I don’t know about you, but I am a little suspicious of Friday the 13th.

When I was a kid, my mom accidentally locked her keys in the car during a snowstorm, and it was on a Friday the 13th. We had to wait in the snow for someone to come and open the car for us.

An old girlfriend, the one I argued with more than any of the others … she was born on a Friday the 13th.

Let’s just say I have some concerns.

Tomorrow, April 13 — yes, Friday the 13th — Citigroup Inc. (NYSE: C), JPMorgan Chase & Co. (NYSE: JPM) and Wells Fargo & Co. (NYSE: WFC) will all announce earnings results for the first quarter.

In addition to the three banks I listed above, Bank of America Corp. (NYSE: BAC) will announce on Monday, meaning the four largest banks in the U.S. will report in the next few days.

With all of the volatility we have seen of late, and with this quarter expected to reflect the benefits of the tax cuts, I hope this doesn’t turn into a horror film for the market.

Sentiment and Fundamentals Are Mixed

Expectations are high for earnings for most companies this quarter. But the expected year-over-year growth for these four banks is really high.

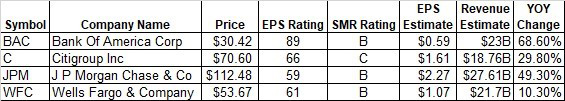

I put together the following table that shows how each bank has performed in the recent past, and how much they are expected to grow earnings this quarter compared to last year.

The EPS rating and SMR rating are from Investor’s Business Daily, and they measure the company’s fundamental performance.

The EPS rating compares the company’s earnings growth to other companies. The ratings range from 1 to 99, with 99 being the best and 1 being the worst.

The SMR rating measures the sales growth, profit margin and return on equity. These ratings range from “A” to “E,” with A being the best and E being the worst.

By those two standards, Bank of America seems to be the best stock of the four, with Citi lagging on the SMR grade and JPMorgan lagging on the EPS rating.

And if we look at Bank of America’s expected earnings growth, it is the highest of the bunch, with Citi and JPMorgan both having lofty expectations as well.

Anything but Bearish

Looking at two sentiment indicators, the short interest ratio and analysts’ ratings for these four stocks shows mixed results as well.

The short interest ratio simply measures the number of shares sold short divided by the average daily trading volume. A high ratio (above 5) is considered to reflect bearish sentiment. But short sellers have shied away from these four banks.

The highest short interest ratio among these four banks is JPMorgan, with a ratio of 1.66. Both Wells Fargo and Citi have short interest ratios under 0.50. This is anything but bearish.

Looking at the analysts’ ratings for these four, the most bullish forecast is for Bank of America, and the most bearish forecast is for Wells Fargo.

In total, there are 119 ratings on the four banks, with 56.3% being “buys,” 35.3% being “holds” and 8.4% are “sells.”

Wall Street’s Favorite Stocks

The total sentiment toward banks is moderately bullish … the short interest ratios are too low, but the analysts’ ratings are neutral. If you compare that to the FANG (Facebook, Amazon, Netflix and Google/Alphabet) stock results I showed a few weeks ago, the banks are getting far less love.

The FANG stocks and Apple had 80.3% “buy” ratings, 17.1% “hold” ratings and 2.3% “sell” ratings.

While your first thought might be that having bullish analysts’ ratings is good, from a contrarian view, having too much bullish sentiment is bad.

Look at it this way. If all the analysts rate a stock as a buy, the only thing they can do from there is issue downgrades.

2 Big Policy Changes

There have been two recent policy changes that should help banks in the coming years.

First, the new tax laws should benefit banks in several ways. The lower corporate tax rates should help all corporations, including banks.

The second benefit for banks specifically comes from the one-time tax break for companies repatriating foreign assets. Many experts believe the repatriated cash will lead to an increase in mergers and acquisitions (M&As). Big banks benefit during increased M&A activity, as it generates fee income for them.

The second policy change that should benefit banks is rising interest rates. As interest rates rise, the spread between deposit rates and lending rates gets wider. In other words, banks pay a little higher rate on deposit products, but the rates they charge for loans rise more.

While both of these policy changes should be long-term benefits for the banks, I think analysts are jumping the gun. The projections for this quarter are extremely high. Too high, in my opinion.

The Bottom Line

I am looking to add a bank or two to my portfolio, but not yet. I plan to wait until after the earnings reports. Then if the stocks pull back a little, I may look to add one or two of them to my long-term portfolio.

Like I said, the policy changes are good for them in the long term, but the expectations appear to be too high in the short term.

Regards,

Rick Pendergraft

Senior Analyst, Banyan Hill Publishing