Gold prices are fickle.

The precious metal is the one natural resource that confounds most investors. It’s an anomaly. We can make good estimations of the direction of oil, copper, lead and zinc prices based on supply and demand. We can’t with gold.

That plays hell with mining stocks, as I’ll show you.

Where most natural resources are consumed, gold is not. Nearly all the yellow metal ever mined remains in circulation today. That means that the new supply coming from mines is practically a rounding error on the total volume. Each year is a small addition to the total supply.

However, the price is still subject to the tides of supply and demand … just from much larger sources.

Gold: An Unpredictable Metal

What gold is, to the market, is a measure of confidence in currencies around the world. As Americans, if we are happy with the U.S. dollar, we own less of the precious metal. If we are worried about the devaluation of the dollar (inflation), we buy more. It works the same in all countries and currencies.

Mostly. Sometimes.

That unpredictability makes investing in miners even more difficult. It was compounded lately by the price’s deep fall from 2011 to 2016. It fell below the price at which most miners can produce gold profitably.

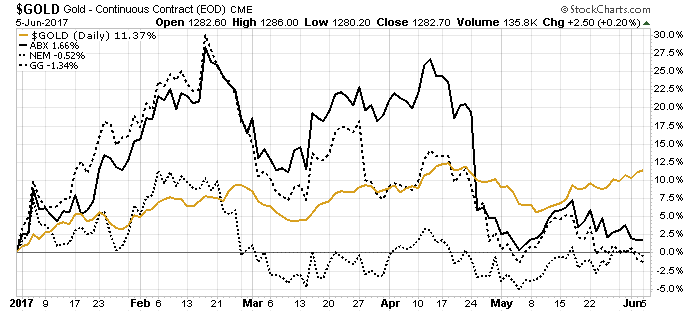

As the price rebounded in 2016, so did the mining stocks … but in 2017, the gold price and the miners’ stock prices aren’t moving together anymore.

Today, the price of gold is up over 20% since January 2016. That’s good news, but it is 10% below its August 2016 high of $1,375 per ounce. In 2016, giant gold miners such as Goldcorp Inc. (NYSE: GG), Newmont Mining Corp. (NYSE: NEM) and Barrick Gold Corp. (NYSE: ABX) soared as the gold price rose.

Where gold prices went up 30%, Goldcorp rose 75%, Newmont shares soared over 150% and Barrick stock climbed nearly 220%.

Then, just when investors were making a ton of money on mining stocks again, the price reversed course. It fell 18% in four months, from August to December 2016. Gold stocks fell too.

The price of the yellow metal bottomed in December 2016 and has steadily rose this year. In fact, 2017 has been a great year for gold so far — up over 12% in a steady bull market. But the big miners are not following, as you can see in the chart below:

The likely reason is an enthusiastic buying spree that pushed shares up too high.

Investors plowed in early. Shares of Goldcorp and Barrick were up 30% in mid-February. As prices peaked, investors took profits and shares fell again. Both are now back to where they started the year.

That’s fine with me, because I see an opportunity to cash in on miners setting up.

The major miners got a huge boost in 2016 thanks to the jump in gold prices. However, their lack of response to the metal’s move this year is likely due to too much money rushing into the space too soon. Now investors have pulled back, looking to cash in elsewhere.

We’re still here, waiting for our opportunity … and it will come.

As the metal’s price continues to climb in 2017, those stocks become more and more valuable. When the share prices of the big miners start moving up, that’ll be the time to buy. I suspect that we’ll see a big jump in their prices if the rally continues through the summer.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist