The retail sector seems to present investors with significant risk. If a company makes a mistake, traders tend to sell quickly, pushing prices down before individuals have a chance to preserve capital.

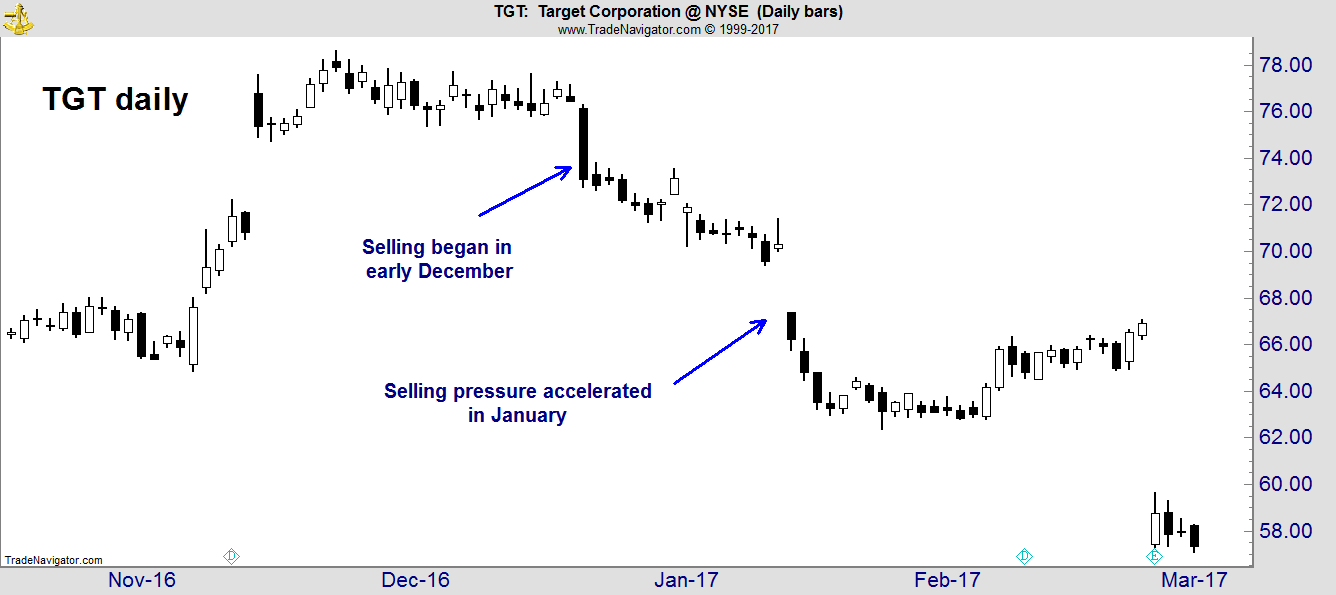

The latest example is Target Corp. (NYSE: TGT), which fell more than 12% last week after reporting subpar earnings for the most recent quarter. Sellers might be correct, since management also acknowledged they are struggling to cope with the “rapidly changing” behavior of consumers.

Traders seemed to know problems were coming because the stock had been selling off ahead of the news. Shares of TGT are down more than 26% since the end of November.

Here’s what Target plans to do to get its profits up … and what you should look for when deciding whether or not to invest your money in the retail sector…

A New Era in Retail

Like many large firms, Target seems to be planning to spend its way out of trouble. Management announced plans to spend more than $7 billion over the next three years. This money will be used to update more than 600 stores and open over 100 small-format stores by 2019. The company will also introduce more than 12 new brands over the next two years, and it will lower prices by at least $1 billion this year, an amount equal to about a third of the company’s profits over the past 12 months.

Management is confident these changes will help the company meet the challenges of what they now believe is a “new era” in retail.

Forward-looking management teams recognized the new era some time ago. In this new era, shoppers are armed with information about what products cost and are looking for the lowest prices. Target has traditionally offered customers products that were a little pricier but more stylish than those offered by competitors such as Wal-Mart. This strategy doesn’t seem to be working anymore.

