The town of Lively, Virginia, isn’t much more than a tiny speck on the map.

Lively is about a 15-minute drive from my mom’s house on Virginia’s rural Northern Neck. It’s the birthplace of Mary Ball Washington, George Washington’s notoriously cranky mom.

Next stop is Lancaster Courthouse … even smaller.

And then Kilmarnock — what everyone calls “town.”

Kilmarnock is a good 40 minutes away if you stick to the speed limit … more if you get stuck behind a combine.

After years visiting Mom’s place on the shores of the Rappahannock River, I know where to go if she runs out of something.

If the shopping list is small, and the items are generic and packaged, the short trip to Lively will do. (Also, beer, if it’s domestic or Mexican.)

For anything more than that — including fresh items — it’s Kilmarnock. (Imported beer and wine, too.)

That shopping calculus reflects the fact that Lively possesses the fastest-growing and most profitable type of retail store in the U.S. — a dollar store.

We make a lot of trips to the local dollar store … and so do a rapidly increasing number of Americans.

Fast and Cheap

The dollar store is the fastest-growing type of retail establishment in the United States. Three new ones open every day.

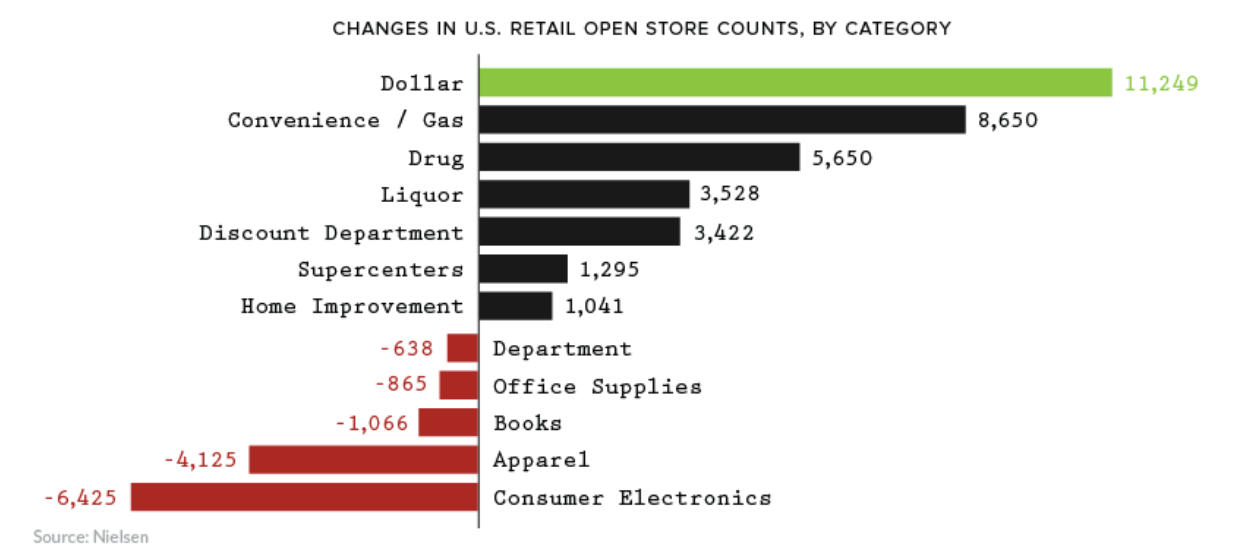

Other than gas stations, nothing else is even close. Over the last 10 years, more than 11,000 new dollar stores have opened their doors:

There are more dollar stores than the six biggest U.S. retailers combined (Walmart, Kroger, Costco, Home Depot, CVS and Walgreens).

By 2021, there will be more than 38,000 dollar stores in the U.S. That’s 760 for each of the 50 states … although the South and Appalachia have more than most.

The rapid growth in dollar stores reflects two facts.

First, economic growth is strong and unemployment is low.

But real wages for most Americans haven’t increased significantly in several decades. This is especially true of rural areas and small towns.

And the cost of essentials like health care and education is rising.

Declining disposable income is forcing millions of American households to resort to the lowest-cost shopping options.

With their massive national footprint and bulk-purchasing capacity, dollar stores are the kings of cheap. They now feed more Americans every day than Whole Foods.

