quickly as many had hoped.

Americans are spending with new confidence in this economy, but a lot of that spending has come in the form of added debt. As interest rates rise, Americans are going to get squeezed. They will have to cut back on spending in order to pay that debt.

And if you take the American consumer out of the picture, the economy starts to stumble.

Regards,

Jocelynn Smith

Sr. Managing Editor, Banyan Hill Publishing