My dad is a HUGE sports memorabilia collector.

His passion for the hobby is contagious.

So, I found myself drawn to collecting at a young age…

Opening packs and sorting cards in my free time.

Looking back, collecting sports memorabilia together made our relationship stronger.

Many have a similar story.

The social aspect of the hobby has helped it grow into a $5 billion market.

But the collectibles industry is undergoing a massive shakeup…

Producers of collectibles are ditching cardboard cutouts for blockchain technology.

Instead of cards, producers are selling content via nonfungible tokens (NFTs).

NFTs are digital certificates. They certify ownership of digital assets.

They’ve risen in popularity dramatically in the past few years.

And the content looks drastically different than anything we’ve seen before.

Dapper Labs pioneered the sports collectible NFT trend with its NBA TopShot brand.

NBA TopShot creates collectible moments, which are short video clips of in-game basketball action.

I’m not a big basketball fan, but they’re SWEET.

The TopShot moments have been a huge hit with collectors and investors.

They’ve generated $692 million in marketplace sales since their release in late 2019.

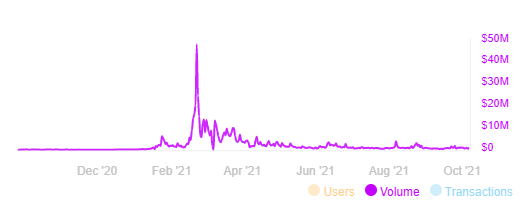

Daily volume peaked near $50 million in February 2021 and has trailed off substantially.

TopShot Daily Volume Over the Past Year

(Source: DappRadar.)

But sports collectible NFTs are far from a fad…

The Huge Opportunity in Sports NFTs

At first, I was skeptical of sports collectible NFTs.

I figured seasoned collectors would laugh at the idea. But I was wrong.

When I asked my father about them, he was blown away by the idea.

He’s not the only one…

The entire sports industry is fascinated by them.

Professional sports leagues are scrambling to enter the market.

At the end of September, Dapper Labs announced another partnership…

This time with the NFL.

Like its partnership with the NBA, Dapper Labs has an exclusive agreement to create NFT moments of the NFL’s best plays.

The agreement comes just months after the MLB inked an NFT deal with Candy Digital.

The MLB’s deal is interesting since Candy Digital is owned by the sports apparel company Fanatics.

A clothing company entering the blockchain space? I’ve seen it all.

One thing seems certain. Sports NFTs are not going away.

This is big news for crypto investors.

NFTs = Crypto Profits

NFTs can be purchased using various cryptocurrencies. (Check out Ian’s article on how to buy your first NFT here.)

And as demand for NFTs heats up, so will crypto prices.

Although buying sports NFTs could be lucrative…

The real trade is buying crypto.

Crypto is at the center of several mega trends and could hand investors huge gains.

And that’s why Ian is presenting a brand-new special event called “Crypto’s Third Wave.”

He’s going to discuss the $9 trillion boom taking place right now.

Readers of Ian’s crypto research service have already had the chance at 3,900% gains in just three months … selling just half the position. And another 1,900% gain in four months — again on half a position.

Those gains could be just the beginning. That’s why, in his presentation, Ian will be revealing three new crypto picks that could multiply your money 12X over the next 12 months.

We’re inviting you to claim VIP access to this special event right now. Click here to sign up. The event kicks off Tuesday, October 12.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Kuaishou Technology (OTC: KUASF) is a short-form online content platform that rivals TikTok in China. It is up 22% this morning as part of a market-wide move in Chinese stocks. With fines and restrictions being phased out, investors are starting to believe that the worst of the regulatory crackdown is coming to an end.

Zijin Mining Group Co. Ltd. (OTC: ZIJMF) is a Chinese mining company that mostly focuses on precious and semiprecious metals. It is up 13% on the news that it will be acquiring Argentinian lithium miner Neo Lithium for $737 million, as part of its push into new energy minerals.

Dutch Bros Inc. (NYSE: BROS) operates a drive-thru coffee chain and is up 13% this morning. The company has been on winning streak as it expands its number of locations and gains popularity with new customers. Some even say it’s on its way to being the next Starbucks.

SunPower Corp. (Nasdaq: SPWR), the solar-power company, is up 13%. It’s continuing its rally from last week, when it announced the acquisition of Blue Raven Solar for $165 million. This expands the reach of its residential solar business.

SoFi Technologies Inc. (Nasdaq: SOFI) operates an online platform that provides a range of financial services. It is up 13% after Morgan Stanley initiated coverage on the stock with a buy rating and a price target of $25.

Daqo New Energy Corp. (NYSE: DQ) is a Chinese solar panel manufacturer. It’s up 12% this morning along with other solar stocks, but has no real news to report.

ImmunityBio Inc. (Nasdaq: IBRX) develops cell and immune therapies to treat cancers and infectious diseases. It is up 12% today as part of a bounce-back after facing a steep sell-off last week.

Marathon Digital Holdings Inc. (Nasdaq: MARA) is a cryptocurrency mining company that has been on an upward trajectory recently as the crypto markets surge. The stock is up 11% this morning.

Riot Blockchain Inc. (Nasdaq: RIOT) is also a cryptocurrency miner and a rival of Marathon Digital. It is up 11% this morning for the same reasons as Marathon.

Aspen Technology Inc. (Nasdaq: AZPN) is an industrial software solutions provider. It’s up 10% on the news that Emerson Electric Co. is combining its software solutions business with Aspen in a deal worth $11 billion.