Gold is not dead.

Just ask Germany.

Germany’s Bundesbank recently announced that it finished its transfer of $13 billion in gold bars that had been stored in vaults under Lower Manhattan, bringing the metal back home again. The country had started repatriating its gold in 2013 with the goal of storing 50% of its reserves in Frankfurt once again.

When the gold transfer is complete, Germany will have removed all the gold it stored in Paris, left behind only 13% of its reserves in London and approximately one-third of its reserves in New York.

With the rise of cryptocurrencies — such as bitcoin — and digital cash, such as PayPal, Apple Pay and other apps, there has been a steady drop in the use of physical cash, making the yellow metal feel downright archaic.

But gold holds a special status, stronger than even the couple twenties in your wallet right now. The precious metal offers a blanket of safety and security. It is seen as more trustworthy than any government-issued currency.

Just look at the euro — a currency for a union of countries that is threatening to tear apart. (Germany certainly feels better having its gold home again.)

Or even the U.S. dollar — a currency backed by roughly $20 trillion in debt.

Not only is gold alive and kicking, but it needs to play an important role in your portfolio…

Let me just start with this: I’m not a goldbug.

I’m a trader, first and foremost, and usually with a short time frame as my target. I was raised on the versatility of options and the quick trade for nice profits. I don’t care whether the market is bull, bear, or — shudder to think — range-bound. There’s always a way to make a profit if you know where to look.

But gold is a tricky thing.

It doesn’t pay a dividend, so there’s an opportunity cost associated with the metal.

However, when there is uncertainty in the market, shaky economic growth or geopolitical discord, gold shines as a safe haven in the storm. When stocks are getting hammered, investors will run to gold as a safe way to store some of their greenbacks rather than just converting it to cash and stuffing it under their mattresses.

And going by the way gold has been trading, it looks as if many investors aren’t too sure about this market rally.

The Hedge

In 2016, the price of gold rallied more than 8%, nearly keeping pace with the stock market, as the S&P 500 gained 9.5%.

In 2016, the price of gold rallied more than 8%, nearly keeping pace with the stock market, as the S&P 500 gained 9.5%.

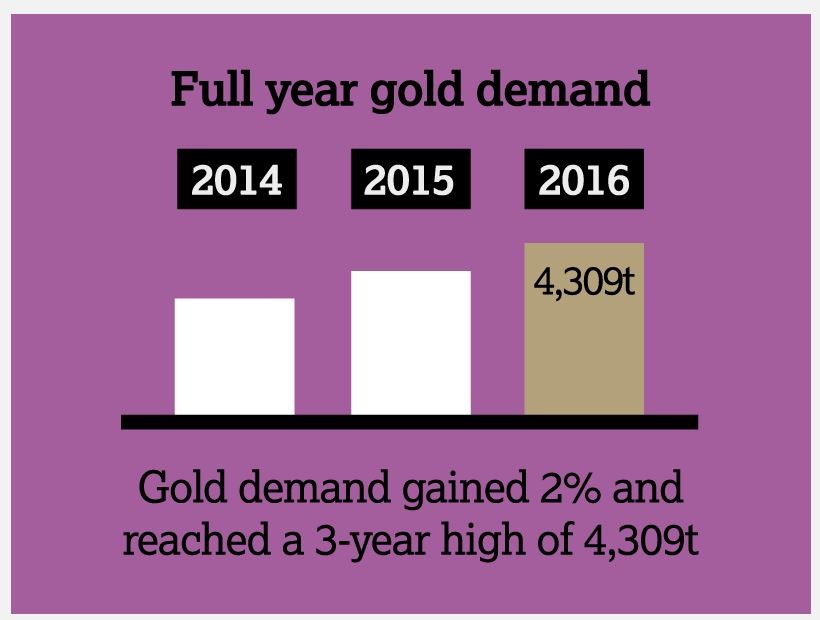

In fact, the World Gold Council reported that gold demand rose 2% in 2016 to 4,309 tons, tagging a new three-year high.

And less than two months into the new year, we have gold up another 8%, beating the S&P’s gain of approximately 5% — which is noteworthy.

When stocks are strong and investors believe in the market rally, they are happy to abandon gold for high-flying stocks that promise a far better return.

For example, during the dot-com bubble, the S&P 500 rallied from January 1995 through September 2000 by more than 200%. In contrast, gold stumbled 27% during that same time period.

Or look at the market’s rally from October 2012 through January 2016, when the S&P 500 gained 37%, while the yellow metal tumbled 35%.

In short, when times are good, gold is the forgotten child left in time-out until he can learn to play well with the other assets.

And when times are bad, gold is the prodigal son offering security and protection.

So if the stock market is trading at all-time highs and regularly setting new records, why is gold still shining as a favorite?

The financial market has its fair share of potential stumbling blocks that could send everything tumbling sharply lower. Let’s look at a quick list:

- Stocks are overvalued. Jeff Opdyke has recently explained that, according to traditional measures, stocks are painfully overvalued, and we are setting up for a reversion to the mean.

- Washington in turmoil. Our new president has promised a series of extreme moves that could have significant repercussions for both the U.S. market and the global market that could start with a sharp earnings slowdown.

- The next exit in Europe. The EU and U.K. are stumbling their way through Brexit as well as major upcoming elections — Italy, Germany, the Netherlands and France. Furthermore, Europe’s growth has been largely overlooked by many investors and could become the next hot trade as they grow weary of drama in the U.S.

- The derivatives nightmare. The U.S. is facing a collapse that could rival the fallout from the housing sector debacle as America’s top five banks have loaded up on derivatives tied to interest rates.

- The Fed wild card. The latest transcripts from the Federal Open Market Committee meeting revealed that the Federal Reserve is looking to lift interest rates “fairly soon.” Higher interest rates will suck money out of the economy as it costs more to service our mounting debt. Higher interest rates also have a tendency to crush stock rallies.

Investors are closely watching these issues, waiting for one or more of them to kick stocks off their current track.

Your Disaster Insurance

Of course, this doesn’t mean that the market is going to fall off a cliff tomorrow.

I think the one quote that every speculator is beaten over the head with is: “The market can remain irrational for longer than you can remain solvent.”

In short, just because a stock or index has risen to all-time highs doesn’t mean it can’t keep going higher, even if it doesn’t make logical sense to you and me.

But it doesn’t hurt to have a hedge in place to protect yourself when it all comes tumbling down.

Gold remains that perfect hedge: your insurance against the Fed, Washington, reckless banks, Europe and even that black swan that hasn’t even hit our radar yet. That’s why gold is still shining as the favorite even during this year’s stock market highs — investors know they need a safe haven, just in case.

Physical gold is your best option rather than investing in “paper gold” such as exchange-traded funds. One avenue is the EverBank non-FDIC insured Metals Select® Allocated Account. It’s a great way to increase your own economic power. It allows you to purchase specific coins and bars, and it’s even IRA eligible (gold and silver American Eagle coins only).

For the sake of full disclosure, we receive a marketing fee based on our relationship with EverBank. But, honestly, we’d work with them regardless.

No matter how you choose to add physical gold to your portfolio, the important part is that it is there, ready to be your safe haven when it all falls apart.

Regards,

Jocelynn Smith

Sr. Managing Editor, Sovereign Investor Daily