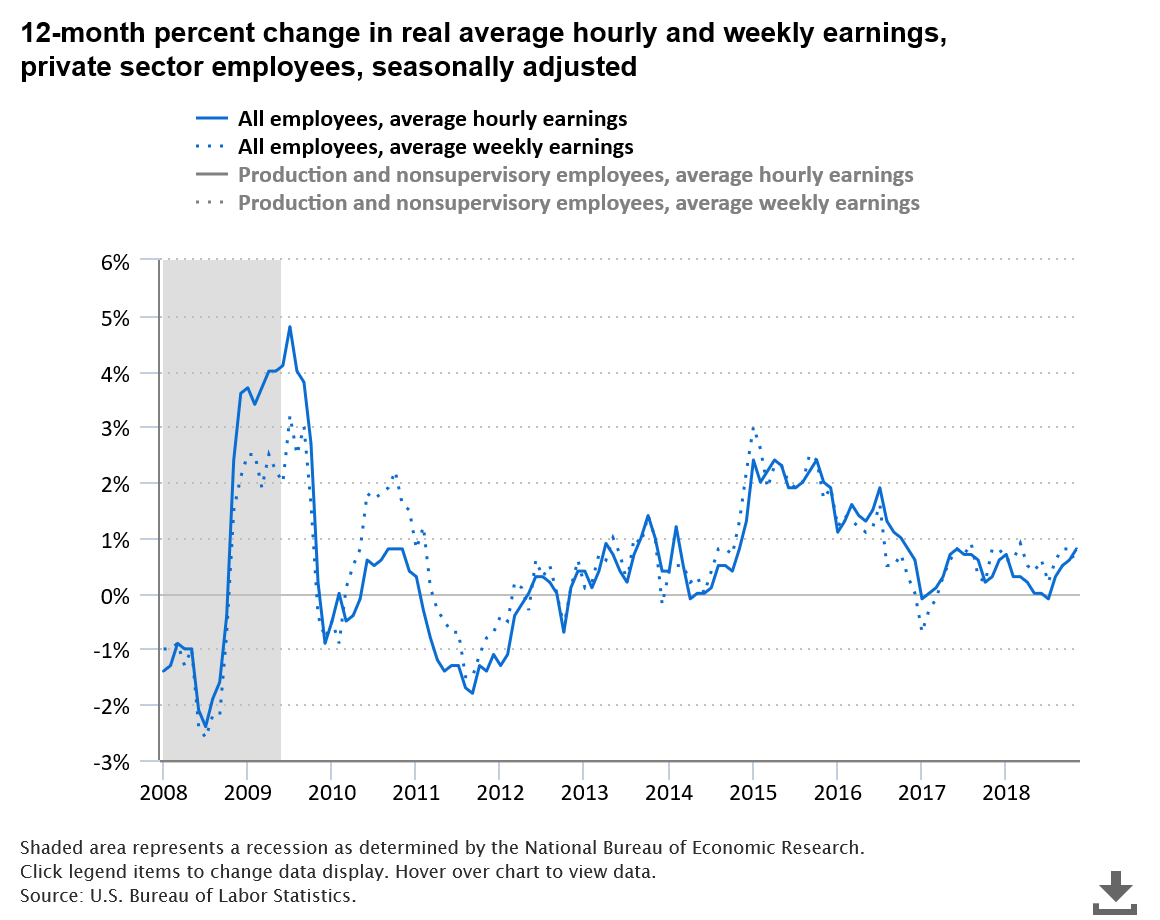

The economy might be humming along nicely, but workers have struggled to see the same kind of growth in their paychecks.

The latest from the Bureau of Labor Statistics reported that real average hourly earnings climbed 0.8% on a year-over-year basis in November.

But that small earnings growth has translated into more people feeling better about their finances.

The Federal Reserve recently reported that 74% of Americans say they are “okay” financially, which is a 12 percentage-point improvement over the previous five years.

Unfortunately, a new technology aimed at making our lives easier and simpler could also be poised to put us back into financial trouble…

Just a Wave of Your Phone

Mobile payment on your smartphone is the newest trend to make purchases faster and easier for consumers. It’s great! No more digging for your wallet to mess with credit or debit cards. No more touching dirty bills.