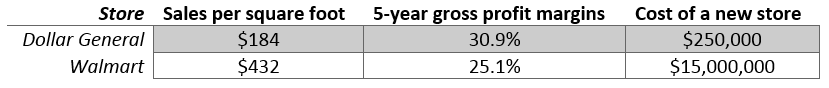

Second, dollar stores are cheaper to create — and more profitable to run — than retail supercenters like Walmart:

Dollar stores use a standardized, no-frills design. They thrive where land is dirt cheap.

That’s why a new dollar store costs, on average, only 1.6% as much as a Walmart.

That allows dollar store operators to open them in the thousands … and, crucially, closer to their customers’ homes than Walmart.

The average travel time to a dollar store is about half of that to a Walmart. Dollar stores are the logical choice for everyday shopping across vast swathes of the country.

Together, these factors have made the dollar store industry the primary beneficiary of retail growth over the last decade.

The King of the Dollar Store

There are two major dollar store chains in the U.S.: Dollar Tree Inc. (Nasdaq: DLTR) and Dollar General Corp. (NYSE: DG). They each own about 15,000 stores with similar layouts and product lines.

Together, these companies are quietly upending the retail sector.

They’ve forced drugstore chains like CVS and Walgreens to build up their pharmacy and medical services businesses, where dollar stores can’t compete.

Even retailers like J.C. Penney, Bed Bath & Beyond and Gap are losing market share to dollar stores.

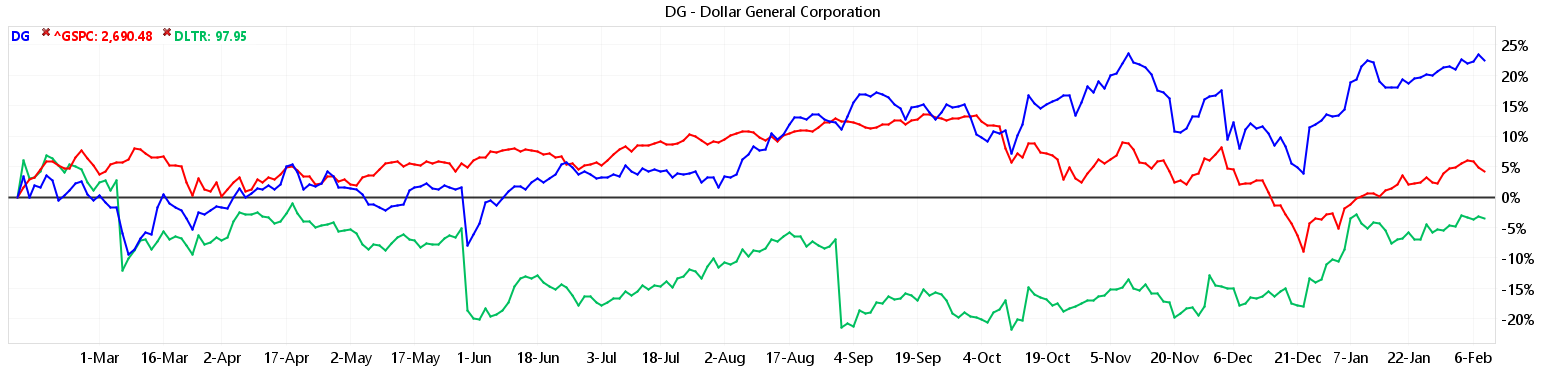

But the two companies are quite different in terms of share price performance. Dollar General has blown Dollar Tree — and the S&P 500 Index — out of the water over the last year:

That’s due to DG’s superior profitability and finances.

DG’s return on equity is 29% vs. 23.3% for DLTR. Its return on assets (its stores and distribution network) is 14.6% vs. 11.2% for DLTR.

DG is better-managed and, therefore, a more profitable company.

DLTR is also more heavily indebted than DG.

Its long-term debt-to-equity ratio is 0.64, compared to DG’s 0.46. That means Dollar General has more cash to invest in expansion and less need to borrow.

Making the Best of It

Not everyone is happy with the expansion of dollar stores.

They’ve been blamed for driving local grocery stores out of business in American small towns. Because they are national corporate chains, dollar store profits flow out of local communities.

That sounds a lot like the criticism leveled at Amazon, doesn’t it?

It’s true. Dollar stores are in the same position as Amazon. They’re just a little earlier in the process of consolidating their hold over the national low-end retail market.

You know how much money you’d have made if you’d bought Amazon early on. Dollar General gives you another bite at that same apple.

Kind regards,

Ted Bauman

Editor, The Bauman Letter