Traders love bear markets.

Prices fall faster than they rise. That results in rapid gains for bearish strategies.

One bearish strategy involves buying short-term rallies. Rallies also move quicker in bear markets. Short up moves deliver large gains to traders.

Up and down moves are quick because volatility increases in bear markets. Volatility creates days with big gains.

Sometimes the gain is so large that investors believe the bear market is over. They buy, pushing prices up even more. The brief uptrend delivers gains to traders who can spot the liftoff and sell in time.

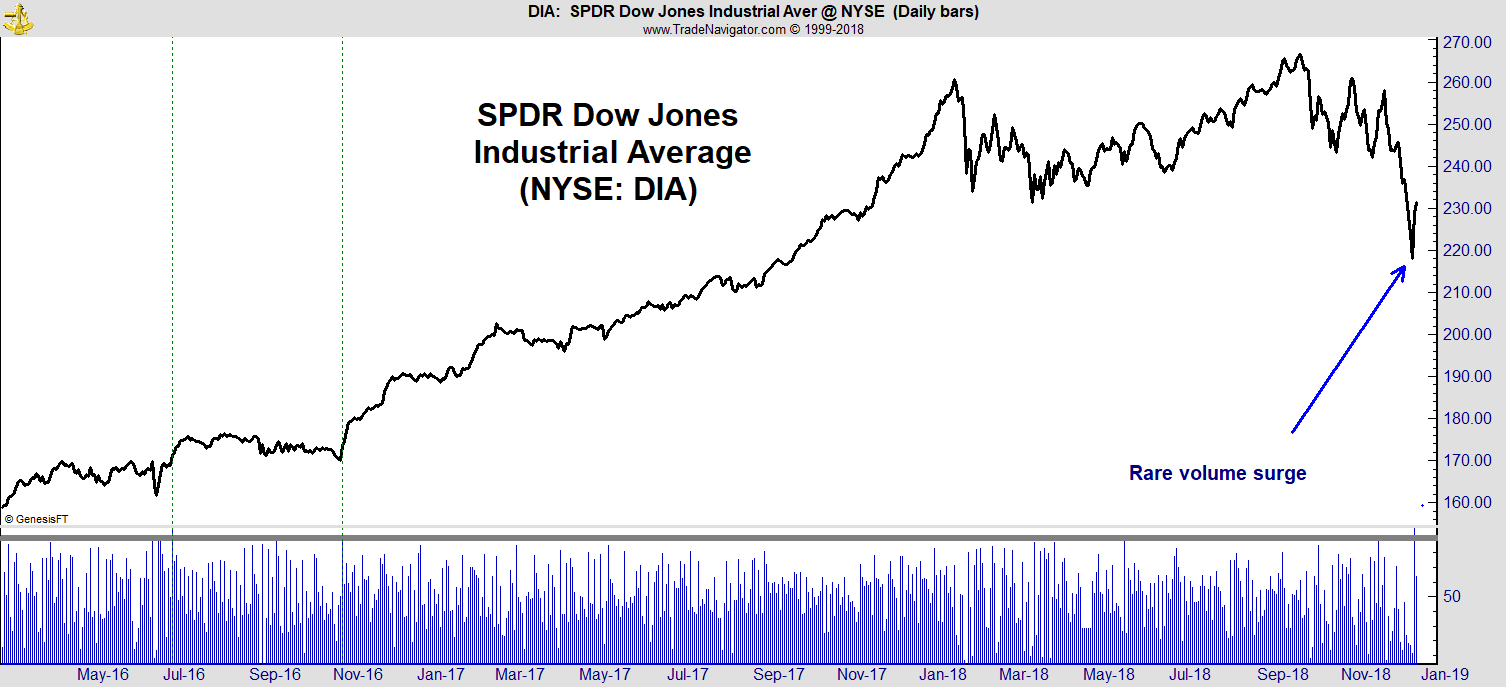

The chart below shows the Dow Jones Industrial Average’s 1,000-point gain on the day after Christmas included a rare buy signal.

That day, more than 90% of trading was on the upside.

Every day, exchanges report volume, or the number of shares traded. Combined with a history of transactions, this data allows analysts to determine whether traders were buying or selling.

Buying pressure creates “up volume.” Selling results in “down volume.”

The indicator at the bottom of the chart is up volume as a percent of total volume. It rarely gets above 90%.

The day after Christmas, up volume reached 96.6%. That indicates buyers did 96.6% of the trading that day.

The previous buy signal came the day after the 2016 election.

Before that, a rally in June 2016 kicked off with a 90% up day.

Dashed lines mark those signals in the chart.

These signals show buyers rushing into stocks. This reveals a sudden shift in sentiment as bulls jump in to the market.

Sometimes the signal tells us the bear market is over. That requires a very low reading in up volume the day before the buying surge. That’s not the case this time.

This is a short-term signal. It could mean the Dow heads higher for a week or a month. After that, there’s more downside ahead.

But for now, traders are buying.

Regards,

Michael Carr, CMT, CFTe

Editor, Peak Velocity Trader