Anyone who makes regular TV appearances will tell you the key is to have clear, concise talking points.

Typically, these follow a simple format: Point 1, Point 2, closing point (with emphasis).

If you watch any TV pundit, you’ll see the same format.

Oh, and always stare straight into the camera, and keep a faint smile while the other guest or host is talking.

My wife has constructively criticized my “resting grouch face” when I’m concentrating and forget to smile.

But sometimes these lessons get thrown out the window when you’re talking to an indomitable host like Lou Dobbs, as I did last week.

Dobbs is an icon in the TV journalism world, starting his broadcast career as the host of CNN’s Moneyline in 1980.

He’s also a welcoming but pugnacious host who is quick to interject with his own thoughts.

After all, it’s his show with his name on the banner. Viewers are tuning in to watch Dobbs and listen to his spiel about the markets and the world.

So when he cuts you off mid-sentence, you need to roll with the punches and still manage to land some good talking points.

Sitting in front of the camera reminds me of my hedge fund days sitting at my trading turret.

There’s a lot of chaos going on behind the scenes. And the skilled trader has to remain calm and focused.

As Dobbs pointed out, Apple Inc. (Nasdaq: AAPL) has had a rough month.

On January 2, Apple lowered its revenue guidance following less-than-expected iPhone sales and a weakened economy in China.

The stock dropped 7% on the news to $142. That price left AAPL down 38% from its all-time high of $232.07 on October 4.

The negative AAPL news should not have been much of a surprise, as the stock market has sold off significantly in the last month on the same growth worries.

That’s why the price of AAPL bounced off those oversold lows and retraced much of its sell-off from a week ago.

But a cyclical slowdown in Apple is not what should worry investors. What’s even more troublesome is that Apple is falling behind the competition.

Products That Will Win the Future

Much has been written about how AAPL is no longer the biggest company in the U.S. by market cap. Lately, that top spot has been a battle between Amazon and Microsoft.

