Story Highlights

- This week’s chart pinpoints the opportunity to make money on a downtrend: a simple options trading strategy.

- John explains the advantage of working with a proprietary system to help you maximize your gains in a relatively short time.

- Click here to see how you can get in on the action and start learning how to trade smarter, not harder with this options trading strategy.

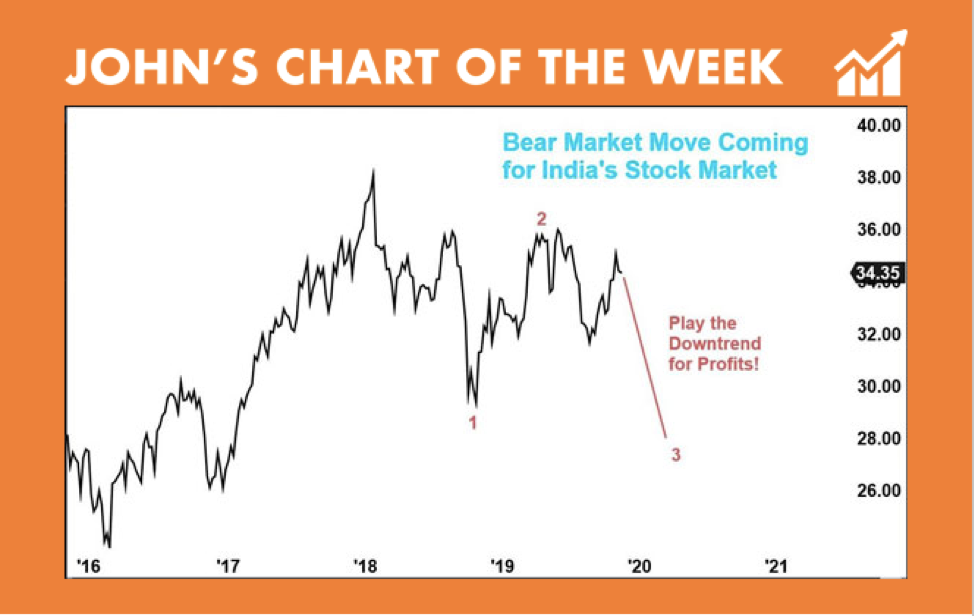

A quick glance at this week’s chart tells me investors should watch out for a 20% drop in price on this exchange-traded fund (ETF).

More than that, investors like us can play the decline for triple-digit gains.

I’m talking about the iShares MSCI India ETF (BATS: INDA). This U.S.-listed ETF tracks an index of top stocks in India’s stock market.

It holds stocks in sectors such as financial, materials, consumer goods, energy and technology.

And this setup will drive INDA’s downtrend. Check out the chart below.

As you can see, INDA broke above $36 back in 2017. And that price held for barely a month.

All subsequent attempts to push above that level failed. The latest rally won’t get even that far.

Its short-term climb looks complete. A decline of at least 5% is coming … and that’s if investors don’t flee the ETF out of fear that India’s economy can’t keep pace.

But it’s not looking good.

The Apex Movement Patterns (AMPs) — labeled 1-2-3 — my colleague Matt Badiali and I use to monitor stock prices suggest INDA is in for a deep decline that will rival its 22% bear market plunge in 2018.

That’s the move we can play for double-digit gains. We can make those gains in a relatively short amount of time with a proven system.

That’s the key to grabbing the potential gains to every trade you make. And I want to share an approach that helps you do exactly that.

I made a video about this can’t-miss approach we’re finally sharing with you.

Watch the video below to learn more about my colleague’s proprietary system related to options trading strategy.

Investors’ Fear: Your Opportunity for Bigger Gains

Now, the AMP foreshadows how investors are going to react to stress in India’s economy.

Economists and investors expect India to be the next large-scale source of growth and opportunity. Investors tout it as the next China.

But that’s been the case for nearly 10 years. Growing pains seem to outnumber growth spurts these days.

Yes, India’s economy gained respect when it became the customer call center and code developer for most of the developed world.

But that’s old news. India is struggling to keep its momentum.

Credit growth is slowing.

Consumers and businesses are having such trouble getting loans that they’re pawning their gold. Indian households have a lot of it. Gold holdings are at about $1 trillion, equivalent to 40% of India’s GDP!

At the same time, half of India’s labor force is stuck in the farms and barber shops of yesterday’s economy.

Without a transition into manufacturing and modern industries, the growth flame of a burgeoning middle class will go dark.

And investors’ anticipation for returns from India’s stock market will darken as well.

The INDA chart above warns us it could slide 20% by April.

When investors can no longer see the potential for economic growth, they will flee. My system suggests a major flight is possible.

A price decline that exceeds 20% is considered a bear market.

But even if the decline is not that deep, there’s a way to play the setup in INDA for triple-digit gains. It’s a price move you don’t want to miss!

Bigger Profits From a Proven System

I have my eye on a play that could return 216% in four months if INDA drops to $32 per share. That’s just a 7% decline from its current price of $34.35.

That’s because the trade uses put options.

Put options are a great way to trade a stock that’s declining.

But the mechanics and risks are a tiny bit different.

If you don’t have experience trading options, we can help you there.We do the research based on our proprietary trading systems, which will allow us to help you build your understanding — and show you how to grow your profits.

My Apex Profit Alert co-editor, Matt Badiali, prepared a video to show you a revolutionary strategy that uses put options and call options.

This is advice you can use to work smarter, not harder — by only watching certain stocks four days a year instead of every day!

Good investing,

John Ross

Editor, Apex Profit Alert

P.S. Check out my YouTube channel. Hit the subscribe button — or the little bell — to receive a notification when I post new content regarding this options trading strategy and other fantastic videos.