The laws of supply and demand are one of the few things most of us remember from economics courses. The idea is simple enough. If supply decreases and demand remains the same, prices will rise.

We recently saw this idea in action as the price of gasoline in Texas and then Florida rose as hurricanes approached. In those cases, demand increased as supply shrank. Prices, predictably, rose.

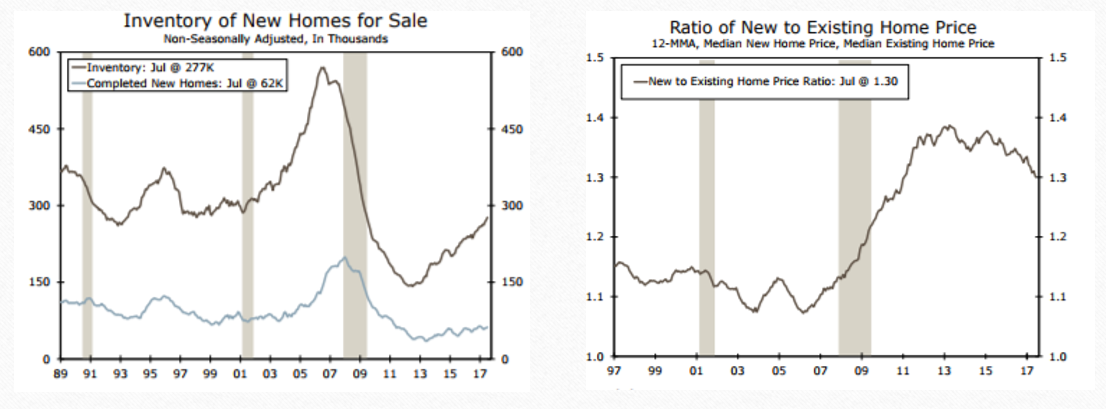

Sometimes price gouging is less obvious, as in the case of new homes. Prices are now at record highs, and the charts below explain why.

(Source: Wells Fargo Economics Group)

The chart on the left shows the supply of new homes is lower than it was throughout the 1990s, before the housing market bubble. The chart on the right shows that new homes now sell at a 30% premium to existing homes, twice the premium seen before the financial crisis.

In other words, supply is lower than demand, and prices are up. This explains high profit margins for homebuilders.

The financial crisis of 2008 led to an industry shakeout. Weak builders couldn’t find financing in the downturn. Banks remained cautious in the recovery and squeezed smaller builders out of many markets in favor of larger, more stable builders.

Now, new homebuyers face limited choices and high prices. The average new home sells for almost $315,000, well beyond the means of the average household. That’s unlikely to change since supply will remain low if builders choose to keep it low.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader