A peaceful, financially sound retirement is the American dream.

Well, that might not be the classical definition of the American dream, but the keyword to describe those golden retirement years may just be “dream,” because retirement is financially unavailable to many people — and I’m not only pointing fingers at our dangerously floundering Social Security system.

There is a massive retirement savings shortfall building, and it is going to create a crisis across the globe.

Will you be able to retire?

If you fear that the answer to that question is “no,” then you’re far from alone. But you still have a chance to change that answer to a firm “yes”…

Reviving the Dream

I find myself more concerned about my retirement savings now — regularly checking my 401(k) savings, searching for ways to goose my returns and having long chats with my husband about effective cost-cutting measures — but it might have to do with the fact that I’m closer to retirement than at the start of my professional career.

And I’m not the only one who should be worried.

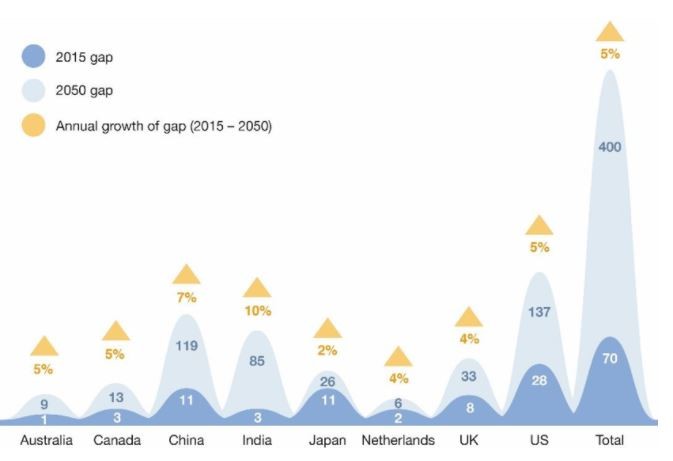

The World Economic Forum (WEF) reported that there will be a $400 trillion global shortfall in retirement savings by 2050.

In fact, $224 trillion of the gap can be found in six large pension-saving systems: the U.S., Canada, the U.K., Australia, Japan and the Netherlands.

As you can see from the chart below created by the WEF, the U.S. is facing the biggest shortfall, with a $28 trillion gap in 2015 growing to $137 trillion by 2050.

The WEF reached this figure by calculating the amount of money the government, employers and individuals would need to provide each person with a retirement income equal to 70% of annual earnings prior to leaving the workforce.

This retirement shortfall is largely due to longer life spans and disappointing investment returns over the past several years. What’s more, women face an even larger retirement savings gap due to their lower wages and longer life expectancies.

A Plan for Retirement Freedom

But there are still time and ways to make the dream of retirement a reality.

The WEF offers up solutions such as:

- A review of the national retirement age. In the U.S., the full-benefit retirement age is 66 (for people born in 1943-1954) and gradually rising to 67 for those born in 1960 or later. In Japan, the retirement age is 60.

- Make saving easier for everyone, particularly through the use of automation.

- Support financial literacy efforts. Too few people understand their options when it comes to retirement savings.

I’ll admit that I’m not overly keen on increasing the retirement age. I’d prefer to work late in life simply because I love my job, not because I’m fighting to get my full retirement benefits. But if we’re going to live longer, I guess we’ve got to work longer.

I definitely agree with the WEF’s suggestion of increased support for financial literacy. Too many people are unaware that a self-directed IRA gives them far more investment options and a chance at better returns than a traditional IRA.

Also, very few people are aware that you can use a health savings account as a very effective vehicle for savings for your retirement.

That’s why I’ve come up with a short list of steps that you can begin right now to help improve your retirement savvy.

- Learn your savings options. There’s more out there than just an IRA and your 401(k). Ted Bauman specializes in wealth solutions that protect and grow your assets while also helping to reduce your tax obligation. He’s even got this special report about how you can use a health savings account as a retirement fund.

- Maximize your stock returns. You’ve started saving for your retirement, but now you need investment advice from an expert. Paul is a former hedge fund manager who has developed a system for uncovering stocks that are poised to shoot sharply higher. He’s achieving gains that far surpass the average return of the broad market, getting you closer to the savings you need for a comfortable retirement.

- Diversify your retirement savings. I’m sure we’ve all been admonished a time or two not to put all our eggs in a single basket. The same goes for your retirement nest egg. All your savings shouldn’t be exclusively in stocks or any single market. Be sure that you’re also investing in gold and rare tangible asset such as coins or diamonds.

These three steps should help to improve your retirement savings and put you on the course to achieving your retirement dreams.

Regards,

Jocelynn Smith

Sr. Managing Editor, Sovereign Investor Daily