The Pearl Street Station in New York City was the first central power plant in the world. Powered up by the Edison Illuminating Co. in September 1882, it first generated electricity for a few dozen lights in lower Manhattan.

Large-scale power plants completely changed the way that people lived. Before these power plants, people produced their own power with waterwheels, created their own light with kerosene-burning lamps, and heated their food and homes with cast-iron stoves that burned wood or coal.

Here in modern times, a similar shift is happening. Something called “the cloud” will do for computing what power plants did for generating electricity 150 years ago. In fact, it’s already happening.

This is a mega-trend that will permanently change how governments, businesses, and consumers store and access their valuable data. And for investors, it’s a trend where fortunes can be made.

The Cloud?

Watch CNBC or Bloomberg TV and you’ll hear the cloud discussed almost every day. In the simplest terms, “cloud computing” means the storing and accessing of data over the internet instead of a computer’s hard drive. “The cloud” is just a metaphor for the internet.

In the old days, consumers and businesses stored all their data on hard drives or local servers.

So, all your data was physically close to you. Either on your personal hard drive or in a computer room down the hall at work. Working off a local hard drive is how the computer industry functioned for decades.

Conversely, with cloud computing, you access your data or applications over the internet. For example, I used a cloud service from Carbonite (CARB) to back up all the data on my personal computer.

The advantages of cloud computing are overwhelming, especially for businesses:

- Lower Costs: Cloud computing eliminates the high cost of hardware. Instead of spending big bucks for on-site storage hardware, cloud storage services offer pay-as-you-go subscription services. And their fees are generally a fraction of what it would cost businesses to store data themselves.

- Flexible Scalability: Every business hopes that it will grow, but the future is always uncertain. With the cloud, you only pay for what you need. And if your needs increase, it’s easy to scale up your capacity.

- Work From Anywhere: Whether employees are on the road or at their homes, they can still work. With cloud computing, if you’ve got an internet connection…you can be on the job.

- Collaboration/Efficiency: An endless team of employees – from offices anywhere in the world – can access, edit and share documents anytime, from anywhere. Cloud file-sharing applications make it possible for authorized users to access updated files in real time.

- Disaster Recovery: Hurricane Harvey is a painful reminder of how disasters can wipe out locally stored data. Cloud storage services archive data at multiple locations and make recovery a snap.

- Automatic Software Updates: Software is updated all the time. However, your cloud service can include automatic updates for your software applications. Easy peasy!

- Leave It to the Pros: Maintaining data storage and IT infrastructure is neither simple nor cheap. And it’s too time-consuming for busy business owners.

- Security! Lost laptops and lost smartphones are a potential security disaster. But with cloud computing, data can be wiped remotely from lost devices.

Despite those overwhelming advantages, the majority of businesses still use on-site servers to store their data. Morningstar estimates that only 20% to 25% of business data is stored in the cloud.

“We think the single most important trend in technology

remains the ongoing shift toward cloud computing.”

— Brian Colello, Morningstar

The Early Innings

Our opportunity comes from that low market penetration. The cloud-storage business has taken off like a rocket, but there is much more to come.

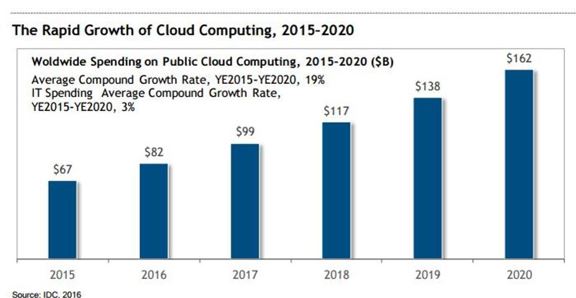

Analysts at IDC estimate that cloud-spending – which was roughly $67 billion in 2015 – will reach $162 billion in 2020, a 19% compounded annual growth rate.

Consultants at Bain & Co. are even more optimistic – predicting that 2020 cloud-spending will hit $390 billion!

The actual number will likely be somewhere in between. But regardless of who is right, we’re talking about a mountain of money.

What’s the best way to invest in the cloud? My pick is an old, familiar tech giant that has quietly transformed itself into what I expect to be the biggest cloud winner of them all.

Stock of the Month

For decades, Microsoft Corp. (MSFT) had a near-monopoly on the PC market. And most investors still think of Microsoft in terms of Windows and Office.

Microsoft certainly makes a mountain of money off those products. But Satya Nadella, who became CEO in February 2014, has successfully changed Microsoft into a dramatically different company.

Today, Microsoft ranks as the cloud’s biggest player, making a rapidly growing fortune from its cloud services.

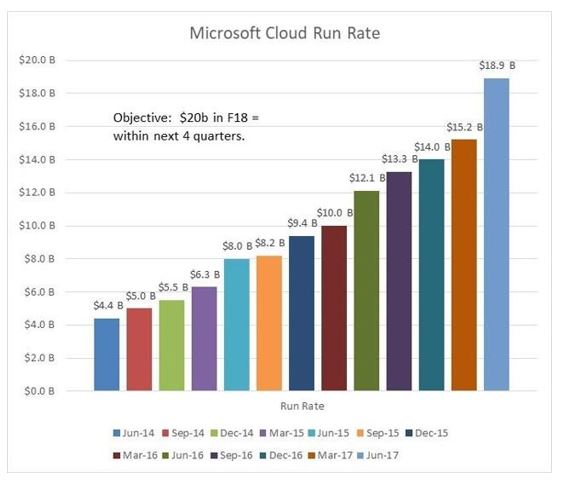

In 2015, Wall Street laughed when Microsoft predicted that it would pull in $20 billion of cloud revenue by June 2018. Wall Street isn’t laughing today. Microsoft has transformed itself into the undisputed leader of the cloud.

And as of the most recent quarter, Microsoft stands within $1 billion of that bold forecast with a year yet to go.

The bottom line: Microsoft still prints money from its traditional Windows and Office business. But it is supplementing that with a new $20 billion-plus cloud business that is growing like wildfire.

Five Reasons to Buy Microsoft Today

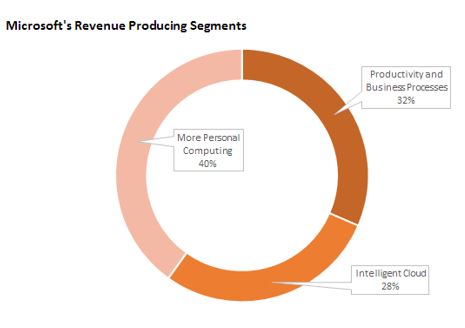

Reason #1: The Cloud…Of Course. “Azure” is what Microsoft calls its cloud services. And cloud revenues now represent 20% of Microsoft’s total revenues. That number will grow rapidly.

In the most recent quarter, the Intelligence Cloud division reported a 93% year-over-year increase in revenues to $6.8 billion. Think about that. Something monumental is happening when a multibillion-dollar business can grow by 93% in a year.

The best part is that Microsoft’s cloud (Azure) revenues are recurring, subscription-based contracts. Get this — about 86% of that $20 billion is a recurring annuity stream. According to Nadella:

“We closed the highest number of multimillion-dollar Azure deals to date, and improved our annuity mix to 86%, up 3 points year-over-year.”

That recurring annual revenue now sits at $3.15 billion, a 24% increase from last quarter!

In the previous year, Microsoft had to invest heavily to build its cloud infrastructure with small (but recurring) subscription revenues instead of large, upfront fees. However, Microsoft’s subscription-based sales model means that both revenue and earnings are teed up for enormous growth.

Reason #2 Microsoft Office = Another Annuity Stream. Microsoft enjoyed its fastest growth in the 1980s and 1990s thanks to the explosive growth of the PC industry. Remember the skyrocketing stock price of Dell Computers?

The PC industry, however, has been steadily shrinking and Microsoft’s deep connection to the personal computer has been a millstone around its neck. However, that’s a big mistake because Windows and Office are still gigantic cash-flow cows.

In the old days, consumers would buy a copy of Office (Word, Excel, PowerPoint, etc.), which made them Microsoft customers but not a steady, ongoing source of revenue. Today, consumers buy Office on a subscription basis, paying a fee to Microsoft every year.

Microsoft has transitioned Office into a subscription-based product like Azure. There are currently over 100 million business users paying an annual fee to use Office 365. In fact, Office 365 commercial revenue surged 43% over the past 12 months.

And that doesn’t include regular consumers, like you and me.

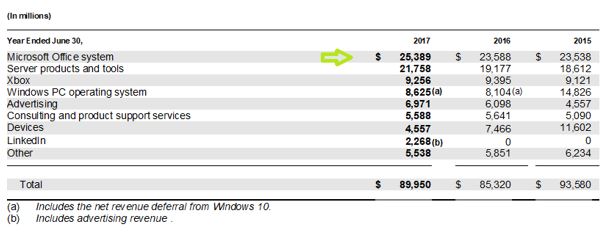

Over the past 12 months, Microsoft pulled in over $25 billion of Office-related sales. So it is far, far from suffering the same shrinking fate as the PC business.

Microsoft has grown its EPS from $1.48 in 2015 to $2.71 over the last 12 months and the double-headed subscription revenues of Azure and Office is a formula for reliable profit growth.

Reason #3: Record Orders for New Xbox. Before my boys went off to college, it was a constant battle to get them to do something – ANYTHING – other than play video games.

Lost in the Office and cloud growth is Microsoft’s very profitable Xbox gaming console. A new Xbox console, the One X, is scheduled to be released on Nov. 7 at $499.99. And pre-orders are already setting all-time sales records.

In fact, the new Xbox is completely sold out at GameStop and even Amazon!

And don’t forget that Microsoft also sells video games in addition to the console. So, console sales are just the tip of the gaming iceberg. Over the past trailing 12 months, Xbox revenues totaled $9.2 billion. (See above table in Reason #2 that breaks down revenues by division.)

Lastly, Microsoft holds a profitable 26% market share of the console market. So we’re talking about a mountain of money.

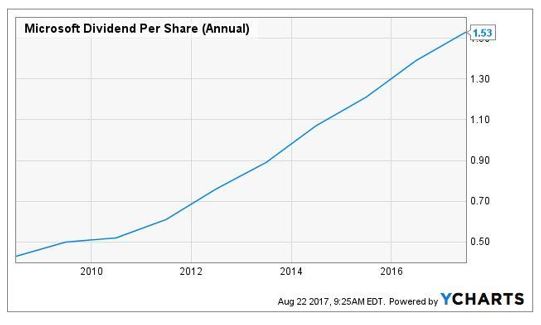

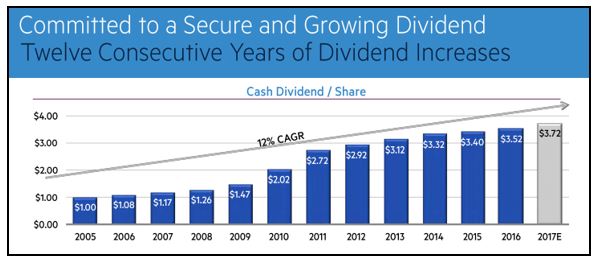

Reason #4: Bill Gates Loves Dividends. Microsoft currently pays a $1.56 per share annual dividend, which works out to an enjoyable 2.1% dividend yield. That’s good but it’s almost certain to grow, grow, grow.

Microsoft has increased its dividend EVERY year for the last 10 years. From $0.46 in 2008 to $1.53 today, it racked up an impressive 15.4% compounded growth rate.

Microsoft can afford to increase its dividend because it is a cash-flow machine. In the past year, the company generated $39.5 billion of free cash flow, more than three times its $11.8 billion dividend payment.

NOTE: The next quarterly ex-dividend date is mid-November, so you’ll have to wait 2-1/2 months for your first dividend check.

Reason #5: By the Numbers. Microsoft is trading for roughly 20 times earnings, which doesn’t sound cheap, but that is pretty cheap considering Microsoft’s profits increased by 108% over the last 12 months.

Moreover, Microsoft had more than $129 billion of cash, which works out to $16.77-per-share. If you back that $16.77 out, the PE ratio shrinks from 20-times earnings to only 15.6 times earnings.

Over the last 10 years, Microsoft has spent $117 billion on stock buybacks. Your heard that right; $117 billion, which works out to 2 billion shares or 20% of outstanding shares, which is one of the reasons why it is one of only two U.S. companies that has a AAA credit rating from Standard & Poor’s.

