I’ve had numerous people in my life smile and remind me: “Patience is a virtue.”

I’m not a patient person. No matter how hard I try, I’m just not.

I don’t like waiting on other people to make a decision or take action. I like to gather my information, assess the situation and then move forward.

Yet, I have to admit that there are times when a wait-and-see mentality is wise when it comes to both life … and investing.

And after the release of the latest economic numbers from the Commerce Department, I can see that there are a number of traders who are adopting the wait-and-see approach to their portfolios.

But are they poised to miss out on the next big rally?

GDP Stumbles

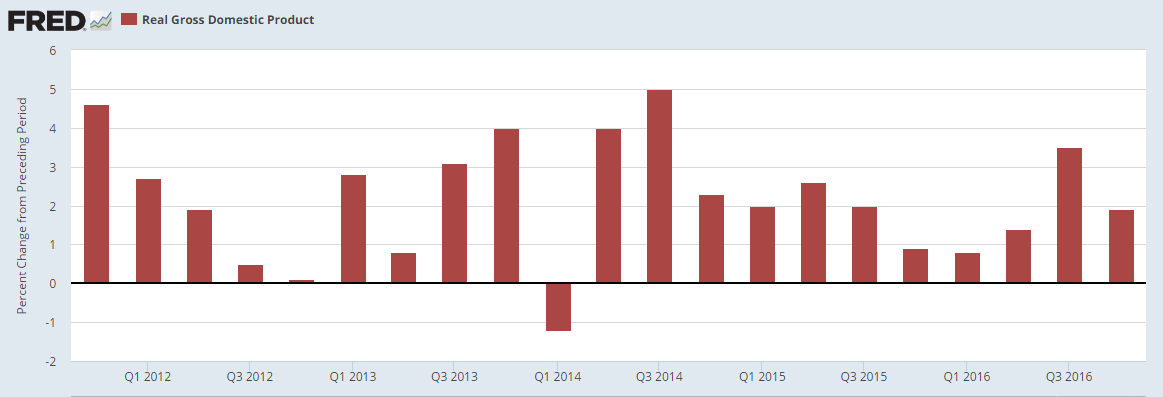

The Commerce Department did not provide investors with a reassuring snapshot of the economy today. The fourth-quarter gross domestic product (GDP) grew only 1.9%, missing forecasts for growth of 2.2%.

While the number was largely in line with the average annual growth rate of 2.1% since the end of the recession in mid-2009, it remains the weakest average rate since 1949.

The so-called recovery following the Great Recession has been anything but impressive.

Digging into the numbers, we find that consumer spending — which accounts for roughly two-thirds of all economic activity — slowed a bit to 2.5% growth from the third quarter’s 3% growth.

Business investment started to pick up late in 2016, with companies switching their focus to equipment and intellectual property products such as software and research and development.

Of course, the fourth quarter’s lackluster performance put a crimp in the GDP for all of 2016, as growth ebbed to a painful 1.6% — down from 2015’s growth of 2.6%.

In fact, this was the GDP’s smallest growth since 2011.

Slowdown Culprits

Consumers struggled to keep the economy going in 2016, as they continue to shoulder the bulk of the economic activity occurring within the U.S.

But a big chunk of 2016’s weakness came in the form of businesses reducing their spending throughout the year. Many companies reduced their production in an effort to chip away at excessive inventory levels that had built up in 2016.

In addition, companies within the oil sector sharply reduced their business spending as oil prices hovered below $50 per barrel for most of 2016. Oil drillers cut their rig demand and other equipment as it was simply too expensive to pull crude out of the earth.

While oil prices have started to rebound and hold steady above $50, many companies have increased their rig demand. But we still have a far way to go. Baker Hughes reported today that active North American rigs number 1,057 — which is still down 43% from the 1,840 that were active at the close of 2014.

Should oil prices continue to tick higher, we will see a rush among oil companies back into the fields, putting employees and rigs back to work. That’s a big plus for the economy.

But getting the GDP moving higher again — and toward President Trump’s pledge for a pace of 4% growth — isn’t as simple as getting oil prices to climb up and away from the $50-a-barrel mark.

Two Roads

The new president has brought a great deal of uncertainty into the market, leaving many companies hesitant to take big steps that would burn through the stockpile of cash they’ve accumulated.

Trump has tempted many companies with the promise of corporate tax cuts, reduced regulation and increased infrastructure spending.

But will those nice bonuses be quickly offset by the trade war that he appears determined to pursue? The promise of increased tariffs against China and Mexico — two of our three top trading partners — will very likely result in tit-for-tat tariffs against American-made goods and that will hit multinational companies hard in the bottom line. And Trump could potentially extend tariffs to cover imported goods from many other countries around the globe.

So … American companies win with lower taxes and regulations but lose when their revenue drops as fewer people around the globe buy their goods.

Many traders have decided to adopt a wait-and-see mentality, with their eyes focused on our new president. If Trump can find a way to cut taxes while not disrupting the trade — and in turn, not disrupt the steady flow of revenue coming from overseas consumers — we could see business and consumer spending rebound, lifting America’s GDP back toward 4%. And that will send the market soaring far above the 20,000 level the Dow Jones Industrial Average just conquered.

But a trade war could prove to be massively detrimental to this recovery and the companies caught in the middle.

For now, I’m staying in a market determined to hold onto its gains despite lackluster economic news, but I have an exit plan in place to protect the gains I’ve made.

Regards,

Jocelynn Smith

Sr. Managing Editor, Banyan Hill