When my editors at Banyan Hill asked me for my forecasts for 2019, I immediately thought of this quote that may (or may not) have been attributed to the late, great Yogi Berra:

“Predictions are difficult, especially about the future.”

A market forecast is a prediction of investor behavior. And investor behavior is based on beliefs.

As I’ve oft contended, you do not trade stocks, bonds or cryptos; you trade your beliefs about stocks, bonds or cryptos.

Thus, a market forecast is something that correctly predicts the future beliefs of investors.

That’s why the trader in me tries to avoid too much conviction that a particular scenario will play out.

It’s nice to have a framework for the market. But it’s better to be mentally flexible and change when the conditions change.

After that disclosure, here’s what I think may happen in 2019.

My 2019 Predictions

- The U.S. will end its longest expansion in history at 38 quarters and fall into a recession by June. Even though economic optimism and growth are currently surging, the sugar high from the tax cuts will wear off early next year, and this sets us up for a short, sharp recession.

- In the aforementioned scenario, the market is the tail that wags the dog. As goes the market, so goes the economy. U.S. stock markets suffer their first bear market since 2008. Volatility surges, yet the S&P 500 Index manages to find a floor in February on hopes the Federal Reserve cuts interest rates. (Keep in mind that bear markets do not go straight down, and this bear market will be no different. It will be characterized by big plunges and sharp short-squeeze rallies.)

