With fall in the air, hedge funds have winter on their minds. Low natural gas stores are shaping up to be one of their biggest holiday bets.

Last year’s harsh winter drew down natural gas reserves more than usual. The long winter delayed the start to building back the inventories.

America uses 30% to 35% more gas during the winter months, according to the Energy Information Administration (EIA).

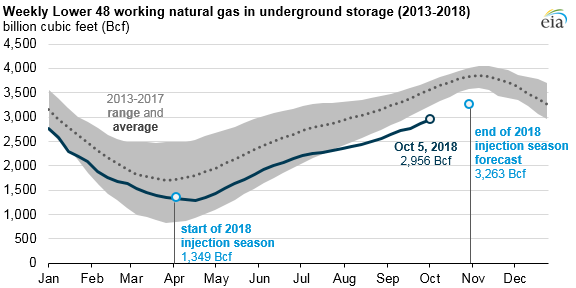

Utilities and producers build up stores of natural gas from April through October to balance supply and demand.

Homes use less energy during summer months, and renewables like solar, wind and water produce more energy.

Now with only weeks left to build reserves before the winter chill sets in, there is little time to make up ground.

We are heading into winter with a shortage of natural gas. Inventories are set to be well lower than their five-year average.

The U.S. recently became a net exporter of natural gas. The shale revolution helped to drive gas production.

Domestic gas is finding buyers overseas. East Asia is one of the largest consumers of natural gas. China, South Korea and Japan consumed 40% of our liquefied natural gas exports.

That drove producers to sell gas overseas instead of stocking up for the winter months.

The Winter Forecast

The National Oceanic and Atmospheric Administration puts the likelihood of an El Niño at 70% to 75%. El Niño usually brings with it mild winters for North America.

Last year’s winter storms that shook the Northeast saw record long positions from hedge funds.

The weather is tough to predict. Even with a mild winter, tighter inventories mean more volatile prices.

Hedge funds are likely to pour money to strengthen their bets with the threat of blizzards or storms.

To bet on short-term trends in natural gas, consider the VelocityShares 3x Natural Gas Long ETN (NYSE: UGAZ).

This exchange-traded note is leveraged to the price of natural gas. UGAZ will rise about three times as much as the price of natural gas.

This type of fund isn’t good for long-term buy-and-hold strategies, however. Use it to capture short-term trends in commodities.

Regards,

Anthony Planas

Internal Analyst, Banyan Hill Publishing