Last year’s Nobel Prize for Literature went to Bob Dylan, who warned us that change is inevitable. While we’ll never really know what Dylan was talking about in his lyrics, he could have been assessing the current political climate in one of his most famous songs, “The Times They Are A-Changin’,” when he wrote:

The order is

Rapidly fadin’

And the first one now

Will later be last

For the times they are a-changin’

These words could have described last year’s U.S. presidential election and the surprising victory of Brexit supporters in the United Kingdom.

Despite warnings of chaos from many pundits, financial markets have cheered the results. We know the S&P 500 has roared higher since President-elect Donald Trump’s surprising victory, but look at what’s happening in Great Britain…

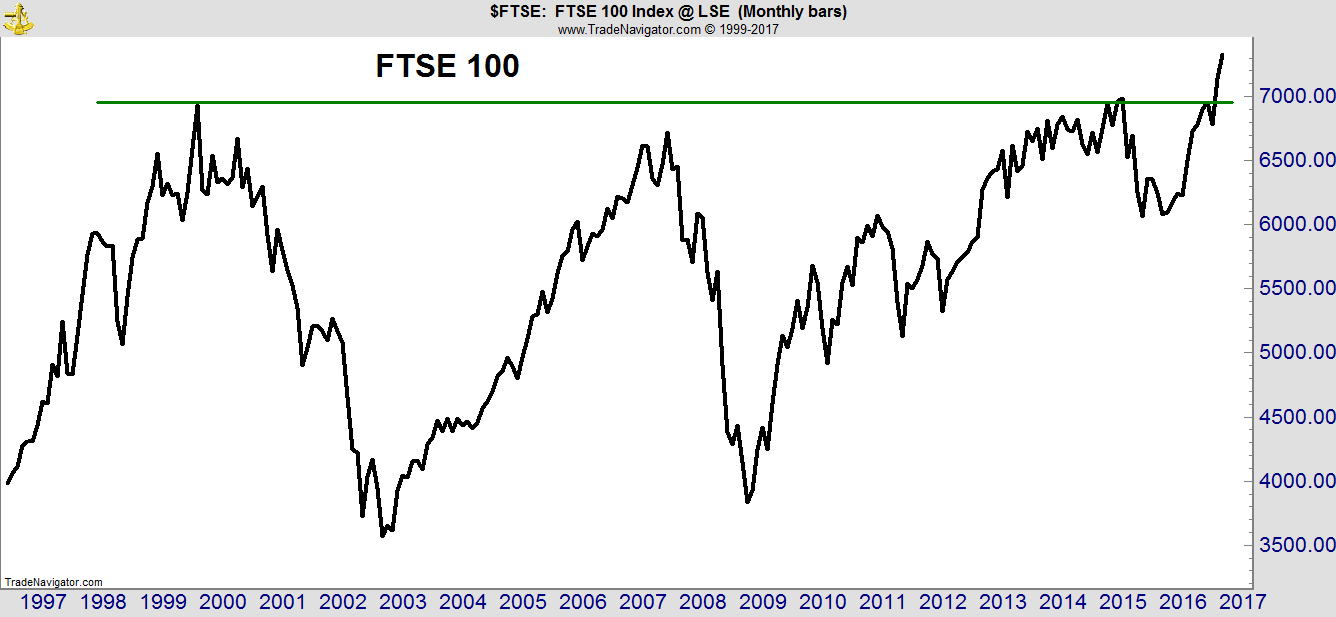

The Financial Times Stock Exchange 100 Index (FTSE 100), a benchmark index for British stocks, just reached a new all-time high, surpassing the peak seen in 1999.

Some investors fear new all-time highs, worried the market will crash after prices set records. That can happen, and we have seen a few crashes after new all-time highs were reached.

But, most of the time, new highs are bullish. In fact, they are the most bullish signal possible in the stock market. In the U.K., stock prices reached new all-time highs for 10 consecutive days before pausing.

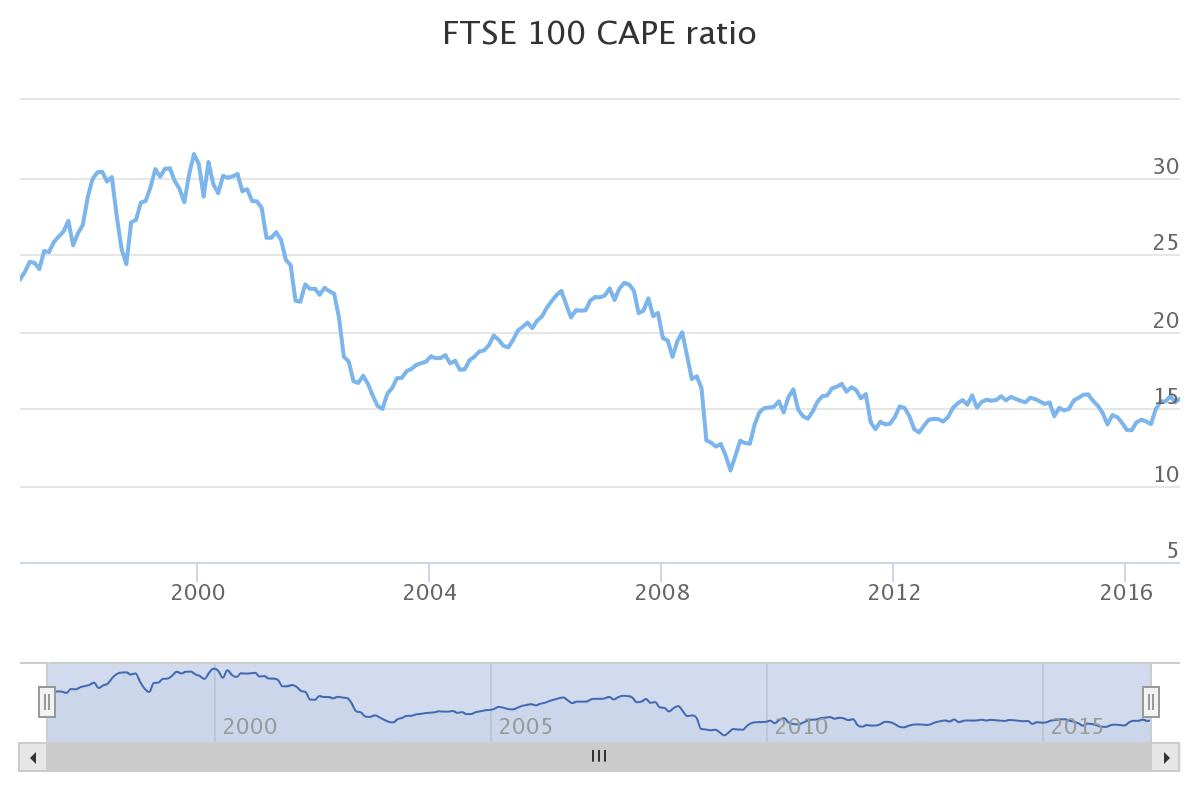

Fundamentals point to more new highs in the U.K. The cyclically-adjusted price-to-earnings (CAPE) ratio is 16, well below its 20-year average of 20.

The CAPE ratio is a long-term indicator of whether or not stocks are overvalued. When it is well below average, as it is now, it means stocks are undervalued, and the long-term trend in prices should be up.

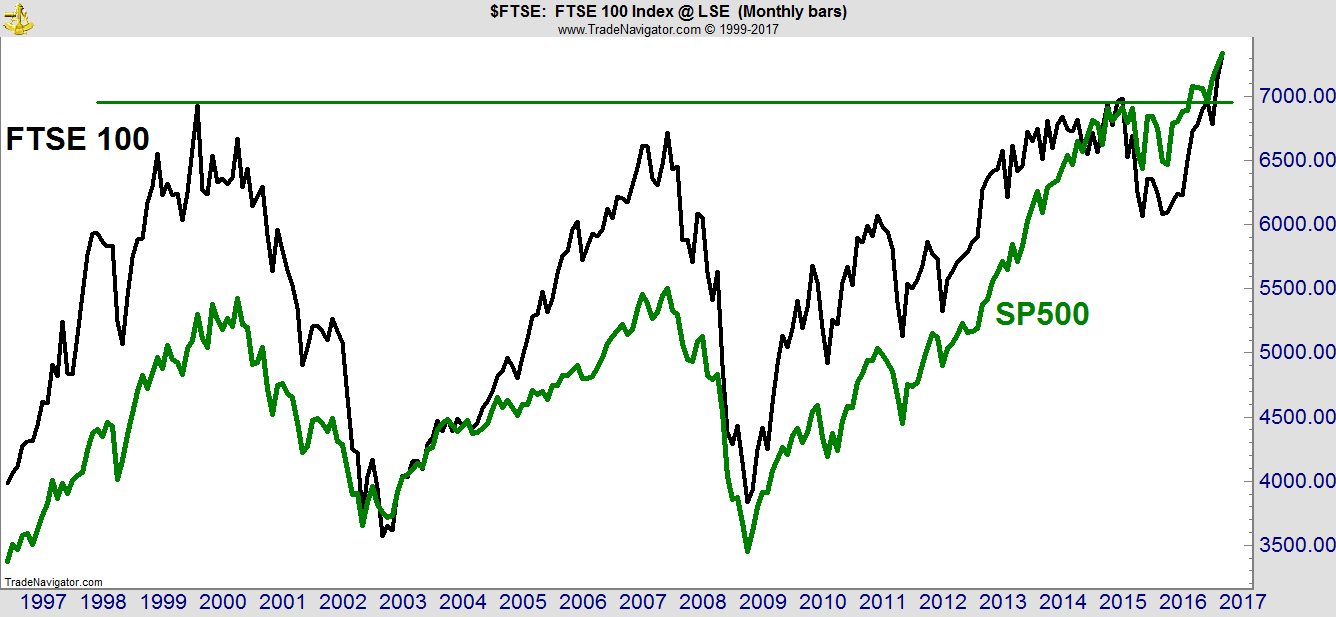

The next chart shows why U.S.-based investors should care about the FTSE 100. The S&P 500 moves in the same direction as the FTSE 100 most of the time.

The FTSE 100’s new high is confirming a bullish outlook for stocks in the U.K. and the U.S. More new all-time highs are likely ahead for investors in both countries as the times appear to be a-changin’ for the better.

Regards,

![]()

Michael Carr, CMT