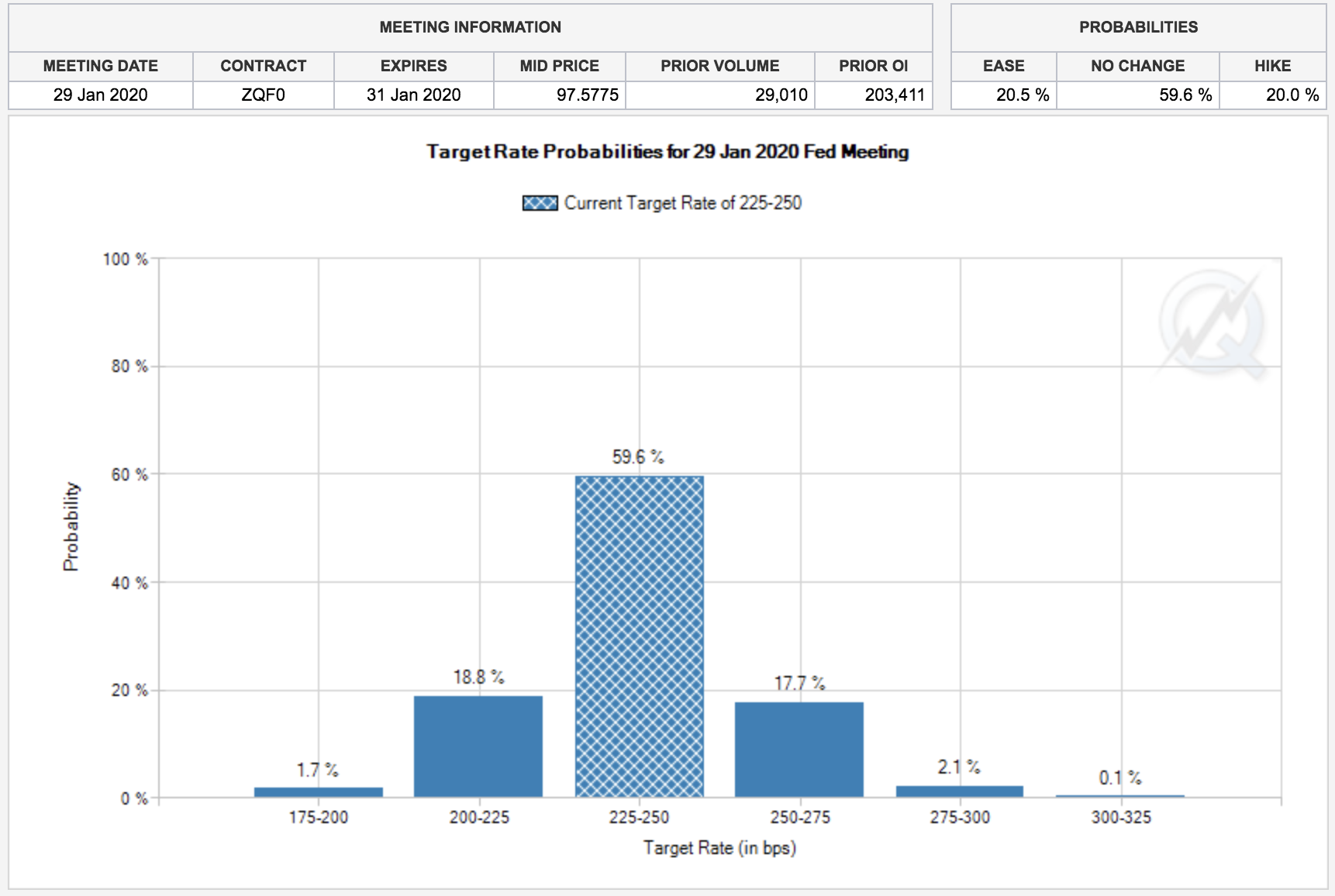

- The Fed will not raise rates in 2019, and perhaps will even cut them. The Fed’s job of cooling off the economy is already done, and it might have overshot to a hard landing. After December’s sell-off, fed funds futures have already priced out 2019 rate hikes. For the first time in over six years, there’s a higher probability of a cut a year from now than a raise.The following chart shows the target rate probabilities for the January 29, 2020 Fed meeting. The current target rate is 225 to 250, and fed funds futures imply a 59.6% chance of no cut or raise. Markets are giving just an 18.8% chance that rates will be 200 to 225, and only a 17.7% chance that rates will be 250 to 275.

- Hamstrung by declining stock markets, President Donald Trump and Chinese President Xi Jinping agree to a trade truce by February. Similar to the renamed NAFTA trade deal, the previous U.S.-China status quo remains intact. Both sides declare victory.

- The price of oil drops into the $30s on fears of a slowing global economy. The price never recovers as increased adoption of electric vehicles convinces investors that demand has plateaued and will trend lower in the future.

- Italy’s universal basic income plan is a success, insofar as people are happy and no one cares about the coinciding debt. France moves to pilot a similar plan. At least one U.S. Democratic candidate mentions universal basic income as part of their presidential platform.

- Google’s autonomous taxi service takes off in Phoenix, and the self-driving car race is upon us. Uber and Lyft launch initial public offerings into the bear market, taking 20% haircuts on valuation. Uber raises $10 billion at a $100 billion valuation.

- Later in 2019, Trump and House Democrats unveil a sweeping infrastructure spending plan that upgrades roads, bridges and airports. This “Build America Plan” aims to spend as much on the U.S. as was spent on rebuilding Iraq.

- The 21st-century space race takes off, as satellites become a more viable option for cheaper, faster broadband. Boeing and SpaceX already plan to launch about 7,500 satellites next year, which could lay the groundwork for internet speeds equivalent to 5G.

- Scaling solutions such as “sidechains” and the Lightning Network allow bitcoin to be transacted faster and cheaper than credit cards. Starbucks becomes the first global merchant to accept bitcoin as payment through its app.

- Square Inc. (NYSE: SQ) doubles, even during the bear market, as companies rush to integrate the Square Reader into their bricks-and-mortar and e-commerce stores.

- Bitcoin replaces the bolivar as the unofficial national currency of Venezuela. Other habitually profligate governments take notice and respond with spending cuts. Bitcoin outperforms all other currencies.

- Decentralized gaming takes off, where players can own their digital goods. Video game makers begin exploring ways to integrate crypto into this $100 billion arena.

- Protein-folding supercomputers begin developing and testing next-generation cancer treatments for ailments previously considered untreatable. 2019 ushers in the new wave of biotech companies that use unprecedented computational power to unlock new cures.

Those are some of the things that may happen in 2019.

It’s hard to predict when the 10-year stock rally will end. But excessive optimism and nonexistent volatility typically indicate that a rally is near its end and a reversal will ensue.

It looks like that reversal is now upon us.

Regards,

Ian King

Editor, Crypto Profit Trader