Benjamin Franklin famously said that only two things in life are certain: death and taxes.

The investment world has its own certitudes.

Octobers are volatile. Big drops are followed by a temporary bounce. Markets hate interest-rate hikes.

So-called “safe-haven assets” are a particularly evergreen certitude.

If things are looking dodgy in the market, buy gold. Or the Japanese yen.

U.S. utility stocks are traditionally considered one of the safest of safe havens:

- Utilities are typically regulated monopolies.

- They enjoy long-term supply contracts.

- Their captive customers have no choice but to buy their products.

- They face a fixed price for their product, so their path to profitability is by reducing costs.

- They typically pay excellent dividends.

For all these reasons, utilities are usually up there with gold, the yen or the Swiss franc when it comes to safe havens.

That may be about to change … and if your portfolio is loaded up with utility stocks, you need to pay careful attention.

The Utilities Sector Is No Longer Reliable

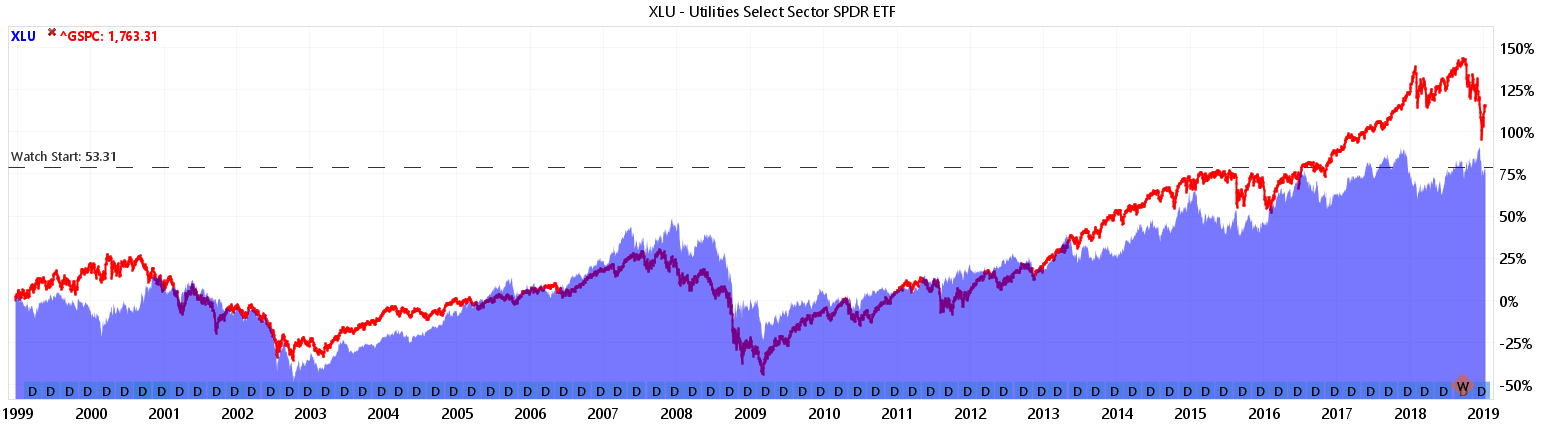

Back in 2007, when markets began to sense what was to become of the subprime mortgage crisis, the most-traded utilities exchange-traded fund — the Utilities Select Sector SPDR ETF (NYSE: XLU) — began to outperform the S&P 500 (^GSPC).

XLU continued to beat the market until mid-2013, by which time the postcrisis bull market was securely in place:

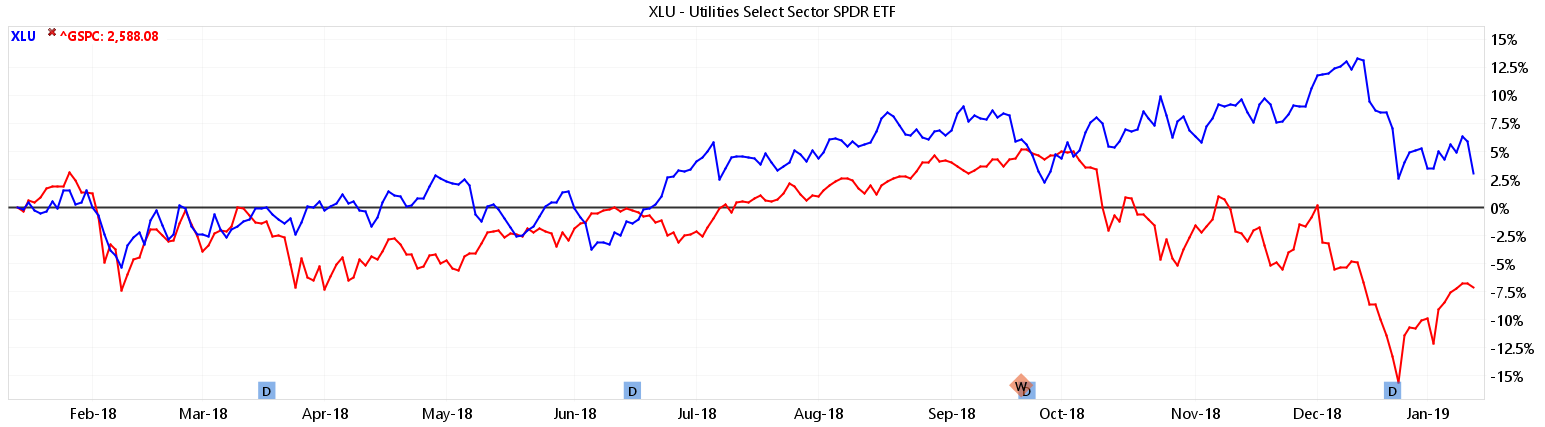

During the market’s upheaval last year, XLU again outperformed. It ended the year in positive territory, way above the S&P 500:

