Bonds are safe … or at least that’s what everyone seems to think. Actually, some bonds are riskier than stocks right now.

Since 1982, U.S. government bonds have delivered a risk-free annualized return of more than 9% a year. Many of us haven’t seen anything except a bond bull market. But that will change someday.

A long-term bull market in bonds ends when interest rates turn up. That could start today, next year or 10 years from now. I don’t know when the bear market in bonds will start, but I do know that investors will suffer terrible losses when it happens.

A simple formula lets us estimate the loss in value when interest rates rise … and the results aren’t pretty.

A Breakable Bond

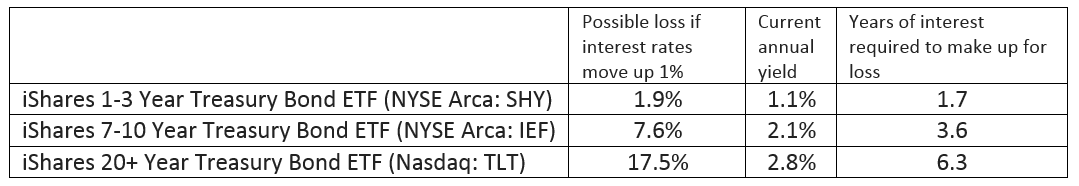

One example we can look at is the iShares 20+ Year Treasury Bond ETF (Nasdaq: TLT). Investors have more than $6.2 billion in this exchange-traded fund (ETF), which offers an annual yield of about 2.8%. If yields rise just 1%, these investors face a loss of 17.5%.

With inflation at 2%, government bonds should yield at least 4% annually. But if yields get back to 4%, investors in these bonds will lose 6.3 years’ worth of interest income. Investors face a near-certain double-digit loss when the Federal Reserve stops printing money.

If there’s any good news, it’s that investors in short-term bonds only lose about 2% when rates go up by 1%. That’s only about two years’ worth of interest.

In the chart below, the size of potential losses for some popular ETFs are shown. ETF providers show this data on their websites, but it’s not easy to find. They also don’t explain how to calculate the size of a potential loss.

A New Train of Thought

Investors keep pouring money into bonds. They seem unconcerned about the risks … maybe because they don’t realize the risks are so large.

Many of us expect the future to be like the past. Bonds have been in a bull market since 1981. That’s all most of us know.

The real problem is what happens after investors suffer devastating losses. Many are likely to sell, creating more downward pressure on prices. In the end, the Fed might create a runaway train in the bond market.

Rather than risking so much for so little, investors might want to look at stocks. At least in the stock market, the potential rewards justify the risks.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader