Tax reform lowers the top tax rate for corporations from 35% to a 21% flat rate. New rules also repeal the corporate alternative minimum tax. These two changes make taxes less expensive and reduce the cost of preparation.

The law also changes the way companies depreciate new equipment and eliminates the value of some deductions while increasing the value of others. It’s safe to say companies are still reviewing the rules, looking for ways to lower their taxes even further.

Each change in the law will affect not just taxes but also the company’s earnings. And analysts have been scrambling to increase their earnings estimates for companies.

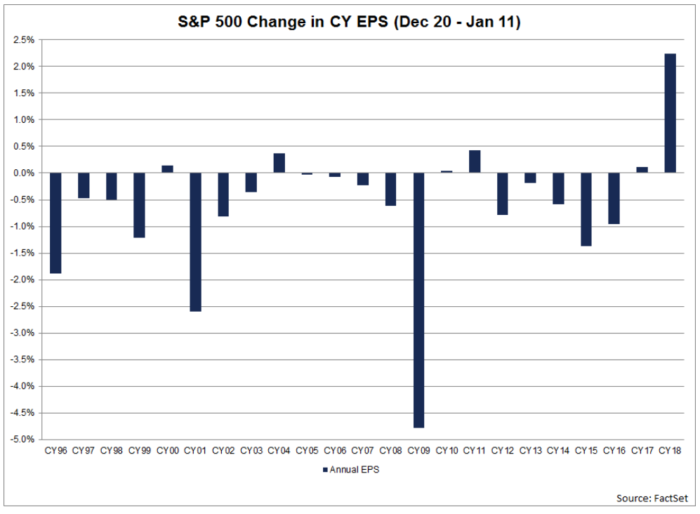

The chart below shows how unusual it is for analysts to boost estimates at this time of year.

(Source: FactSet)

As the chart shows, analysts are usually reducing their estimates in this three-week period.

There is 23 years worth of data. This is just the sixth year that analysts raised estimates.

Earnings estimates for the companies in the S&P 500 Index increased by 2.2% between December 20 and January 11. The size of the increase is more than quadruple the previous largest increase.

And analysts are still sorting through the new rules. More revisions are likely. The trend tells us to expect even higher earnings.

This chart shows tax reform provides another reason for stock prices to rise. We won’t know how high until we learn how much earnings will grow. That will take at least a few more weeks to clarify.

In the meantime, look for higher and higher prices in the stock market.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader

Editor’s Note: Matt Badiali’s No. 1 goal with his new research service is to weed out the riskier, go-nowhere stocks and zero in on the biggest, fastest and most solid moneymaking opportunities the natural resource sector has to offer. Opportunities like Millrock Resources, which rose 2,500% … Aurelian Resources, which shot up 6,250% … and Ventana Gold, which surged by 10,558%. To find out why Matt is guaranteeing that anyone who joins his research service will have the chance to turn $10,000 into $100,000 in the next 12 months, click here now.