TIDBIT: The only two companies to buy back more shares than Microsoft in the last 10 years are ExxonMobil Corp. (XOM) and Apple.

Lastly, I love the fact that Microsoft reports its profits on a GAAP (generally accepted accounting principles) basis instead of phony-baloney pro-forma basis, like most tech companies.

| Here’s what to do: BUY Microsoft Corporation, symbol MSFT, at the market. |

Portfolio Review; Plus New Cybersecurity Pick

Stock in Lazard Ltd. (LAZ) has largely gone sideways in 2017, and it’s close to unchanged for the year. The reason: The once-hot mergers-and-acquisition business has turned ice cold.

That’s a dangerous backdrop for Lazard, and it should translate into lower revenues and profits later this year. The right move is to get out now while we are roughly at breakeven.

That’s a dangerous backdrop for Lazard, and it should translate into lower revenues and profits later this year. The right move is to get out now while we are roughly at breakeven.

| Here’s what to do: SELL all your shares in Lazard Ltd., symbol LAZ, at the market to close. |

As for the rest of your portfolio:

AT&T Inc. (T): The delayed AT&T/Timer Warner merger appears close to getting approved by the Department of Justice. That’s important because a big reason behind the 20% increase in AT&T’s stock last year was based on the presumed synergistic growth created by the combined entities.

Plus, AT&T’s $1.96 annual dividend translates into a fat 5.2% dividend yield. And it should go up from there. AT&T has raised its dividend for 33 straight years. Continue to hold.

New Subscribers: BUY to open AT&T, symbol T, at the market.

Ambarella Inc. (AMBA): Ambarella delivered strong second-quarter results. Its earnings of $0.10 per share matched Wall Street estimates. And, AMBA beat analysts’ earnings estimates of $71 million, instead topping out at $71.6 million.

The company also updated its guidance for its third-quarter of fiscal 2018 – estimating revenues between $87.5 million and $90.5 million.

Ambarella jumped on that positive news. However, the euphoria didn’t last long. That’s because it warned that full-year 2017 revenues would be 3% to 7% lower than last year.

One of the knocks against Ambarella is its dependence on GoPro. But its non-GoPro business grew by 16.3% for IP security camera OEM automotive markets.

“We continue to invest in the technologies required to deliver future generations of highly intelligent, HD and Ultra HD cameras with particular emphasis on high-performance computer-vision functionality. We see computer vision as a key differentiator for us in camera markets, including automotive, IP security, drones and robotics, and it is our key area of focus for the future.”

-CEO Fermi Wang

Two Chinese automakers – Shanghai Automotive Industry Corp. (the largest automaker in China) and GD – are equipping vehicles with embedded dash-cameras that have Wi-Fi connectivity. These cameras use Ambarella chips.

Despite the skeptical reaction to Ambarella’s forward guidance, continue to hold your shares.

New Subscribers: BUY to open Ambarella Inc., symbol AMBA, at the market.

Apple (AAPL): Apple announced that it will unveil the iPhone 8 on Sept. 12.

The media will obsess over the newest features.

But here’s what’s important to us: Apple has traditionally started selling the new models within two weeks of unveiling.

And that should translate into a supersize revenue bounce in Q3.

The BIG picture, however, is to remember that Apple is transforming from a device company into a services company.

Apple is making an increasing percentage of its money from services. That includes its App Store, mobile games, or subscription services like Netflix and Spotify. Continue to hold.

New Subscribers: BUY to open Apple, symbol AAPL, at the market.

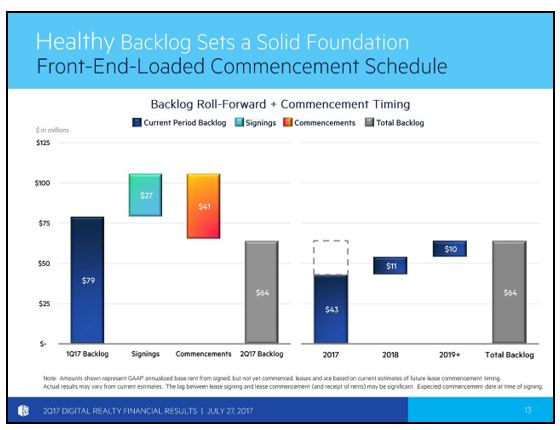

Digital Realty Trust (DLR): Guess how many hours of streaming video Netflix transmits every day?

