Illumina-ughty By Nature

Gene sequencing army with harmony.

Mr. Great Stuff, drop a load on ‘em.

Illumina (Nasdaq: ILMN), how can I explain it? I’ll take you frame by frame it, to have y’all jumpin’ shall we singin’ it.

Nope. No singing … that’s just silly. Enough “O.P.P.,” Joe, let’s just get to the point.

Fine. Spoil sport.

Anyway, where was I … ah yes, Illumina. This company is tha bomb, Great Ones. It’s on the cutting edge of genetic research, specializing in gene sequencing, genetic analysis and clinical testing.

Now, when most of us think about gene sequencing and messing around with DNA and the like, we get images of ‘90s sci-fi movies in our heads. You know, super mutants from some failed scientific experiment trying to take over the world because they’re “evolved” superhumans? Or … dinosaur theme parks?

Well … at least that’s what I think of. Your results may vary.

Reality is much more boring … that is, if you think gene sequencing viruses to make vaccines is boring. One of the big things that the COVID-19 pandemic brought to the forefront was the usefulness of gene sequencing.

It’s literally saving lives right now. I know you hear this a lot, but the future is here!

Driving that future are companies like Illumina. And, thanks to the pandemic’s spotlight on genetic research, Illumina is in a period of impressive growth. Now, to clarify, Illumina doesn’t specialize in virus genetics or vaccines. It has its sights set on the Big C. Cancer.

Banking off the surge in genetic cancer research, Illumina announced this morning that it expects first-quarter revenue to top $1 billion for the first time. What’s more, Illumina also expects fiscal 2021 revenue growth of between 25% and 28%.

You down with gene sequencing? Yeah, you know me!

Hold your horses there, Great Ones. There’s a major hitch in Illumina’s giddyap.

Earlier this year, the company announced plans to buy gene sequencing firm Grail for $7.1 billion. Grail spun off from Illumina back in 2016, and the company wants it back to strengthen its cancer biopsy testing products.

But the FTC doesn’t like this acquisition one bit. It’s challenging the buyout, putting Illumina’s plans for genetic domination in limbo. So, while ILMN shares surged on this morning’s revenue news, there are still storm clouds hanging over the stock.

The bottom line is that while Illumina could be an excellent addition to your portfolio, giving you exposure to the red-hot gene sequencing market, there is still a fair amount of uncertainty surrounding the company’s future plans.

If you’re brave, ILMN is a buy-the-dip opportunity. Otherwise, you might want to hold off until the FTC matter is taken care of … and instead check out what else is crackalackin in the genomics market.

It’s called “Imperium.”

It’s something that only science geeks know about right now (no shame here). But according to experts, Imperium is set to go from 1 million users to having 2 billion in the next four years, launching a stock market “gravy train” that almost nobody sees coming.

Genomics? Gravy? Good God, man, spit it out!

Click here to discover why the world’s richest investors are piling into Imperium.

Going: The Ripple Effect

Today, Tharman Shanmugaratnam, chairman of the Monetary Authority of Singapore, blasted cryptocurrencies and said that they’re “certainly not suitable for retail investors.”

I hate to break it to Tharman, but that’s not why cryptos are popular. In fact, for cryptos like Ripple’s XRP (XRP), government backlash appears to only feed the fires.

Yes, let your crypto hate flow through you!

XRP tagged a fresh three-year high this morning despite an ongoing SEC investigation. The SEC, you see, doesn’t like the fact that Ripple raised $1.3 billion by selling XRP in unregistered securities offerings.

That’s a big “no-no” on Wall Street. But it’s a big “yes-yes” among many crypto enthusiasts. Remember, the original point of cryptocurrencies like XRP and Bitcoin was to take power away from central banks and the global financial system.

“The XRP army is not going to be dissuaded by an SEC enforcement, even if it means that Ripple and XRP could ultimately get iced out of a major financial market,” said CoinDesk Reporter Danny Nelson.

So, it should come as no surprise that XRP — backed by the so-called XRP Army, a group of rabid investors — continues to gain despite government opposition. Now, you can’t trade XRP on many western exchanges, but the cryptocurrency still trades on less-regulated exchanges, especially in Asia.

But, before you go gallivanting off to tear down the global financial system by buying XRP, just note that the crypto’s recent high was only $1. That’s a far cry from bitcoin. Also, XRP largely missed the big crypto run-up earlier this year.

So, if you’re an anarchist … maybe consider XRP?

But me personally? I prefer to get my crypto cues and bitcoin news from Ian King. Click here to find out why!

Going: Clear As MUDS

Hey, baseball card collectors! Ready to start collecting stock?

Collectible cardboard picture maker Topps is finally going public after 80 long years. Now, you’d think a respectable name like Topps would go the traditional IPO route. You’d be wrong. This is 2021, after all.

Nope, Topps is going the SPAC route. The company agreed to merge with Mudrick Capital Acquisition (Nasdaq: MUDS) in a deal that values Topps at $1.3 billion. Put that in your bicycle spokes and turn it!

What’s more, Michael Eisner — yes, that Eisner, the one who used to head Disney — will be Topps’ CEO after the deal is done.

Topps expects the SPAC merger to close in the last half of the second quarter or the early part of the third quarter. Topps will trade on the Nasdaq under the ticker TOPP.

You might think: “After 80 years, why go public now?” Well, Topps had a banner 2020 as the pandemic forced many people to revisit old hobbies … like collecting baseball cards. Topps’ net sales surged 23% to $567 million in 2020 — a record high.