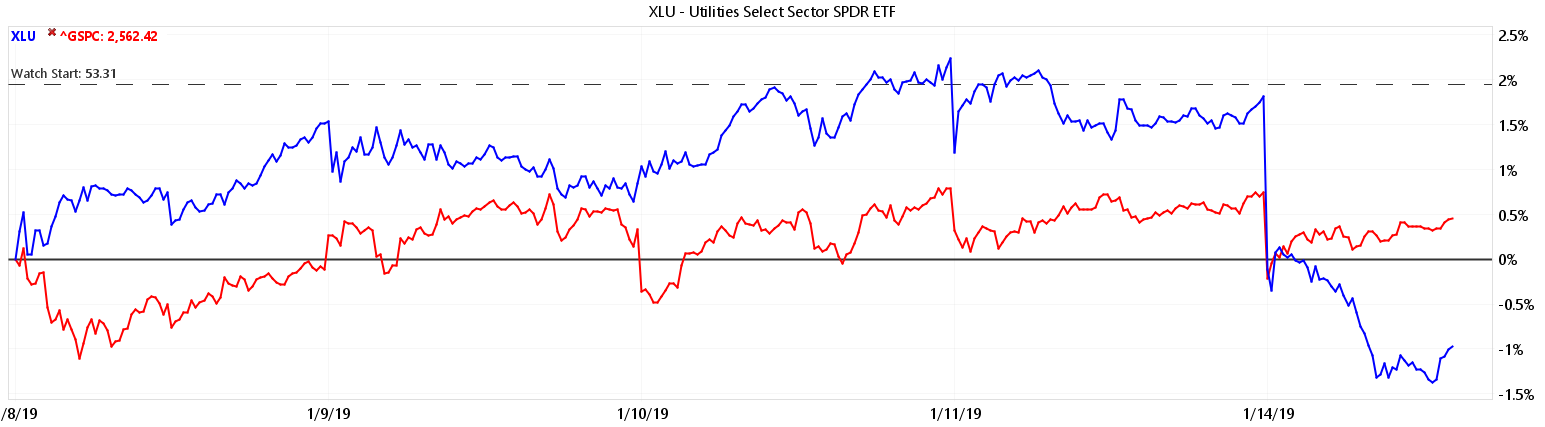

But on Monday, this trend sharply reversed. XLU experienced a 2% drop in overnight futures trading, from which it has failed to recover:

This could be a blip … or it could be the beginning of the end for utilities as a reliable safe haven.

1 Fire Lights Another

With $16.5 billion in damages, last year’s Camp wildfire in California was the costliest natural disaster worldwide in 2018, according to reinsurance company Munich Re.

The Camp Fire was a bunch of smaller fires that merged into one. Some of those fires were caused by electrical transmission equipment owned by PG&E, California’s largest utility.

PG&E could be on the hook for billions of dollars … far more than its insurance would cover.

Over the weekend, PG&E indicated it would file for bankruptcy. Many of its senior executives resigned, including its CEO.

The problem for PG&E is that California holds utilities liable for damages tied to their equipment, even if the companies followed the state’s safety rules. The logic (which I support) is that if a company causes damage in the pursuit of profit, it should pay for it.

As in many things, California is an outlier here. Most U.S. states don’t hold utilities liable for damages if they follow safety rules. Utility industry lobbyists spend millions to ensure that.

The problem is that climate change is changing the calculus … and it could be a game-changer for the U.S. utility sector.

Damned If They Do … or Don’t

Although some people dispute whether humans are causing it, global temperatures are rising. Rising temperatures mean changing rainfall patterns.

That raises the risk of catastrophic events like the Camp Fire.

Imagine you’re a legislator in a state with a lot of forests:

- You might not believe in climate change.

- You’ve been sympathetic to utility industry lobbying in the past.

- You supported limiting their liability if their infrastructure causes damage to third parties.

Now everybody is saying wildfires will probably happen more often. And thanks to rising temperatures and decreased rainfall, the expected value of future wildfire liabilities is bigger than it used to be.

Under your state’s current policy, your constituents bear the cost of a wildfire caused by a utility company. The state government usually helps compensate them after a disaster.

But now you’re faced with a choice: either raise taxes and budget for billions of dollars of compensation or face the wrath of voters.

Either way, you’ve got a problem.

The next time somebody introduces legislation like California’s, requiring utilities to accept liability for wildfires in your state, are all those donations and favors from industry lobbyists going to be enough to stop you from voting for it?

Global Warming: A Warning

The fate of California’s PG&E is a stark warning to electric utilities and public officials across the United States.

Such utilities in fire-prone states will face hard questions about their liability in contributing to natural disasters. That will catch them in a pincer movement.

They’ll face political pressure to accept more liability. And their insurance costs will rise dramatically.

Some utilities may face bankruptcy unless they’re allowed to raise their prices to compensate for the increased risk.

Higher taxes or higher electricity prices? It’s a decision American politicians are ill-equipped to make.

And that makes the future of the U.S. utility sector as a safe haven increasingly uncertain.

Kind regards,

Ted Bauman

Editor, The Bauman Letter