Today’s article is about a speculation.

That means there is a chance you will lose money if you buy today’s stock.

You may not want to continue reading if that scares you.

But if you’re willing to take on a little risk, I have an opportunity for you that could be very profitable.

One of my main ways to find stock ideas is by looking to see what the company insiders are buying. By insiders, I’m referring to the firm’s directors or officers, as well as those who own a big chunk of company stock. And by buying, I mean buying stock with their own money (open market purchases), not via option grants.

When you think about it, there are lots of reasons why an insider would sell their stock. They may need the money to pay bills, buy something, diversify their investments or do a whole host of other things.

There aren’t very many reasons why an insider would buy their company’s stock, though. And the main reason is because they plan to make money.

And who is in a better position to know how a company will perform in the future?

I recently found a stock that could make its owners a lot of money. It isn’t a sure thing, but it has one huge thing going for it…

A Biotech Insider

His name is Robert Duggan. You see, Duggan’s trading activity tipped me off on this idea. And we could double our money as a result.

Duggan is an entrepreneur and self-made billionaire. Importantly, he made most of his money by investing in biotech companies. Duggan netted $3.5 billion when he sold his biotech firm Pharmacyclics to AbbVie in 2015.

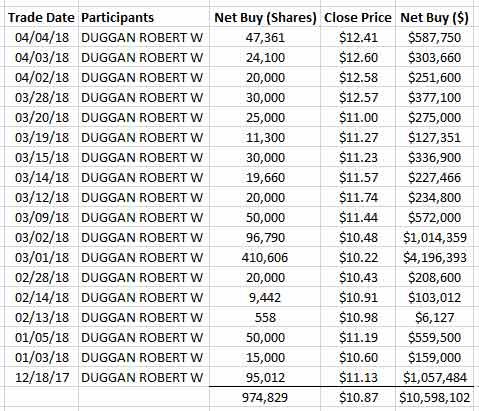

And in the last few months, he bought more than $10 million of shares of a $500 million Bay Area biotech firm:

Duggan was adding to his position in Achaogen Inc. (Nasdaq: AKAO).

He is the company’s largest shareholder, with more than 6.5 million shares. That’s nearly 15% of the outstanding shares.

Investing with insiders is about following smart people into positions. Duggan made his bet via his share purchases. He also meets with the company periodically to ensure it knows where he stands.

He likes the story. And the market is beginning to like it as well. You can see the stock’s recent uptrend in this chart:

Bacteria resistant to antibiotics infect at least two million people each year. And Achaogen is creating antibacterials that actually work.

The company’s plazomicin is the first antibacterial to earn a breakthrough therapy designation from the Food and Drug Administration. This means it shows substantial improvement over the current therapy in treating a serious or life-threatening condition.

The company hopes to receive approval for the drug by the end of June. It is preparing for the product’s launch today and has already hired sales management.

Of course, if something happens to derail that timeline, this stock will struggle. But Duggan isn’t planning on that.

The Bottom Line

Remember, this is a speculation. We are betting on an insider, a promising drug and an uptrend.

If we are right, we’ll make money. But if you consider this trade, please limit your position size to address the risks.

An individual small-cap stock speculation shouldn’t make up more than 1% of your portfolio. So, if you have a $100,000 portfolio, you shouldn’t risk more than $1,000 on Achaogen.

And there’s no rush. The company expects to hear from the Food and Drug Administration by June 25. If shares trade a bit lower from here, you may be able to pick them up for less than Duggan recently paid.

Good investing,

Brian Christopher

Senior Analyst, Banyan Hill Publishing

Editor’s Note: Profits Unlimited Editor Paul has made millions for himself and his clients as a biotech analyst on Wall Street for more than 20 years. He knows how to spot highly profitable opportunities that can turn even a tiny investment into an absolute fortune. And now, he’s revealed a medical breakthrough that will have a profound impact on your life in the coming months and years … and completely transform the $1.7 trillion health care industry. To find out more, click here now.