“Be prepared.”

This is a well-known Boy and Girl Scout motto used worldwide.

It means a scout should always be in a state of readiness so they’re able to do the right thing at the right moment.

This motto holds true for our investments as well.

According to Bank of America Merrill Lynch’s chief investment strategist, Michael Hartnett, August 22 will mark the longest S&P 500 Index bull market of all time. If the S&P 500 holds its course, its bull market will be 3,543 days long.

We all know this bull market run won’t last forever. But the question is: When will it end?

Several analysts and economists predict a recession will strike in 2019 or early 2020.

Our very own Mike Carr, a Chartered Market Technician, expects the next recession to occur in 2019.

Knowing that a bear market is within the realm of possibility, it’s wise to position your portfolio to include some protections, also known as hedges.

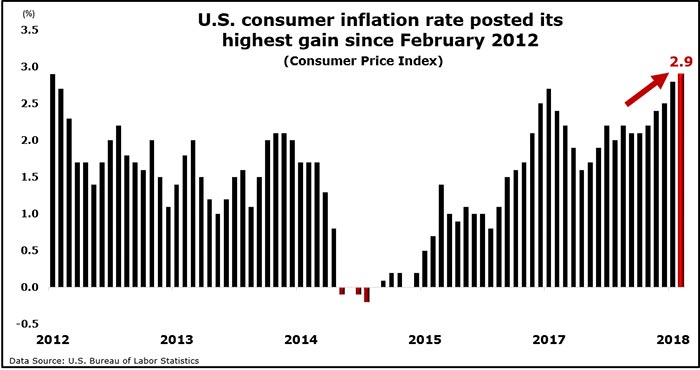

Inflation Risks

Portfolio hedges are important because they aim to shield your assets from the unexpected.

There are various portfolio hedges to protect near-term investors from market declines.

They include:

- Moving to cash.

- Buying index put options.

- Buying inverse exchange-traded funds (ETFs).

- Directing investments toward defensive plays in the consumer staples or utilities sectors.

But what about inflation risks?

The general idea is with inflation the securities principal increases, and with deflation it decreases.

Inflation is a general rise in the price of goods and services, such as food and clothing. Due to this rise, it will take more money to buy the same goods and services — therefore eroding the overall purchasing value of money.

Inflation can negatively impact investors and savers alike as they lose purchasing power. Conversely, it helps debtors, as they’ll be able to pay back their debts faster with money that has lesser value.

Deflation is the opposite.

Deflation takes place when the general prices of goods and services fall over a prolonged time period. The fall in prices allows consumers and businesses to purchase more with their money.

This sounds positive over the short term. However, over the long term a continued fall in prices can negatively impact the economy.

In turn, these price declines will slow down economic growth and likely affect the velocity of money in the economy — which can then lead to what is known as a deflationary spiral.

The Inside Scoop on TIPS

How can investors hedge against inflation, which can eat away at a portfolio’s profits?

According to TreasuryDirect, Treasury Inflation-Protected Securities, also known as TIPS, are marketable Treasury securities whose principal is adjusted in relation to fluctuations in the Consumer Price Index, an inflation measure.

TIPS provide a hedge against both inflation and deflation. So, having a modest position in TIPS can be a good idea.

Twice per year, TIPS pay a fixed interest rate that increases with inflation and decreases with deflation. The interest rate is added to the adjusted principal.

One important caveat: In a deflationary atmosphere, TIPS have what is called a deflationary floor, which aims to protect a holder’s principal value.

TIPS can lose money during a deflationary environment. It all depends on when the security is purchased.

There’s also a phantom-tax risk with TIPS that should be considered before purchase. Please consult with your personal tax adviser to learn more.

Be Prepared

Investors will not make a lot of money investing in TIPS, as they usually pay only a percentage point or two above inflation. But an investor will preserve the purchasing power of their money five, 10 and 30 years from today, which is ideal.

For more information, please visit www.TreasuryDirect.gov.

In all, for those who are nearing or in retirement, maintaining the buying power of their assets is paramount.

Due to a potential looming recession in 2019 or 2020, TIPS can serve as an important hedge in any prudent asset allocation. Be prepared.

Until next time,

Amber Lancaster

Senior Research Manager, Banyan Hill Publishing