Furthermore, Topps is branching out into mobile apps and nonfungible tokens (NFTs). “This is the icing on the cake, going digital completely, with the analog still in place,” Eisner said.

I’ve said all I’m going to say for now about NFTs. The things both intrigue and frighten me, but the hype surrounding them is just silly. One can only hope that TOPP shares don’t succumb to the NFT hype when they finally go public.

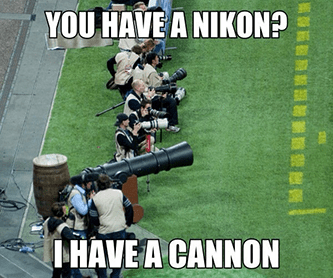

Gone: A Nikon Moment

In a rare spurt of major news out of the camera company camp, Nikon (OTC: NINOY) just announced that it’s buying a majority stake in a startup called Morf3D.

Unlike Morf3D’s Klingon-sounding name would indicate, the company 3D prints satellites and satellite accessories for companies like Boeing (NYSE: BA).

What even is today’s news? We just talked about playing card pros getting into NFTs … of course Nikon wants to be an aerospace supplier now…

So what does Nikon bring to the table besides wads of cash? Why, the very optical processing machines it uses for cameras! Sounds like a snoozefest until you realize it’s 3D printing … with metal! OK, I was jazzed by it, sue me.

Nikon’s 3D-printing tech is perfect for the precise — yet lightweight — needs of satellite making, and the tie-up is a no-brainer for a growing startup like Morf3D.

I’m overall optimistic on the move for Nikon since it should at least keep the company less reliant on its camera biz until the satellite market fully flares up. Honestly, it’s the biggest news from Nikon in eons and probably the last time it’s in the Great Stuff orbit for a while…

But this definitely won’t be the last time we talk up 3D printing and its ever-growing list of uses. Nikon and Lieutenant Morf are just one of many 3D printing pros out there.

But this North Carolina stock is already No. 1 in the race! It’s cracked the code to this technology, which is turning a billion-dollar niche industry into a $100 trillion global manufacturing power, according to the World Economic Forum.

I see [Tesla] as something avoiding analysis of the fundamentals, and I think there’s room for many successful companies in the market. People are just assuming that Tesla has no competition when they put this kind of lofty valuation on the company.

Great Ones, here’s Tuesday’s obligatory “no duh!” moment, aka, our new Quote of the Week.

So, did I fall asleep at the wheel here? Do I have a case of the vapors? Or have we been pointing out the next Tesla (Nasdaq: TSLA) killer all year long?

It’s about time some sleepy soul on the Street woke up to Tesla’s now-busy electric vehicle (EV) market. As if Voltswagen’s April Fool’s joke-not-joke walk-back was for naught!

But instead of the usual half-hearted mixed messages analysts serve up about Tesla, Craig Irwin laid down his bearishness with ultra-heavy huevos.

Not only does Irwin think that TSLA’s overdue for a valuation check, but he also lowered his price target on the sucker down to target on Tesla is $150 — 78% lower than today’s price. Crikey!

Irwin points to the fact that Tesla’s current valuation is pretty much the total size of the U.S. and European auto markets … yet, Tesla’s merely a “minor player” on this global EV stage. I agree on the overvalued part, but “avoiding analysis of the fundamentals” is always a rookie mistake with Tesla, and I can’t help but chortle slightly.

Anyway, take your pick of potential Tesla killers: Ford, Volkswagen, General Motors … the gang’s all here. (Oh, and please do let me know which automaker you think is most likely to steal Tesla’s lunch — email right here.)

Now, Tesla still has a few tailwinds, according to Irwin, such as the company’s expected inroads in India and its prospects in China (which y’all Great Ones know is a flimsy foothold at best). And, while I agree with his overall sentiment on Musk and co., Irwin does miss a big point here.

Two big points, in fact: Tesla’s battery and solar businesses. From a purely car-centric perspective, yes, Tesla is about to be blown out of the water by its competition. But battery and solar make up the rest of Tesla’s potential … sorry to bust your robotaxi robodream.

There’s plenty of solar competition out there … but not that much battery competition. Well, if you forget about Tesla’s biggest obstacle in the space…

Thanks to a former Tesla employee, one of the company’s “original 7” beat Tesla to the punch. Some say he’s the secret to Tesla’s success — even one of the fathers of the EV revolution. But he struck out on his own to make a far more promising innovation: a fundamental leap in battery technology.

It’s 25X more powerful than any Tesla EV battery, and it promises a total transition to an emission-free grid. Click here for the full scoop!

And after you’ve checked that out, what do you think about Tesla’s tenuous time on the EV throne? Do you think a new EV rival like Ford or VW could take Tesla’s crown — and when?

GreatStuffToday@BanyanHill.com. Write us anytime!

And for all those numerous readers writing in saying “Add me!” or “Sign me up!” … first off, how’d you receive this? Second, all you have to do to sign up for Great Stuff is click here!

Once again: Just click here if you want to sign up for Great Stuff!

Finally, remember what Mr. Great Stuff always says: Like Stuff? Share Stuff! So be sure to share ‘Stuff with everyone right down your email list. Send it all!

And don’t forget! If you want to be in this week’s edition of Reader Feedback, drop us a line at GreatStuffToday@BanyanHill.com! But, if that’s still too many virtual hoops to jump through, why not follow along on social media? We’re on Facebook, Instagram and Twitter.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff