Even with a new administration in place, U.S./China relations remain icy. Perhaps that’s why the most recent round of diplomatic talks took place in Anchorage, Alaska.

Sparring continues over issues such as trade, technology and human rights.

Take trade for example. Recently appointed U.S. Trade Representative Katherine Tai stated that we won’t lift tariffs on Chinese imports anytime soon.

So much for resetting an extremely important relationship … one valued at $558 billion.

That’s the amount of goods traded between the two nations during 2019, which demonstrates how the two economies and their supply chains are intricately linked.

But with no new breakthroughs, both sides are now scrambling to cement relationships with other key trade partners. Each wants to ensure that supply chains experience minimal disruptions.

The U.S. has even directed government agencies to review access to areas such as semiconductors and high-capacity batteries. These are critical materials needed to enable high-growth industries such as electric vehicles and 5G infrastructure (here’s a free stock tip for you).

And there is one country in particular set to benefit from the ongoing tensions.

A Rush to Secure Tech Supplies

Just before the high-stakes meeting with China, the Biden administration’s first overseas trip took representatives through South Korea.

Its high-tech manufacturing prowess means the country is of vital strategic importance to trade partners all over the world.

Take semiconductors for instance…

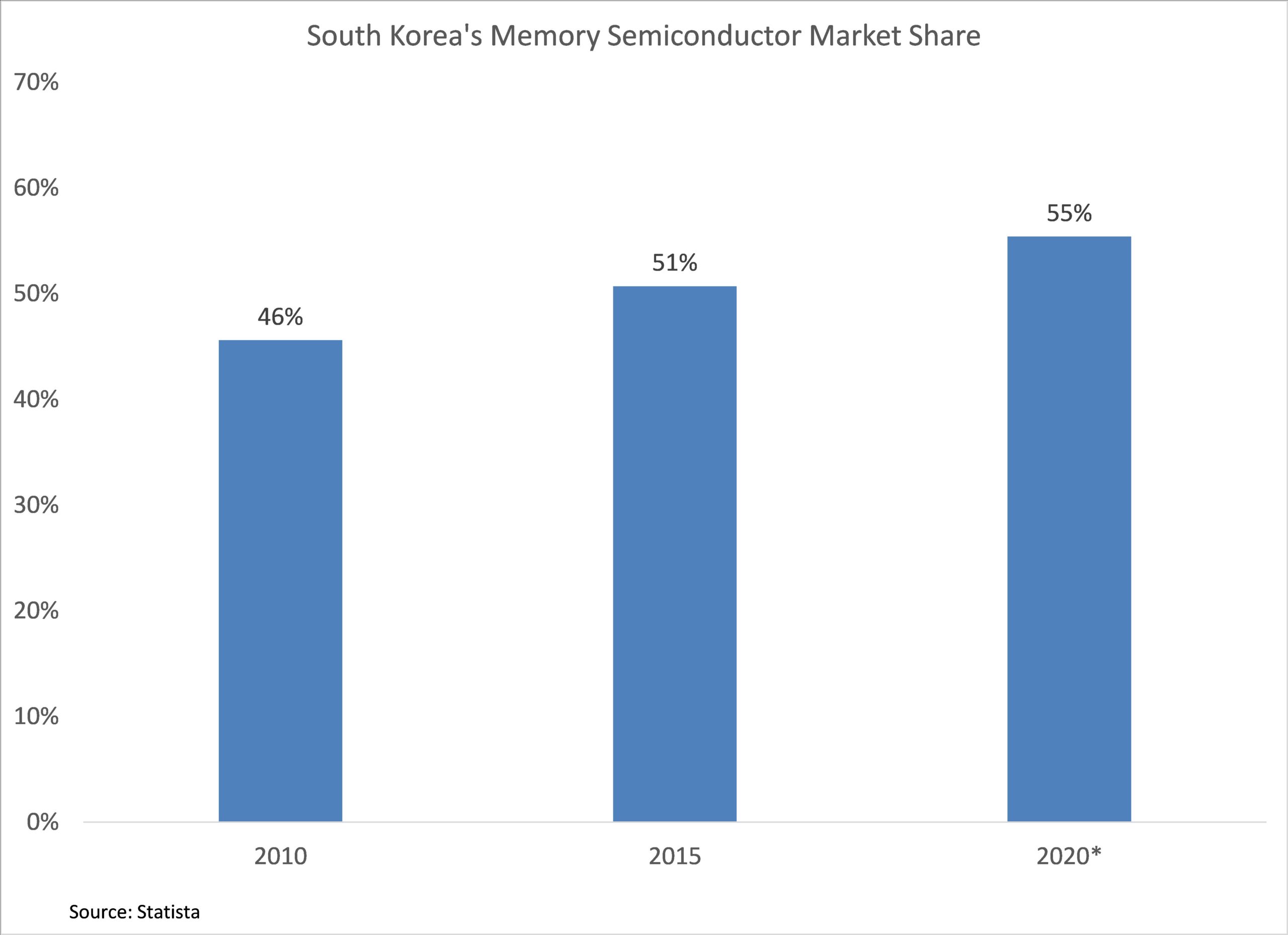

South Korea is home to over 20,000 semiconductor-related companies, and controls 55% of the market for memory chips that power devices such as smartphones. It’s a share that’s been growing over the past decade.

Companies there were also responsible for 35% of the market for electric vehicle batteries in 2020, a 116% jump from prior-year levels.

Semiconductor chips and electric vehicles are just two examples where the U.S. and China are vying for leadership.

Naturally, both are vying for South Korean favor.

Yet Another Check Mark for the Bull Case

I’ve already outlined part of the investment bull case for South Korea in Bauman Daily’s most recent Your Money Matters video.

South Korean equities give you exposure to high-growth sectors of the global economy, but trade at a 50% discount to U.S. stocks based on a price-to-earnings ratio that averages earnings over the past 10 years.

Plus, many measures of stock price momentum point to an emerging rally in the iShares MSCI South Korea ETF (NYSE: EWY), which follows a consolidation since the start of the year. That’s the type of action you want to see as prices awaken from a slumber.

South Korean firms are in pole position to leverage the global economic recovery. The global supplier saw exports rise the most in two years, which set a record for the month of March.

Guess who drove the surge?

Exports to China rose by 26%, while shipments to the U.S. approached record levels.

Add frosty U.S./China relations to the list of catalysts that favor South Korea.

That’s why you should add shares of EWY to your portfolio to take advantage.

Best regards,

Clint Lee

Research Analyst, The Bauman Letter