100,000 hours? A million hours? 10 million hours?

The answer is 125 million hours of streaming video every day.

Of course, the infrastructure to handle that traffic isn’t simple or cheap. And that’s why companies like Netflix – as well as most of the big social media and entertainment giants – are using Digital Realty to transmit and store its digital data.

Digital Realty declared a $0.93 quarterly dividend, payable on Sept. 29 to shareholders of record as of Sept. 13, 2017. I expect to own Digital Realty for a long, long time.

New Subscribers: Buy Digital Realty Trust, symbol DLR, at the market.

Emerging Markets Internet and Ecommerce ETF (EMQQ): How fast is e-commerce growing in China? E-commerce has jumped by 28% in the first six months of 2017 and now accounts for 8.5% of all retail sales in China.

That’s music to the ears to three of EMQQ’s largest Chinese holdings: Alibaba Group Holdings Ltd. (BABA), (9.4%); Tencent Holdings Ltd. (TCEHY), (8.8%); and Baidu Inc. (BIDU) 7.0%.

That rapid e-commerce growth in China has powered EMQQ to a 53% gain so far this year. Yup, 53%! Continue to hold.

New Subscribers: Buy Emerging Markets Internet and Ecommerce ETF, symbol EMQQ, at the market.

JPMorgan Chase & Co. (JPM): JPMorgan is scheduled to repurchase $19.4 billion in stock between July 1, 2017, and June 30, 2018, which translates into 6% of outstanding stock. That 6% buyback combined with a 2.2% dividend amounts to an impressive 8.2% return of capital to shareholders.

JPMorgan would not be permitted to buy back that much stock and pay that juicy dividend unless the Federal Reserve Board’s Comprehensive Capital Analysis and Review (CCAR) showed that its balance sheet was rock solid. Continue to hold.

New Subscribers: Buy JPMorgan Chase & Co., symbol JPM, at the market.

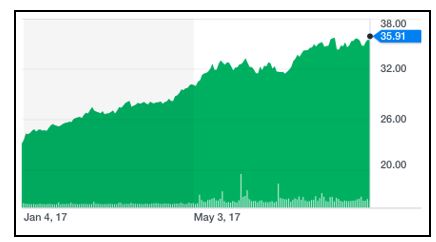

Proofpoint Inc. (PFPT): Proofpoint is off to a great start but that’s just the tip of the iceberg because the cybersecurity industry is in the early innings of a rapid growth phase.

The prospects for the cybersecurity industry are so positive that I want you to add a second cybersecurity stock, Leidos Holdings Inc. (LDOS).

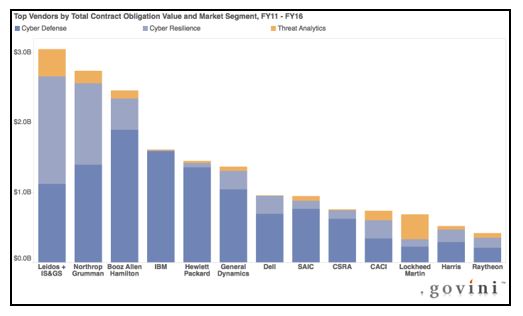

Everybody and their brother would love to land a fat, juicy government contract, but wading through the red tape and bureaucracy isn’t easy but nowhere is that more true than for cybersecurity.

Leidos Holdings, after its recent acquisition of the cybersecurity division of Lockheed Martin Corp. (LMT) — Information Systems & Global Solutions or IS&GS — is now the largest provider of cybersecurity services to the U.S. government.

What Leidos Holdings does for the government is largely classified. But the size of its government revenues are destined to grow, grow, grow.

With a PE of only 16 times earnings, price-to-sale ratio of 0.93, and 2.1% dividend yield, Leidos Holdings is a cybersecurity bargain.

Leidos Holdings is trading in the high $50’s and can be bought immediately.

| Here’s what to do:

BUY Leidos Holdings, symbol LDOS, at the market. |

New Subscribers: Buy Proofpoint Inc., symbol PFPT, at the market.

Best wishes,

Tony