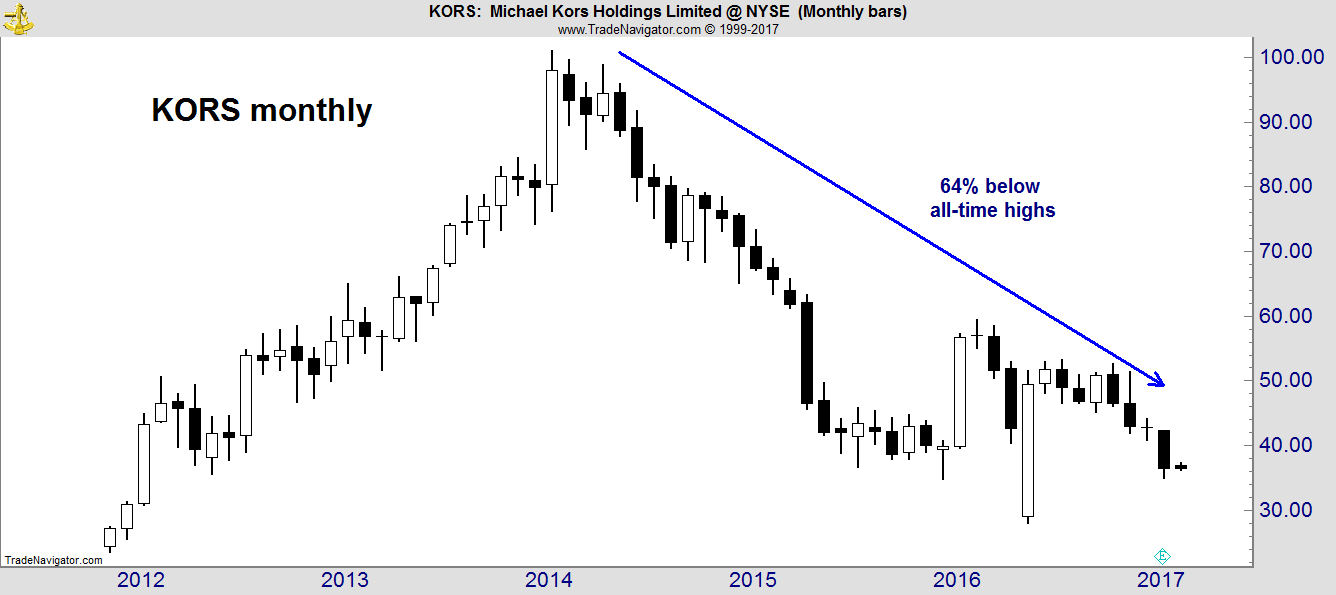

Target’s latest results seem to indicate that income inequality is now creating a sharp divide in the retail world. Demand for products falling between Wal-Mart’s “everyday low prices” and exclusive brands like Tiffany & Co. (NYSE: TIF) is small and shrinking. Astute investors noticed the shift away from the middle years ago when Michael Kors Holdings Ltd. (NYSE: KORS) collapsed.

KORS is an aspirational brand, offering products such as $200 purses that were once considered to be affordable luxuries for those aspiring to the live the wealthy lifestyle popularized by the Kardashians and others glamorizing conspicuous consumption.

Instead of serving as a step toward that luxury life, aspirational brands and stores such as Dillard’s and Kohl’s that catered to those shoppers have plummeted. Meanwhile, TIF is in an uptrend and about 10% below its all-time high.

Everyday Low Prices

The new retail environment TGT is finally recognizing is one where price is king. Consumers can find the lowest price on anything with just a few clicks. It’s likely the in-store complimentary Wi-Fi offered by TGT is costing the company sales.

In this environment, investors need to look hard at stocks trading at levels that seem to be bargains. Before buying, they need to consider the downside risks.

Bargain hunters might be asking how much risk there can be in a stock that’s already fallen significantly. The answer is, investors can always lose 100% of the money they put into retailers that end up in bankruptcy. Sears and J.C. Penney are other examples of retailers that failed to recognize the new environment. Those two stocks are now more than 90% below their 2007 highs.

There will be winners in the new retail environment, but chances are the winners will not be the companies that failed to recognize the shift in the first place.

Amazon is defining the new environment. Stores such as Best Buy are adapting and thriving by offering Amazon-like prices with Tiffany-like service. Stores such as Target need to define themselves, and investors who want to make money should wait for fallen angels to prove they really understand how to attract and retain customers.

Instead of buying stocks that are down, look for stocks that are up. These are the ones that, like Amazon, are proving they know what customers want.

If a company such as Target can turn around, there will be time to make money after it adapts to the new environment. This patient approach will help you to avoid stores, possibly even Target, that follow Sears and J.C. Penney to losses of more than 90%.

Regards,

Michael Carr, CMT