Just pull up the app and give a little wave of your phone in front of the reader. Bam! You’re done and on your way.

I’ve even used it when popping into the local Starbucks to get my caffeine fix before a day of meetings.

But a recent study from the University of Illinois at Urbana-Champaign revealed that mobile payment users typically end up spending more than non-users.

The study examined the spending habits using data from one of the largest banks in China and Alipay, a Chinese mobile payment platform.

And they found that the total amount of money spent increased 2% following the adoption of mobile payments and the number of retail transactions increased 23%.

In fact, mobile wallets made users more likely to spend more money on food, entertainment and travel.

A Debit Problem

I know what you’re thinking. A 2% increase in spending isn’t that bad.

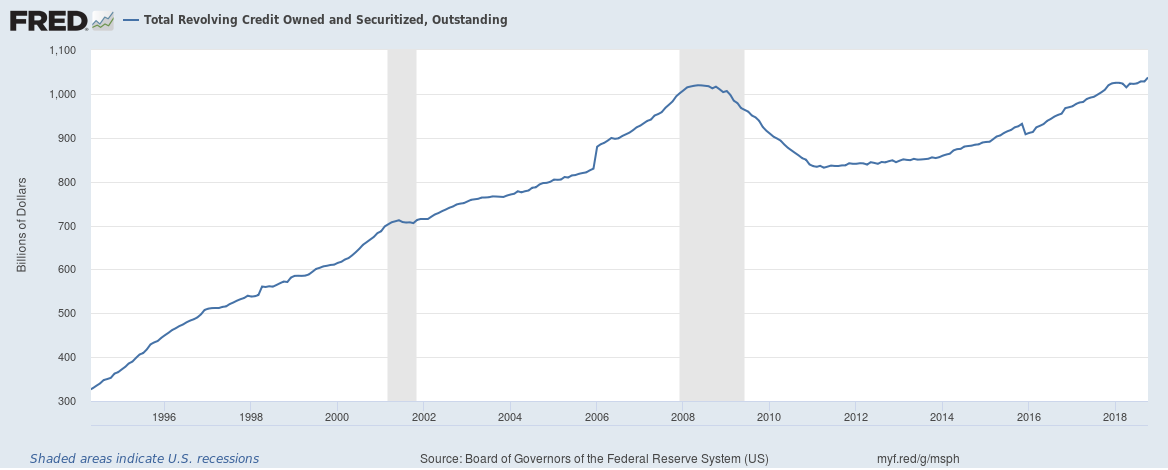

But keep in mind that Americans have a nasty habit of spending far more than they actually have. Total revolving credit hit nearly $1.04 trillion in October — a new all-time high.

Adding to our spending problem is not going to help as interest rates rise, and we’ve got to start making larger interest payments on all the debt we’ve accumulated.

Right now, roughly one-half of American cellphone users have used some form of mobile payment as of 2017. But that number is forecast to jump to 90% by 2020.

The fact is that technology is making it so very easy for us to spend money. Amazon has proven it with its Echo.

Owners of the smart speaker spent an average of $1,700 annually with Amazon, compared with $1,300 who are just Amazon Prime members. That’s a 23% increase in spending!

The farther we are psychologically removed from the money we worked hard to earn, the easier it is to spend.

Standing in a store, you might not give as much thought to a purchase if it takes just a wave of your phone versus actually taking the bills out of your wallet and handing them over to another person.

That’s good news for retailers in the short term.

Bad news for consumers when it’s time to pay the bills.

Watch Your Spending

I love new technology. I’ve got the latest smartphone and a smart watch. I recently picked up a nifty new tablet to help with work.

I don’t have a new smart speaker yet because I’m not quite sure I trust their “listening” habits, but that’s a story for another day.

The important thing to keep in mind is that while some things make our life easier, they might also promote some bad or even reckless habits. Americans already have a habit of poor saving and reckless spending.

And right now, mobile payments stand to make that bad habit even worse.

In past articles, I’ve spoken to Americans’ growing debt problem and it’s only getting bigger.

The lesson here is to be aware of your own spending habits and look for the American consumer to soon run into problems that could derail the current economic growth we’re enjoying.

Regards,

Jocelynn Smith

Editorial Director, Banyan Hill