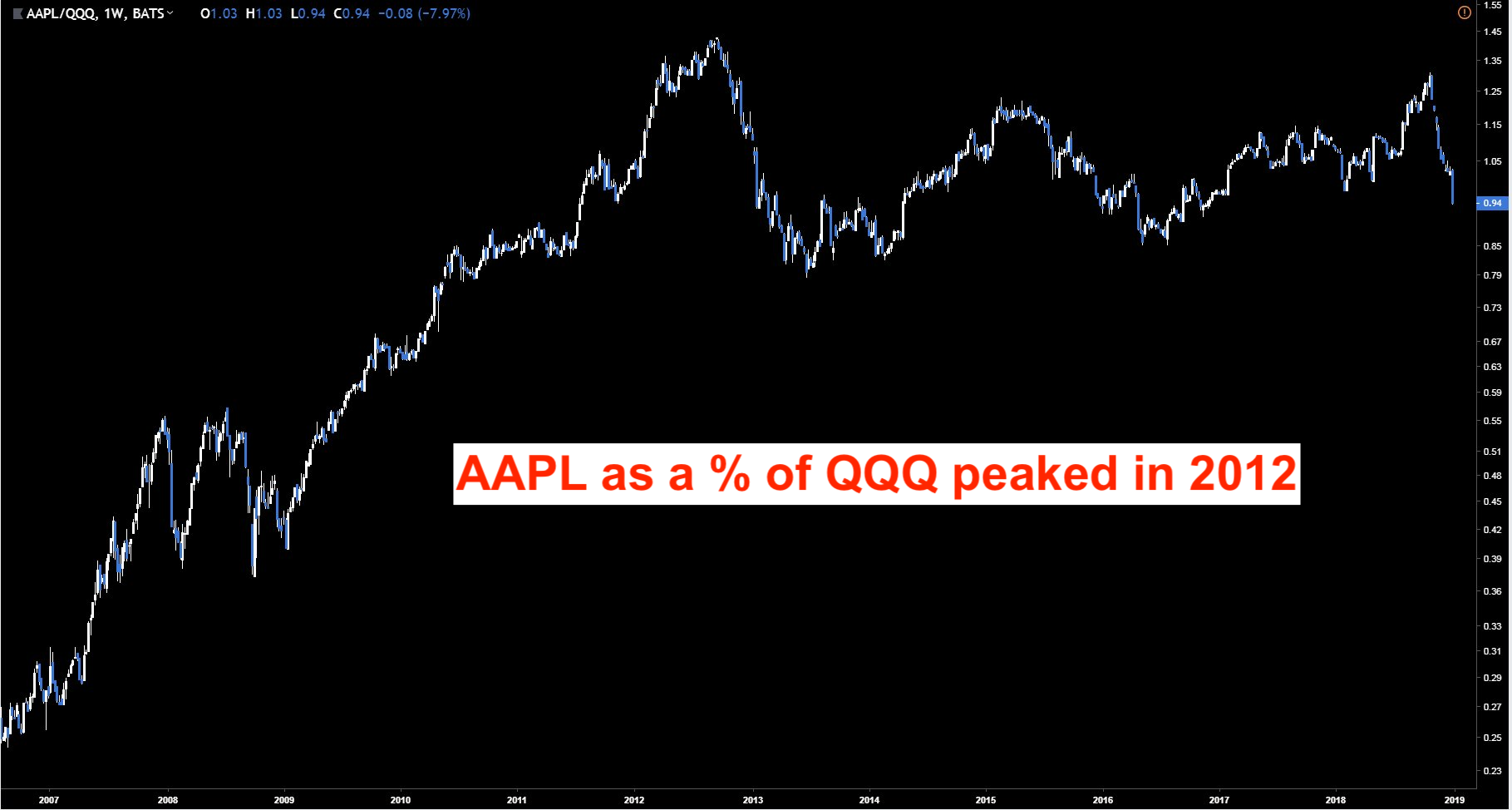

In reality, Apple’s dominance has been fading since 2012, when it peaked as a percentage of the Nasdaq Composite Index (QQQ):

One of the reasons for this is AAPL’s inability to invest in the necessary research and development to “win the future.”

Outside of improvements to existing products, such as the iPhone and the iPad, AAPL’s only new product has been a Bluetooth speaker, the mediocre, high-priced HomePod.

Meanwhile, its FAANG competitors (Facebook, Amazon, Netflix and Alphabet, the parent company of Google) are busy developing products that will win the future.

Alphabet’s self-driving car project Waymo might be worth over $200 billion.

Amazon’s Alexa devices are increasingly managing smart, connected households.

Facebook has sold almost 2 million Oculus virtual reality headsets in the past year.

Yet it feels like the biggest development in Apple has been talking poop emojis.

This isn’t the big technological breakthrough you would expect from one of the world’s largest tech companies.

Big Growth Areas

Even in what AAPL does best — iPhone sales, which account for 60% of revenues — it appears to be falling behind in the big growth areas of China and India.

The reason for this: a failure to offer a price-appropriate product.

As I told Lou Dobbs, only 19% of India owns a smartphone; and in China, only 59%.

These are the biggest countries in the world in terms of population. Apple should be targeting them for new smartphone sales.

Income per capita in India is only around $7,000. In China, it’s $16,760.

Households simply can’t afford Apple’s new line of $1,000 iPhones. Especially when Samsung and Google offer smartphones approximately 30% cheaper in the same markets.

The Bottom Line for Apple

What Apple does have going for it: $237 billion of cash.

And that can be deployed to buy up companies with ideas to help win the future. Heck, it could buy Tesla four times over with that cash.

Or purchase the entire crypto market twice over.

Or dive into the private markets, buy Airbnb and become the largest hospitality provider overnight.

The point is, now is not the time for Apple to be resting on its laurels while the rest of the tech world shoots rockets at the moon and builds cars that drive themselves.

Regards,

Ian King

Editor, Crypto Profit Trader